By Jesse Cohen

Investing.com - Global financial markets were whipsawed this week, with stocks indices in the U.S., Europe and Asia all heading for their worst weekly loss in about four months, as concerns grew over the coronavirus outbreak centered in Wuhan, China.

China's National Health Commission said the total number of confirmed deaths from the virus rose to 170 as of late Wednesday. The number of infected patients meanwhile jumped to nearly 8,000.

A small number of cases linked to people who traveled from Wuhan have been confirmed in about 15 countries, including the United States, Canada, France, Japan and South Korea.

In addition to the coronavirus, market players reacted to the latest figures from a deluge of big-name companies, as the fourth-quarter earnings season continues on Wall Street.

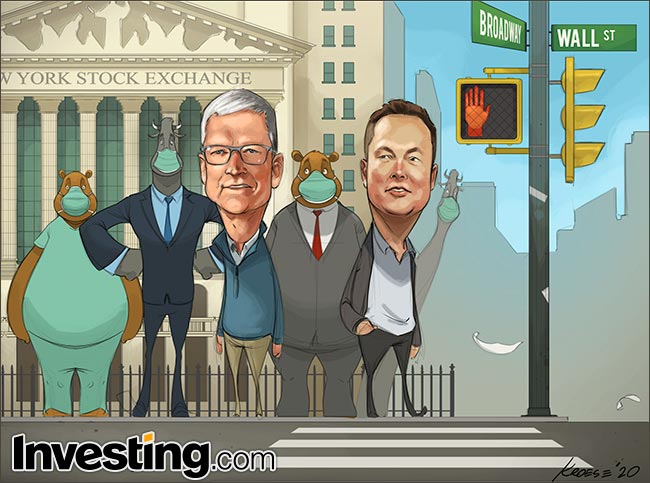

Apple (NASDAQ:AAPL) was in the spotlight on Tuesday after the iPhone maker beat sales and profit estimates for the holiday shopping quarter. The company reported earnings per share of $4.99 on revenue of $91.82 billion, both topping expectations.

The earnings beat comes as iPhone sales returned to growth, with new iPhone 11 models sparking the boost. The company also provided better than expected guidance for its fiscal second-quarter revenue.

On Wednesday, the hype was all around Tesla (NASDAQ:TSLA), a stock that’s up more than 80% in the last three months and now sporting a market cap of more than $100 billion.

The electric automaker posted its second quarterly profit in a row as vehicle deliveries hit a record and the company said it would comfortably make more than half a million units this year, pushing its shares to new highs above $600.

Join Jesse Cohen - the creative mind behind our weekly financial market cartoons - as he breaks down today's comic and provides some key insight in this fun video.