- Volatility may return in 2025, creating fresh opportunities for savvy investors.

- A concentrated rally raises questions—are there still undervalued gems in the market?

- Using a proven stock screening strategy, we've pinpointed three undervalued stocks with 30%+ upside.

- Kick off the new year with a portfolio built for volatility and undervalued gems - subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

Volatility could make a comeback in 2025, with forecasts predicting a shift in market dynamics after two years of nearly uninterrupted gains.

Many financial experts are anticipating a correction, and while that might sound unsettling, more volatility often translates into fresh opportunities—especially in today’s hyper-concentrated market.

A Rally Driven by Just a Few Stocks

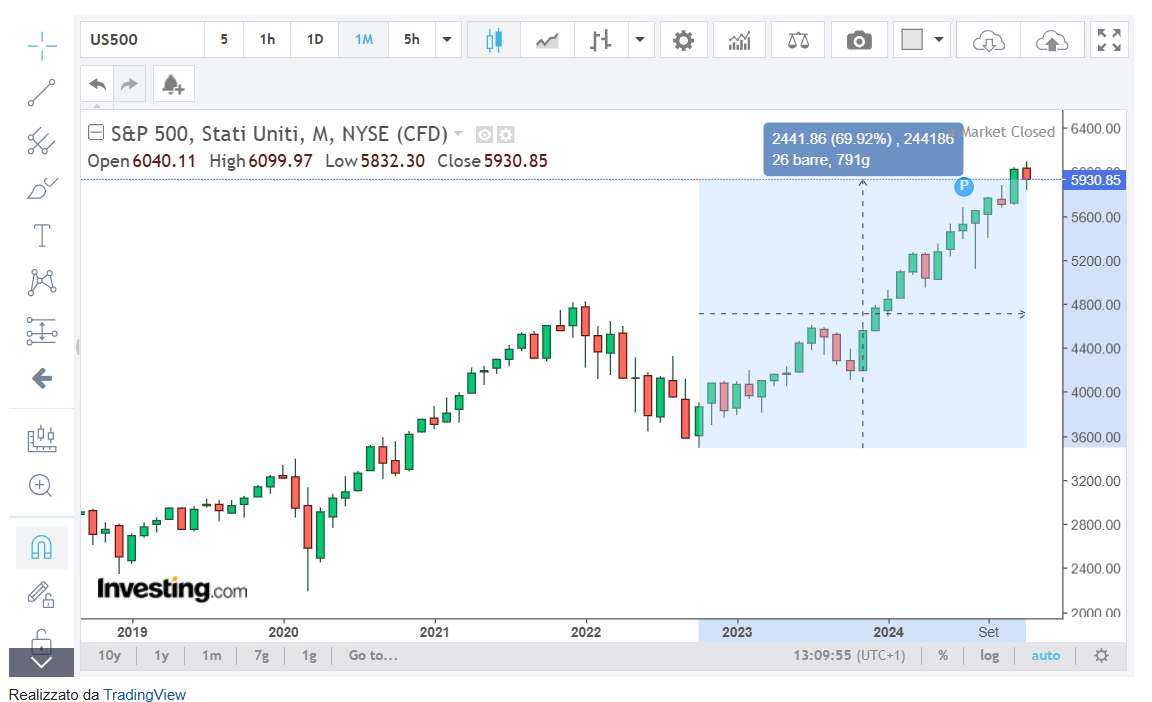

The surge in the S&P 500 since October 2022 has been remarkable, climbing nearly 70%. However, this rally has been largely fueled by a handful of powerhouse stocks—particularly those tied to the AI boom.

As Duncan Lamont, CFA, Head of Strategic Research at Schroders, pointed out, the six largest U.S. companies now hold a combined market share greater than the next six largest countries—Japan, the UK, Canada, France, China, and Switzerland—combined. The weight of these six stocks is equal to that of 2,000 of the smallest global companies.

One standout is Nvidia (NASDAQ:NVDA), whose market capitalization has soared by over $2 trillion this year alone, a figure more than double the total value of Italy's stock market.

Are There Still Undervalued Gems in the Market?

With a few stocks driving the market’s momentum, many wonder if there are other high-quality, undervalued companies still ripe for growth. The answer is yes—though finding them is no simple task. Screening for these opportunities takes time, and as seasoned investors know, time is money.

That’s where stock screeners come in handy. With tools like InvestingPro's stock screener, you can quickly sift through potential candidates, applying filters based on key financial metrics. This allows you to focus on stocks that have strong fundamentals and significant upside potential—without getting lost in the noise.

Here's How I Found 3 High-Quality Undervalued Stocks With 30%+ Upside Potential

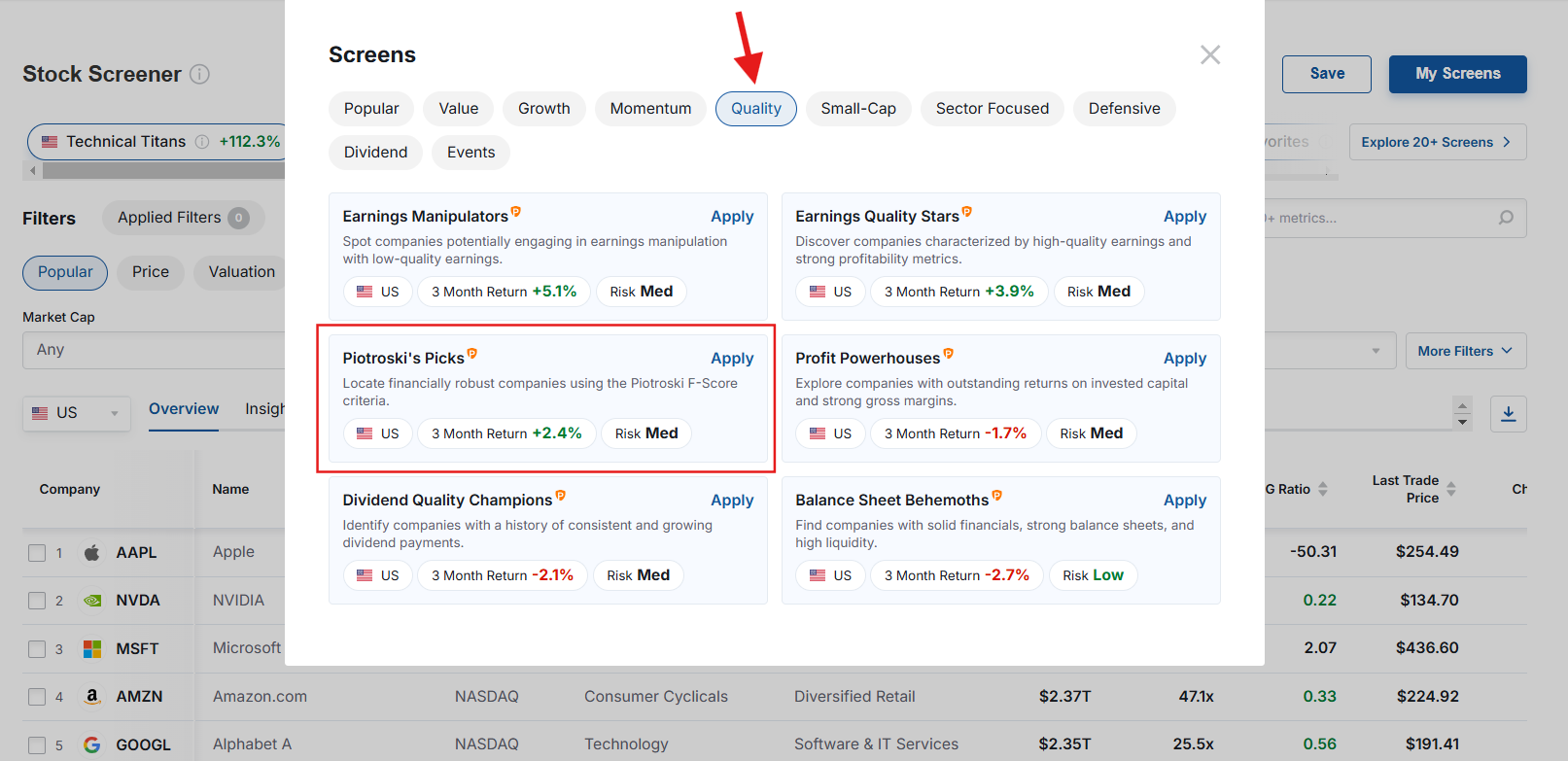

One powerful method for identifying high-quality stocks is using the Piotroski F-Score, a system developed by Stanford professor Joseph Piotroski. This approach evaluates companies on nine key metrics, including profitability, liquidity, and operating efficiency. Historically, this filter has delivered impressive results, with an average annualized return of 23% over two decades.

Using the Piotroski filter, you can narrow down your list to companies with high scores and solid fundamentals. Look for companies that meet at least eight of the nine criteria, focusing on those with positive returns, strong cash flow, low debt, and expanding margins.

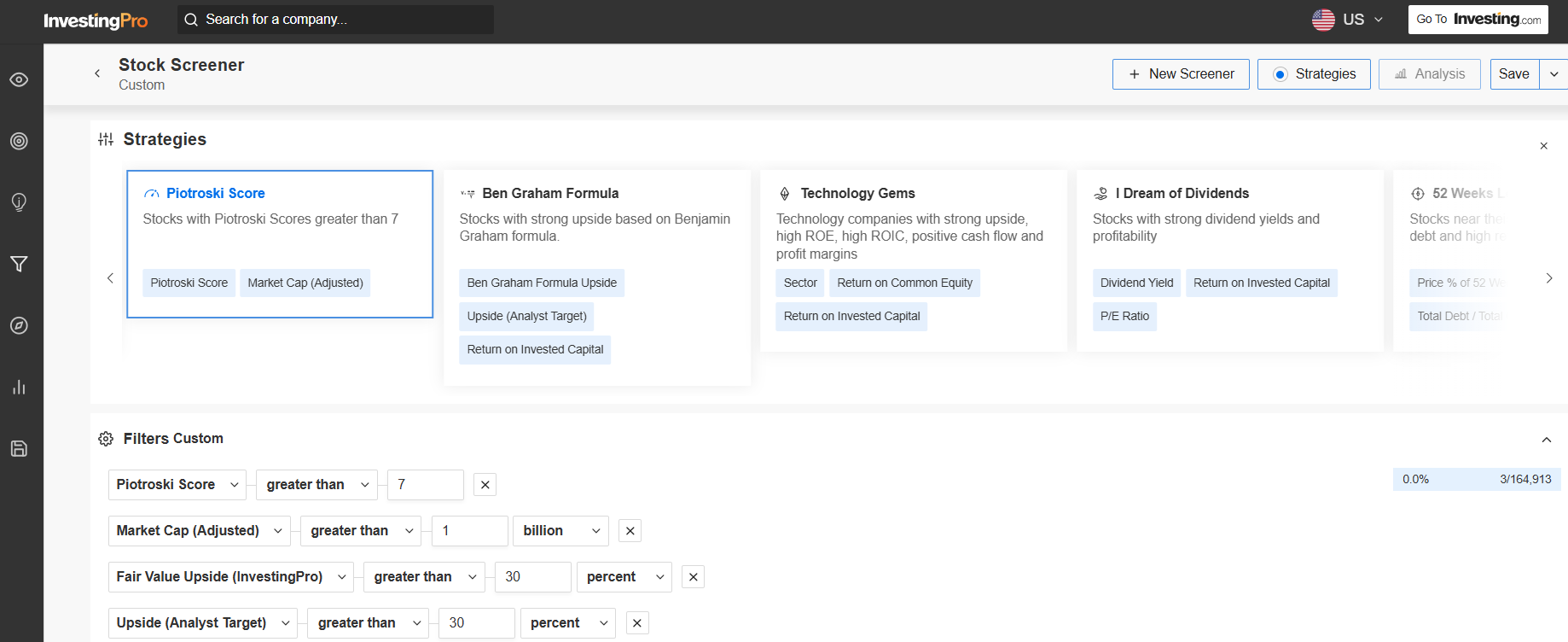

Source: InvestingPro

After filtering for quality, the next step is identifying stocks that also offer significant upside potential. Using predefined parameters—such as a minimum market cap of $1 billion and analysts' target prices—you can further refine your search to highlight only stocks with at least 30% upside potential.

Source: InvestingPro

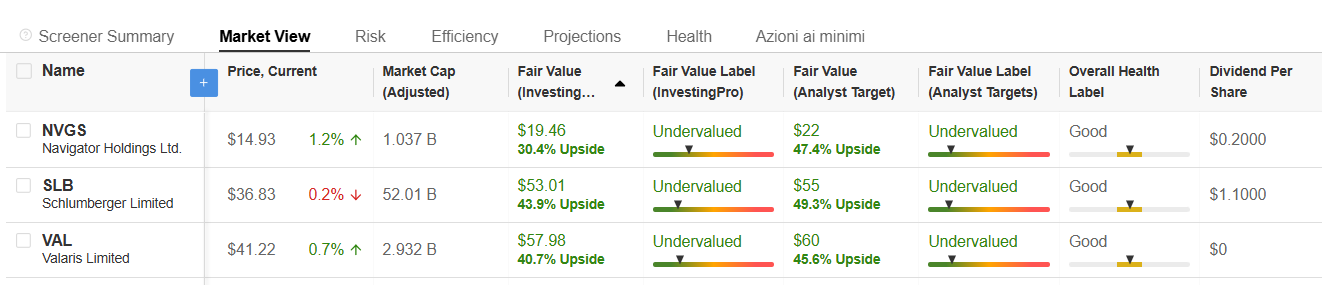

After applying these filters, three standout stocks emerge as strong candidates for 2025. These companies not only score highly on Piotroski’s scale but are also undervalued according to analysts' fair value estimates and target prices:

- Navigator (ELI:NVGR) Holdings (NYSE:NVGS) – Piotroski Score 8, Fair Value +30.4%, Analyst TP +47.4%

- Schlumberger NV (NYSE:SLB) – Piotroski Score 9, Fair Value +43.9%, Analyst TP +49.3%

- Valaris (NYSE:VAL) – Piotroski Score 8, Fair Value +40.7%, Analyst TP +45.6%

Unlock the potential to target solid, undervalued stocks poised for significant growth in 2025 by using the strategy we've outlined.

Curious how the world’s top investors are positioning their portfolios for next year using strategies just like this one?

Don’t miss out on the New Year's offer—your final chance to secure InvestingPro at 50% discount.

Get exclusive access to elite investment strategies, over 100 AI-driven stock recommendations monthly, and the powerful Pro screener that helped identify these high-potential stocks.

Ready to take your portfolio to the next level? Click the banner below to discover more.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.