By Michael Elkins

Baird reiterated an Outperform rating and $252.00 price target on Tesla (NASDAQ:TSLA), while continuing the company as their “best pick”, after the electric vehicle maker announced another round of price cuts with reductions of $1K for the Model 3, $2K for the Y, and $5K for the S/X.

Analysts wrote in a note, “US price cuts continue to make headlines with TSLA margins and macro uncertainty in focus. Despite this second round of US price cuts in a short time frame, we continue to believe the TSLA’s will be able to maintain industry leading operating margins and is in the best position among auto peers to weather economic headwinds. Speculation of more stringent vehicle emission rules may accelerate EV adoption further which we see as a tailwind in addition to the IRA on the policy front.”

These latest price cuts came shortly after Treasury guidance for the IRA's clean vehicle tax credits. As a result of these changes, TSLA does not believe the rear-wheel drive Model 3 will qualify for the full $7.5K credit but still estimates that the other 3 and Y configurations will. Despite this, analysts continue to believe TSLA is best positioned to benefit from these credits due to its leadership in cell and manufacturing technologies.

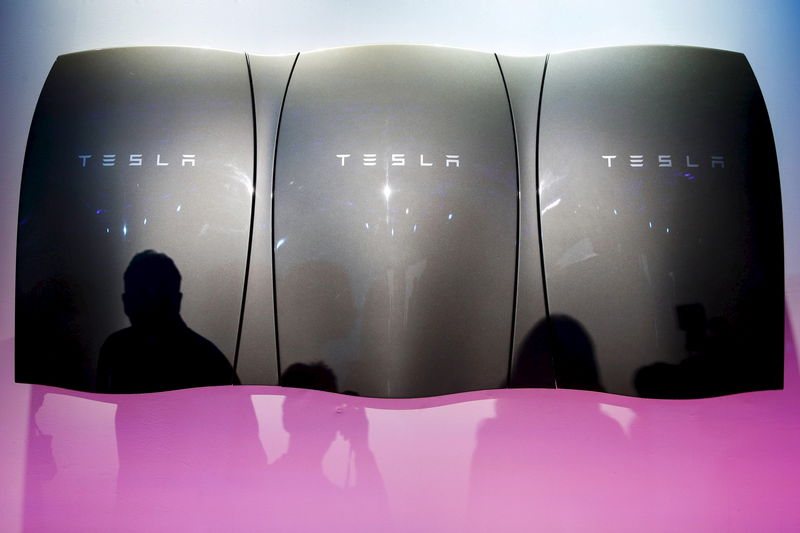

TSLA also announced a Megapack manufacturing investment in a facility capable of producing ~10K units annually, or roughly 40 GWh of energy storage. Baird estimates that the growing Energy business will continue to gain momentum this quarter as the demand for stationary storage grows.

The EPA is expected to release new vehicle emission rules this week which are intended to increase EVs' market share in the U.S. to ~60% by 2030 vs the Biden administration's previous target of 50%. While the details surrounding the new rules are still to be determined, Baird believes TSLA will benefit most from stricter requirements on ICE vehicles due to its scale and U.S. manufacturing capabilities.

Shares of TSLA are up 0.86% in pre-market trading on Tuesday.