- Fed rate hike, Powell comments to drive sentiment

- Nvidia stock is a buy ahead of its GTC conference

- Meta Platforms set for more losses amid ongoing headwinds

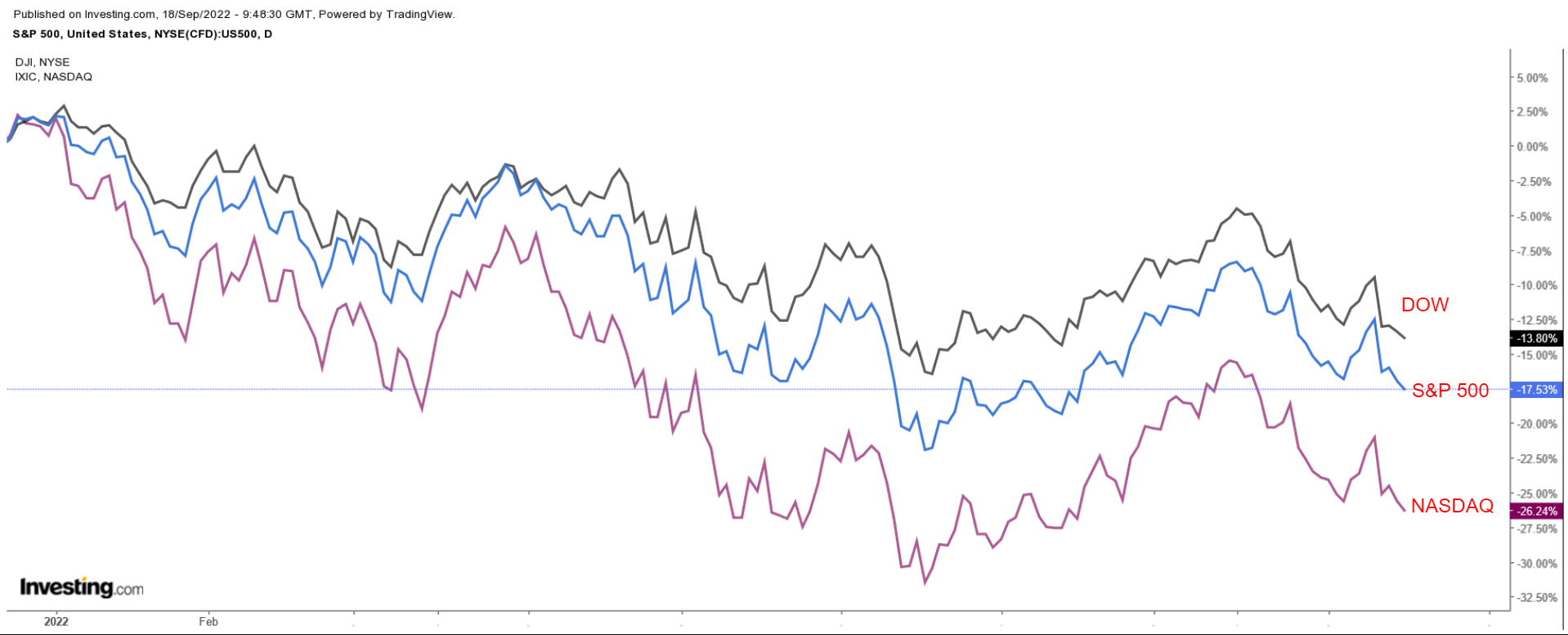

Stocks on Wall Street tumbled on Friday, with the major averages suffering their biggest weekly loss since June, as investors continued to fret over looming interest rate hikes, soaring inflation, and slowing economic growth.

A shock profit warning from global shipping giant and economic bellwether FedEx (NYSE:FDX) further stoked recession fears.

For the week, the blue-chip Dow Jones Industrial Average sank 4.1%, while the benchmark S&P 500 and the tech-heavy Nasdaq Composite declined 4.8% and 5.5% respectively.

Source: Investing.com

The week ahead is likely to be another volatile one, with the Federal Reserve widely expected to deliver its third straight jumbo-sized 75-basis-point rate hike at the conclusion of its policy meeting on Wednesday.

Besides the Fed, this week’s economic calendar consists of important housing data as well as the latest PMI surveys on manufacturing and services sector activity.

Meanwhile, on the earnings docket, there are just a handful of corporate results due, including those from FedEx, Costco (NASDAQ:COST), General Mills (NYSE:GIS), Darden Restaurants (NYSE:DRI), KB Home (NYSE:KBH), and Lennar (NYSE:LEN).

Regardless of which direction the market goes, below we highlight one stock likely to be in demand and another which could see further downside.

Remember though, our timeframe is just for the upcoming week.

Stock To Buy: Nvidia

Despite its recent downtrend, I expect Nvidia’s (NASDAQ:NVDA) stock to put in a strong performance in the week ahead as the tech giant hosts its highly anticipated GTC conference, at which it is likely to show off its latest chip and software advancements.

Nvidia is one of the global leaders in providing graphic processing units for gaming consoles, data centers, and self-driving vehicles.

The four-day online event kicks off on Monday, Sept. 19 and runs through Thursday, Sept. 22, and will be broadcast live on the Nvidia website.

Most of the spotlight will fall on founder and CEO Jensen Huang’s keynote speech, scheduled for Tuesday at 11 A.M. ET.

According to the description, Huang will talk about the latest breakthroughs in emerging trends that are driving transformation in the tech industry, such as artificial intelligence, deep learning, quantum computing, virtual collaboration, and more.

Other members of Nvidia’s leadership team are also expected to reveal fresh details on the company’s new products and features in computer graphics, data science, medical science, robotics, and the metaverse.

At its last GTC conference in March 2022, NVDA shares jumped nearly 10% after showcasing its innovative "Omniverse" metaverse platform and revealing upbeat news on graphics, gaming, and autonomous self-driving technology.

Source: Investing.com

NVDA stock - which has ended lower in five of the last six weeks - fell to its weakest level since March 2021 on Friday, before recovering slightly to close at $131.99.

Year to date, Nvidia’s shares are down 55% and are roughly 62% below their record high of $346.47 touched in November 2021.

At current levels, the Santa Clara, Calif.-based semiconductor giant has a market cap of $328.5 billion.

Stock To Dump: Meta Platforms

In my view, Meta Platforms’ (NASDAQ:META) stock - which sank to its weakest level since March 2020 on Friday - could suffer another challenging week amid ongoing worries over the negative impact of several factors plaguing the out-of-favor social-media giant.

Facebook parent Meta has seen its valuation collapse this year due to a sluggish performance in its core ad business resulting from privacy changes in Apple's (NASDAQ:AAPL) iOS, as well as growing competition from Chinese video-sharing app TikTok.

The ad-reliant social-media company badly missed profit and sales growth expectations when it released Q1 results in late July, and it warned that sales would decline again in Q2 amid the sharp slowdown in digital ad spending.

In addition, concerns are growing over Meta’s big bet to build and develop the metaverse as it continues to spend heavily amid rising costs and investments.

Source: Investing.com

META stock, which plunged 13.5% last week to suffer its worst weekly performance since January, closed at the lowest since the start of the COVID pandemic at $146.29 on Friday.

At current levels, the Menlo Park, Calif.-based company is valued at $393.1 billion.

The Mark Zuckerberg-led company has seen its stock tumble by 56.5% year to date, by far the biggest decline among big tech stocks and more than double the drop in the Nasdaq.

Even more alarming, shares are about 62% below their record high of $384.33 touched in August 2021 amid a potent combination of worsening fundamentals and a deteriorating macro backdrop of higher interest rates and accelerating inflation.

In general, expectations of tighter Fed policy and higher yields tend to weigh heavily on tech companies with lofty valuations, as it makes their future cash flows less valuable and hinders their ability to fund their growth.

Disclosure: At the time of writing, Jesse has no position in any stock mentioned. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

***

The current market makes it harder than ever to make the right decisions. Think about the challenges:

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »