* Nikkei futures up 0.4%; Hang Seng futures up 0.7%

* S&P 500 stock futures up 0.5%

* Dollar gains on euro, yen as U.S. yields race ahead

* Nasdaq falls 2.4%, confirming correction

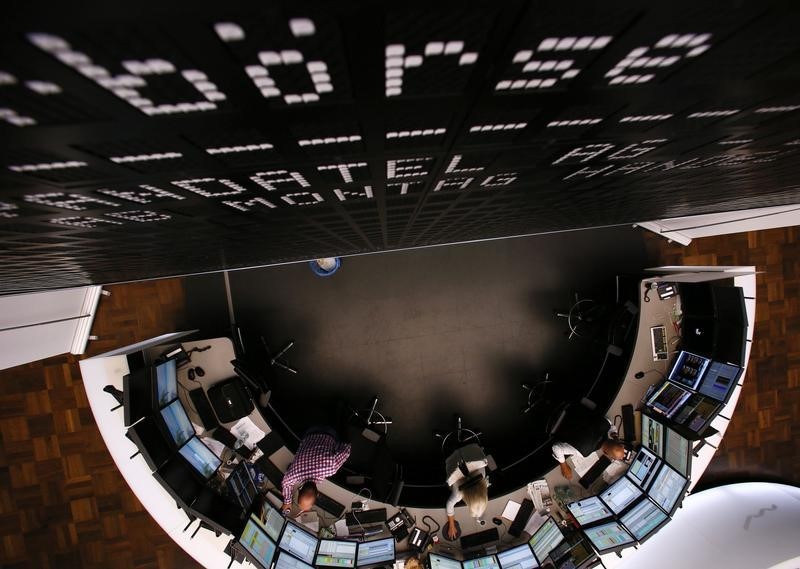

* Banks, automakers lift European stocks

By Matt Scuffham

NEW YORK, March 8 (Reuters) - Asian stocks were set for a

strong open on Tuesday, helped mostly by global recovery

prospects and the passage of a $1.9 U.S. trillion stimulus bill,

shaking off a mixed Wall Street session after a big downturn in

tech shares.

U.S. Treasury Secretary Janet Yellen said on Monday that

President Joe Biden's coronavirus aid package would provide

enough resources to fuel a "very strong" U.S. economic recovery,

and noted "there are tools" to deal with inflation. Despite the positive cues, investors remain conflicted over

whether the stimulus will help global growth rebound faster from

the COVID-19 downturn or cause the world's biggest economy to

overheat and lead to runaway inflation.

Although futures markets suggested a higher open across

Asia, Michael McCarthy, chief markets strategist at CMC Markets,

said there was still a lot of uncertainty.

"What's going to determine the results today is the balance

between buying for the reflation trade and the selling of tech

(stocks)", he said. "It's difficult to say what's going to be

most influential given the spectacular gains across Europe

compared to the big drop in the Nasdaq."

The technology sector and other richly valued names have

been highly susceptible to rising rates.

Australia's benchmark S&P/ASX 200 index .AXJO rose 0.92%

in early trading.

Japan's Nikkei 225 futures NKc1 added 0.36% and Hong

Kong's Hang Seng index futures .HIS HSIc1 rose 0.68%.

E-mini futures for the S&P 500 EScv1 rose 0.55%.

On Wall Street, the Dow advanced while the Nasdaq shed over

2%. That marked a more than 10% fall since its Feb. 12 closing

high, confirming a correction in the index's value.

The Dow Jones Industrial Average .DJI rose 0.97%, the S&P

500 .SPX lost 0.54%, and the Nasdaq Composite .IXIC dropped

2.41%.

The pan-European STOXX 600 index .STOXX rose 2.10% and

MSCI's gauge of stocks across the globe .MIWD00000PUS shed

0.02%.

"If rates are grinding higher because people are getting

optimistic about what economic growth looks like, that is still

supportive for equity prices," said Tom Hainlin, global

investment strategist at U.S. Bank Wealth Management's Ascent

Private Wealth Group in Minneapolis.

U.S. treasury yields advanced as investors continued to

price in higher inflation and more upbeat prospects for the U.S.

economy as it emerges from the coronavirus pandemic.

The benchmark 10-year yield US10YT=RR rose to 1.6029%,

from 1.594% late on Monday.

U.S. economic data also pointed to a continued recovery, as

the Commerce Department said wholesale inventories increased

solidly in January despite a surge in sales, suggesting

inventory investment could again contribute to growth in the

first quarter. On foreign exchange markets, the dollar index =USD hit a

three-and-a-half month high, rising rose 0.523%, with the euro

EUR= up 0.06% to $1.185.

Oil prices settled lower, retreating from a session peak

above $70 a barrel after attacks on oil facilities in Saudi

Arabia lifted prices that high for the first time since the

COVID-19 pandemic began.

U.S. crude futures CLc1 settled down $1.04, or 1.57%, at

$65.05 per barrel. Brent crude futures LCOc1 settled at $68.24

per barrel, down $1.12 or 1.61%.

Spot gold XAU= added 0.2% to $1,685.20 an ounce. U.S. gold

futures GCc1 % to $1,677.70 an ounce.

<^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Global assets http://tmsnrt.rs/2jvdmXl

Global currencies vs. dollar http://tmsnrt.rs/2egbfVh

Emerging markets http://tmsnrt.rs/2ihRugV

MSCI All Country World Index Market Cap http://tmsnrt.rs/2EmTD6j

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^>

- English (USA)

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

GLOBAL MARKETS-Asian stocks set to firm on global recovery prospects

Published 03/09/2021, 07:59 AM

Updated 03/09/2021, 08:00 AM

GLOBAL MARKETS-Asian stocks set to firm on global recovery prospects

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.