Investing.com – In a dynamic context like the current one, some analysts fear that with US indices at their highest and uncertainties about the trajectory of monetary policy, volatility might increase.

“Yesterday's equity session in the US, which we can somehow define as the benchmark for global markets, saw the S&P 500 and NASDAQ Composite gain 0.23% and 0.34% respectively, while the Dow Jones Industrial Average lost 0.17%. Technology, real estate, and utilities stocks led the charge, while communication services, energy, and industrial stocks recorded the worst performances,” comments Saverio Berlinzani, senior analyst at ActivTrades.

“It should be noted that the trend in equity is now largely decoupled from everything, from macro data to other assets, and continues to outperform thanks to the technology sector, particularly artificial intelligence, which some believe is just at the beginning of its development and growth boom,” the expert observes.

“Obviously,” Berlinzani admits, “it is quite frustrating to even think about selling equities because you almost certainly end up holding the bag, but it is strange that there are no minimal corrections in a market that seems intoxicated by euphoria.”

These opposing sentiments are currently shared by many investors. They don’t sell for fear of missing opportunities and don’t buy for fear of a crash. But as we know, immobility in the markets doesn’t pay off in the long run. So what should one do if uncertainty increases?

What are the best undervalued stocks in the S&P 500?

One solution can be to rely on quality stocks that have enough resilience to face any market conditions and possibly also have unexpressed growth potential.

In any case, all investors should have a strategy that allows them to move in any situation, which is why InvestingPro has developed ProPicks, 6 strategies guided by Artificial Intelligence (AI), such as “Top Value Stocks,” which helps to find at any moment the best quality undervalued stocks with the greatest likelihood of outperforming the S&P 500.

- By subscribing to InvestingPro+, you can take advantage of AI models that highlight up to 20 undervalued US-listed stocks each month, each with solid earnings and ready for growth.

The companies chosen by AI are usually traded at a level below their perceived intrinsic value, meaning they also represent a potentially huge bargain.

Normally, sifting through the entire US market for such stocks would be a full-time job. But with advanced AI analysis, evaluated monthly against market variations, it’s a piece of cake.

The Top Value Stocks strategy has outperformed the S&P 500 by 678.7% from 2013 to today.

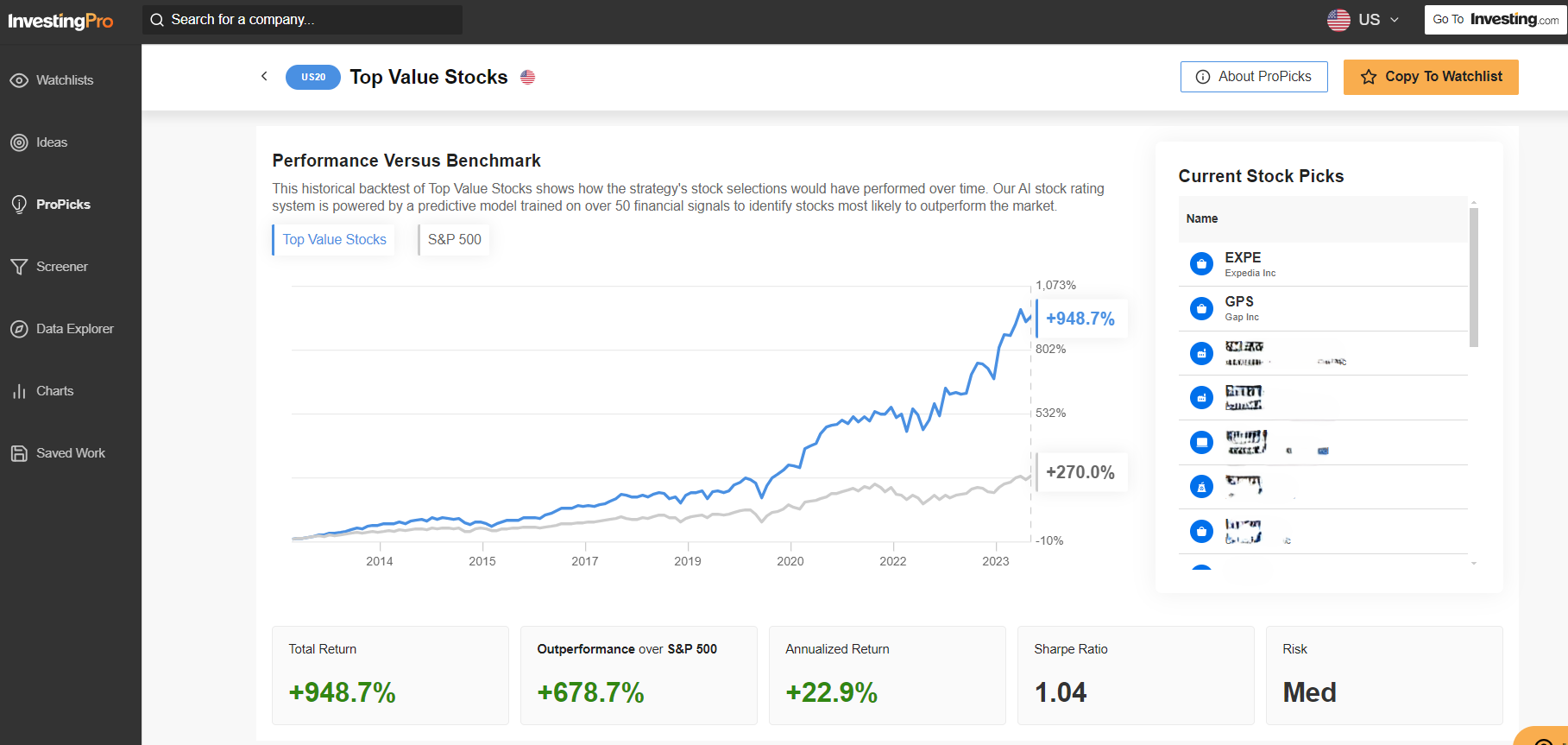

In the following chart, the historical backtest of “Top Value Stocks” shows how the strategy's stock selections have performed over time.

Our AI stock evaluation system is based on a predictive model trained on over 50 financial signals to identify stocks that are most likely to outperform the market.

The annualized return of the strategy from 2013 to today is 22.9% with an outperformance of the S&P 500 by 678.7% and a total return of 948.7%.

Even in May, our Top Value Stocks strategy outperformed the market with a gain of 34.31% compared to the S&P 500’s +14.86%.

For all our readers, the top two stocks of the strategy are: Expedia (NASDAQ:EXPE) and Gap Inc (NYSE:GPS).

As anticipated, all 6 ProPicks strategies are active strategies that update you every month on which stocks to buy and sell.

⚠️ Not sure which stocks to buy and sell? Try InvestingPro and find out! Subscribe HERE AND NOW and get an additional 10% discount for a limited time on your annual plan! ⚠️

Which stocks to buy and sell in June:

Below, for our readers, here are some of the stocks to buy in June selected by the ProPicks strategy:

And two stocks that, on the contrary, according to artificial intelligence, should be sold:

Subscribers to InvestingPro can consult the Top Value strategy and all the other ProPicks strategies by clicking here. (Even in May, they all beat the market!)

Not subscribed to InvestingPro yet? Subscribe HERE AND NOW to get the annual InvestingPro at a discount, and unlock all the stocks to buy and sell, and start investing like professionals!

And if market conditions change? No problem, every month ProPicks are updated to allow all investors to adjust their portfolios optimally.

Below, here’s how to get the discount to subscribe to InvestingPro:

Over 40% discount

If not now, when? Now you can take advantage of a 40% discount on 1 and 2-year Pro and Pro+ subscriptions, plus an additional 10% dedicated to our article readers.

Below are all the details to get the discount and maximize profits with your investments:

PRO FOR 1 YEAR THIS LINK calculates and directly applies the total discount of over 40%. If the page does not load, enter the code PRO124 yourself to activate the offer.

With this subscription, you will have access to:

- ProPicks: AI-managed stock portfolios capable of beating the market.

- ProTips: easy and immediate information that summarizes thousands of pages of complex financial data in a few words.

- Fair Value and Health Score: 2 indicators based on financial data that provide an immediate view of the potential and risk of each stock.

- Historical financial data for thousands of stocks: This way, fundamental analysis professionals can delve into all the details.

- And many other services, not to mention those we plan to add in the near future!

So what are you waiting for?!

Act quickly and join the investment revolution: get your OFFER HERE!

PRO+ FOR 1 OR 2 YEARS

Alternatively, you can CLICK HERE and subscribe to PRO+, our comprehensive subscription that, in addition to all the features of the Pro subscription, offers you:

- Advanced stock screener, with which you can search for the best stocks based on your expectations

- Access to over 1,200 fundamental data points 10 years of financial data on over 180,000 companies (virtually all stocks worldwide!)

- Data export to work offline

- Stock evaluation with over 14 proven financial models

- Fundamental charts

- Useful widgets and dividends to earn from dividends

⚠️ All this costs you less than a cup of coffee a day and opens the doors to all the secrets of the investment world! (CLICK HERE TO SUBSCRIBE TO PRO+ FOR 1 YEAR) ⚠️

If the page does not load, enter the code proit2024 yourself to activate the offer.

To save a bit more, you can also subscribe with the Pro+ 2-year discount (Click here to take advantage of the special biennial Pro+ rate).