- Powell’s Jackson Hole speech, U.S. inflation data, more earnings in focus.

- Dollar General stock is a buy ahead of Q2 earnings thanks to recession-proof status.

- Peloton shares set to struggle further amid dismal profit, sales outlook.

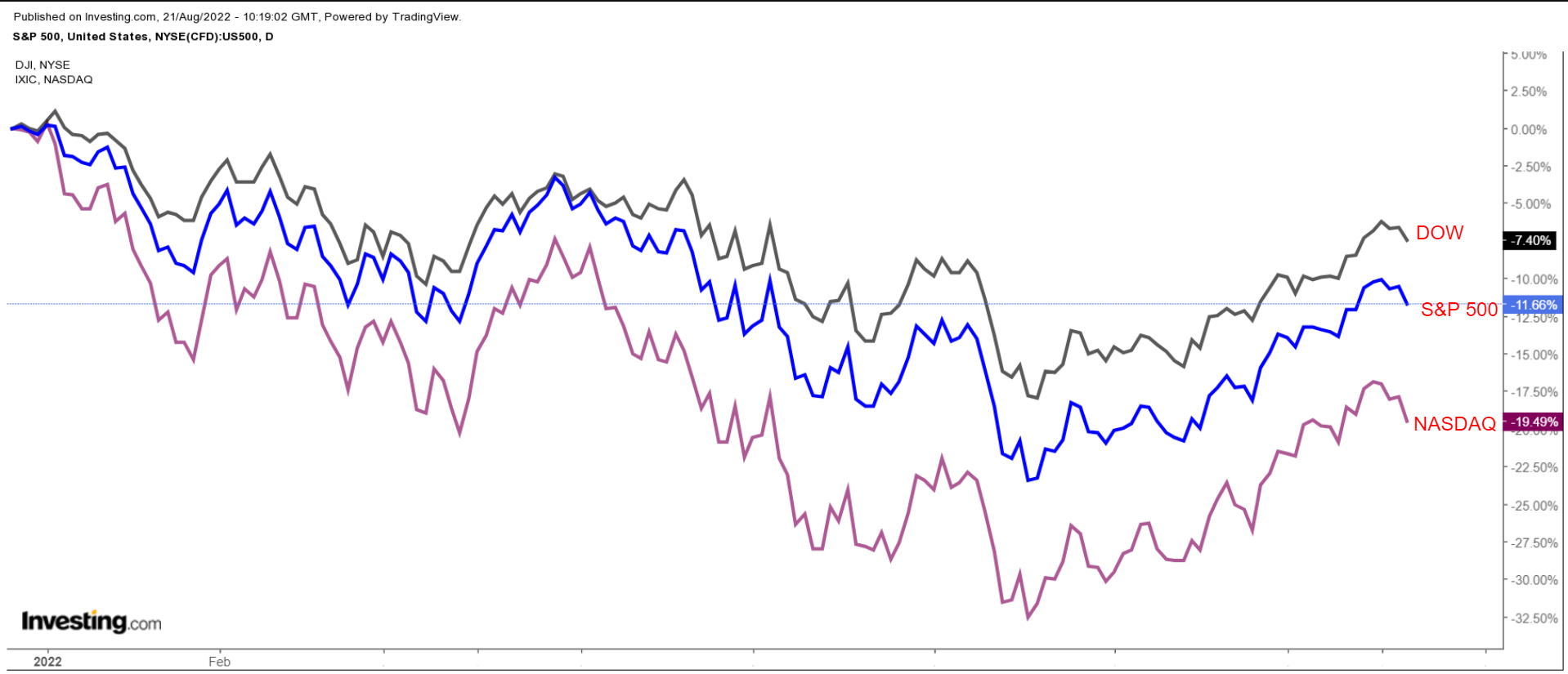

Stocks on Wall Street tumbled on Friday, with the S&P 500 suffering its first weekly loss in a month as fears resurfaced that the Federal Reserve will be aggressive on interest rates hikes to battle inflation.

For the week, the blue-chip Dow Jones Industrial Average shed 0.2%, while the benchmark S&P 500 and technology-heavy Nasdaq Composite slumped 1.2% and 2.6% respectively.

Source: Investing.com

The coming week is expected to be another eventful one as markets brace for Fed Chair Jerome Powell's speech at the annual global central banking conference in Jackson Hole, Wyoming, on Friday.

Meanwhile, on the economic calendar, most important could be Friday’s personal consumption expenditures data, which includes the PCE price index, the Fed’s preferred inflation measure.

Elsewhere, on the earnings docket, there are just a handful of corporate results due as Q2 earnings season winds down, including from Nvidia (NASDAQ:NVDA), Salesforce (NYSE:CRM), Zoom Video (NASDAQ:ZM), Macy’s (NYSE:M), Nordstrom (NYSE:JWN), and JD.com (NASDAQ:JD).

Regardless of which direction the market goes, below we highlight one stock likely to be in demand and another that could see further downside.

Remember, though, our timeframe is just for the upcoming week.

Stock To Buy: Dollar General (NYSE:DG)

Dollar General could see shares break out to new all-time highs this week as the largest discount retailer in the U.S. prepares to deliver upbeat second-quarter results ahead of the opening bell on Thursday, August 25.

The retail giant has beaten Wall Street’s profit and sales estimates in nine out of the last 10 quarters, dating back to Q1 2020, highlighting the strength and resilience of its business in the current environment.

Based on moves in the options market, traders are pricing in a sizable swing for DG stock following the update, with a possible implied move of 7.7% in either direction.

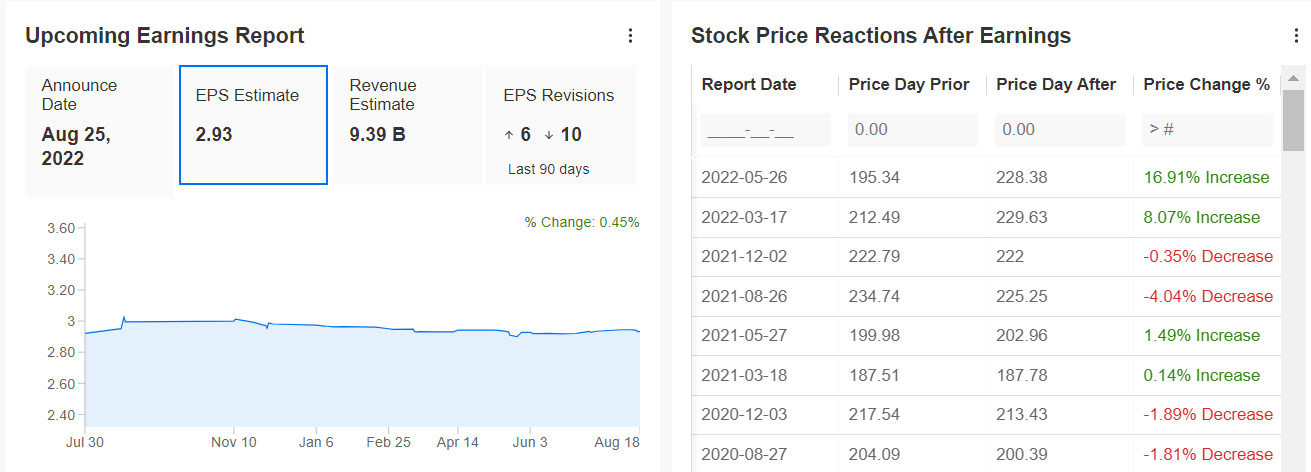

Source: InvestingPRO+

Consensus estimates call for the Goodlettsville, Tenn.-based company to post earnings per share (EPS) of $2.93, improving roughly 9% from EPS of $2.69 in the year-ago period.

Revenue, meanwhile, is forecast to rise 8.5% year over year to a record $9.39 billion, as low-income families and cash-strapped consumers looking for thriftier-priced alternatives shop more at dollar stores amid a challenging macroeconomic backdrop.

Beyond the top- and bottom-line numbers, investors will focus on the retailer’s outlook for the months ahead as bargain-hunting Americans increasingly shop at discounters amid an inflationary environment that is causing disposable income to shrink.

Source: Investing.com

Dollar General, which operates more than 18,000 stores in 44 states, has been a standout performer in the retail sector this year thanks to its recession-proof status. The discount store, which describes its core customers as households earning less than $35,000, mostly sells groceries and household essentials at rock-bottom prices.

DG stock ended at $253.86 on Friday, within sight of its recent record high of $262.20 touched on April 21. At current levels, the discount chain has a market cap of $57.6 billion.

Year to date, Dollar General shares are up 7.6%, easily outperforming industry bellwethers Walmart (NYSE:WMT), Costco (NASDAQ:COST), and Target (NYSE:TGT).

Stock To Dump: Peloton (NASDAQ:PTON)

I expect Peloton’s stock to suffer a difficult week - with a possible breakdown to new lows on the horizon - as the home exercise equipment maker’s latest financial results are likely to reveal a sharp slowdown in both profit and revenue growth.

Peloton has missed top-line estimates for four straight quarters, while trailing revenue expectations three times in that span, reflecting the negative impact of numerous headwinds on its business.

Based on the options market, traders are pricing in a big move for PTON stock following the results with a possible implied move of about 18% in either direction.

Results are due ahead of the U.S. market open on Thursday, Aug. 25.

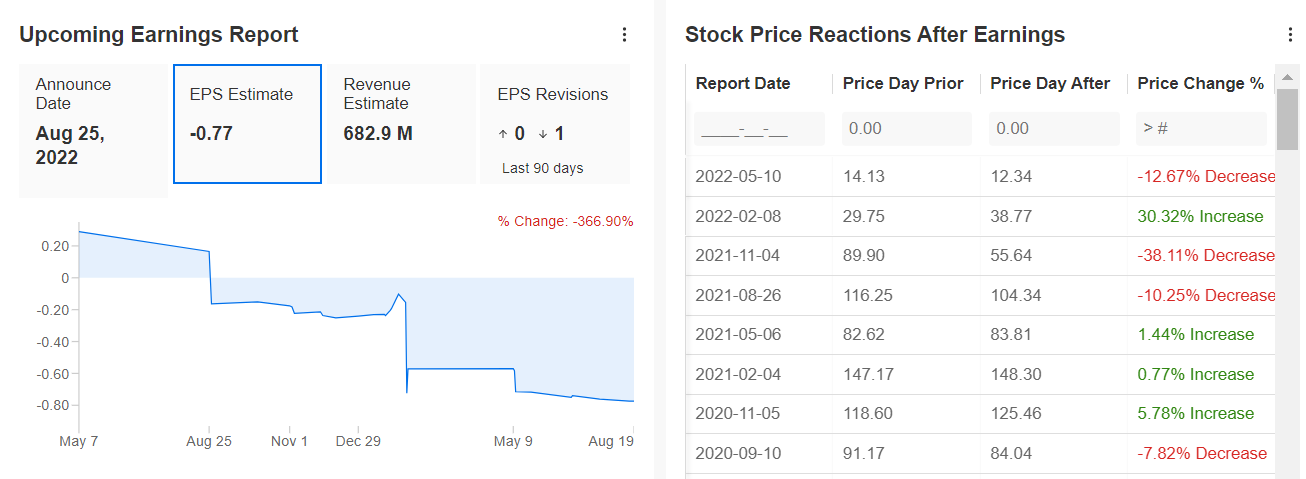

Source: InvestingPRO+

Consensus expectations call for the interactive fitness company - which sells stationary bicycles and treadmills that allow monthly subscribers to remotely participate in classes via streaming media - to report a loss of $0.77 per share for its fiscal fourth quarter.

Revenue is forecast to sink 27.1% from a year earlier to $682.9 million, due to a toxic combination: dwindling demand for its at-home fitness products amid fading COVID restrictions, as well as rising inflationary pressures, higher interest rates, and ongoing supply chain issues.

Perhaps of greater importance, Peloton’s guidance for the rest of the year will be in focus as it faces a challenging environment that is seeing it burn through high levels of cash amid higher cost pressures and decreasing operating margins.

Source: Investing.com

PTON stock ended Friday’s session at $11.71, earning the New York-based company a valuation of $3.95 billion.

Widely viewed as one of the big winners of the 2020 COVID outbreak, Peloton fell out of favor this year as investors dumped high-growth, non-profitable companies with rich valuations that are most sensitive to rising rates and accelerating inflation.

Year to date, Peloton shares have crashed by roughly 67% and are about 93% away from their all-time high of $171.09 touched in January 2021.

Disclaimer: At the time of writing, Jesse owns shares of Dollar General. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

***

The current market makes it harder than ever to make the right decisions. Think about the challenges:

-

Inflation

-

Geopolitical turmoil

-

Disruptive technologies

-

Interest rate hikes

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »