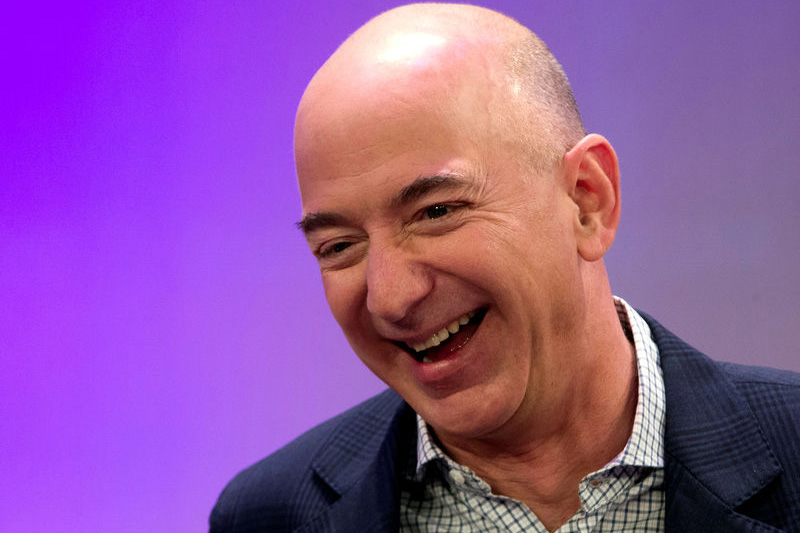

Investing.com -- Jeff Bezos sold a further chunk of Amazon stock (NASDAQ:AMZN), a filing with the U.S. Securities and Exchange Commission showed earlier this week, capping off in days a planned offload of up to 50 million shares in the e-commerce titan.

Bezos -- Amazon's founder and now its executive chairman -- sold 14 million Amazon shares that were worth roughly $2.4 billion over three trading days ending on Tuesday, according to the filing.

Last week, Bezos unloaded around 12 million Amazon shares valued at approximately $2.03 billion. Days before, he had also sold another 12 million share tranche, as well as a further 12 million shares earlier this month. Prior to these moves, Bezos had not sold stock in Amazon since 2021.

Bezos has now netted roughly $8.5 billion from the string of stake sales. Amazon had previously announced that the billionaire could unload up to 50 million shares in the firm by Jan. 31, 2025.

Bezos, the world's third-richest person according to Forbes, has yet to say what he will do with these proceeds. The stock sales come after the tech tycoon said in an Instagram post last year that he is relocating from his long-time home in Seattle to Miami -- a move that would in theory leave him free from having to pay hundreds of millions of dollars in state taxes.

The state of Washington put in place a 7% capital gains tax in 2022. Florida, by contrast, has neither a state income tax nor a tax on capital gains.

Amazon's stock price

Analysts at CFRA Research were skeptical about the impact Bezos' unloading of Amazon shares would have on the stock.

"Bezos selling Amazon shares is a near-term distraction, in our view," the analysts told Investing.com. "We think it will quickly be forgotten and investors will refocus on the growth ahead."

Shares in the e-commerce giant soared by more than 80% last year, buoyed in part by the release of new generative artificial intelligence features at its key cloud division, Amazon Web Services (AWS).

AWS Chief Executive Andy Jassy has told analysts that he believes the nascent technology could help drive tens of billions of dollars in revenues in the coming years, adding that it could eventually be used by virtually all of Amazon's consumer businesses.

Questions still linger, however, over whether AWS will be able to maintain growth at a similar pace to cloud businesses at Big Tech rivals like Microsoft (NASDAQ:MSFT) and Google-parent Alphabet (NASDAQ:GOOGL). Fourth-quarter operating profit margin at AWS trailed behind Microsoft's Intelligent Cloud business, which includes its crucial Azure service, according to Visible Alpha figures cited by Reuters.

Amazon stock price prediction

Amazon has projected first-quarter net sales of $138 billion to $143.5 billion, while operating income is seen at between $8.0 billion to $12 billion.

In a note following the release of Amazon's better-than-anticipated fourth-quarter earnings earlier this month, analysts at Morgan Stanley said the company is showing signs of "improving execution" and "cost discipline." They added that they expect AWS to benefit from a rise in new deals, initiatives and "exisiting migrations" to cloud services.

"We expect these trends and growing generative AI offerings to lead to a continued acceleration in [2024]", the Morgan Stanley analysts said.

Investors are also anticipating that Amazon's advertising revenue will increase in the current quarter following the group's decision to place ads on its Prime Video streaming service.

Amazon has been building fulfillment centers closer to shoppers as well, in a bid to make package deliveries both faster and cheaper. "Buy With Prime," a new service, also aims to entice subscribers to its Prime offering by giving them one- to two-day shipping on items from merchants who many not be on Amazon's website.

Meanwhile, Amazon has been shedding headcount to rein in costs after a spike in hiring during the COVID-19 pandemic. The firm slashed over 27,000 roles in 2023. According to Reuters, Chief Financial Officer Brian Olsavsky told reporters that "there's a general feeling in most teams that we're trying to hold the line" on the size of the workforce.

"We see 2024 marking the second consecutive year of margin expansion and free cash flow growth, driven by incremental retail efficiencies, growth re-acceleration in AWS, and advertising growth (e.g., introduction of Prime Video ads)," the CFRA Research analysts said.

Discover more about Amazon

Get the Numbers on Amazon. Explore a curated collection of Amazon facts and statistics covering revenue breakdowns, Prime membership insights plus learn more about Jeff Bezos.