Investing.com — For the second consecutive month, the S&P 500 was able to weather a volatile start to September to end at its 20th record-high close of the year.

Despite growing geopolitical worries, a combination of improving economic data, a deeper than initially expected start to the Fed's rate cut cycle, and increasing liquidity in China have gathered to provide further breadth to global capital markets.

Against this backdrop, the great rotation from overvalued tech names into smaller-cap value plays kept going strong, broadening across even more sectors of the economy.

That's precisely where our state-of-the-art AI's market-beating picks for September shined brightly.

For less than $9 a month, it notched three mid-caps that returned more than 32% in the month, rendering our users another month of above-average profits. See below:

- DUOL: +32.7% in September.

- POWL: +32.5% in September.

- W: +32.1% in September.

Not only that - With several other winning names, such as FIVE (+17.6%), DDS (+13.3%), and LSCC (+12%), our flagship Mid-Cap Movers strategy not only beat its benchmark S&P Midcap 400 by a wide margin but also crushed the broader S&P 500, despite the index hitting a series of new all-time highs.

But wait, there's even more: Other value-focused strategies such as Dominate the Dow, Top Value Stocks, and Best of Buffett also crushed both their benchmark indexes and the broader market in September.

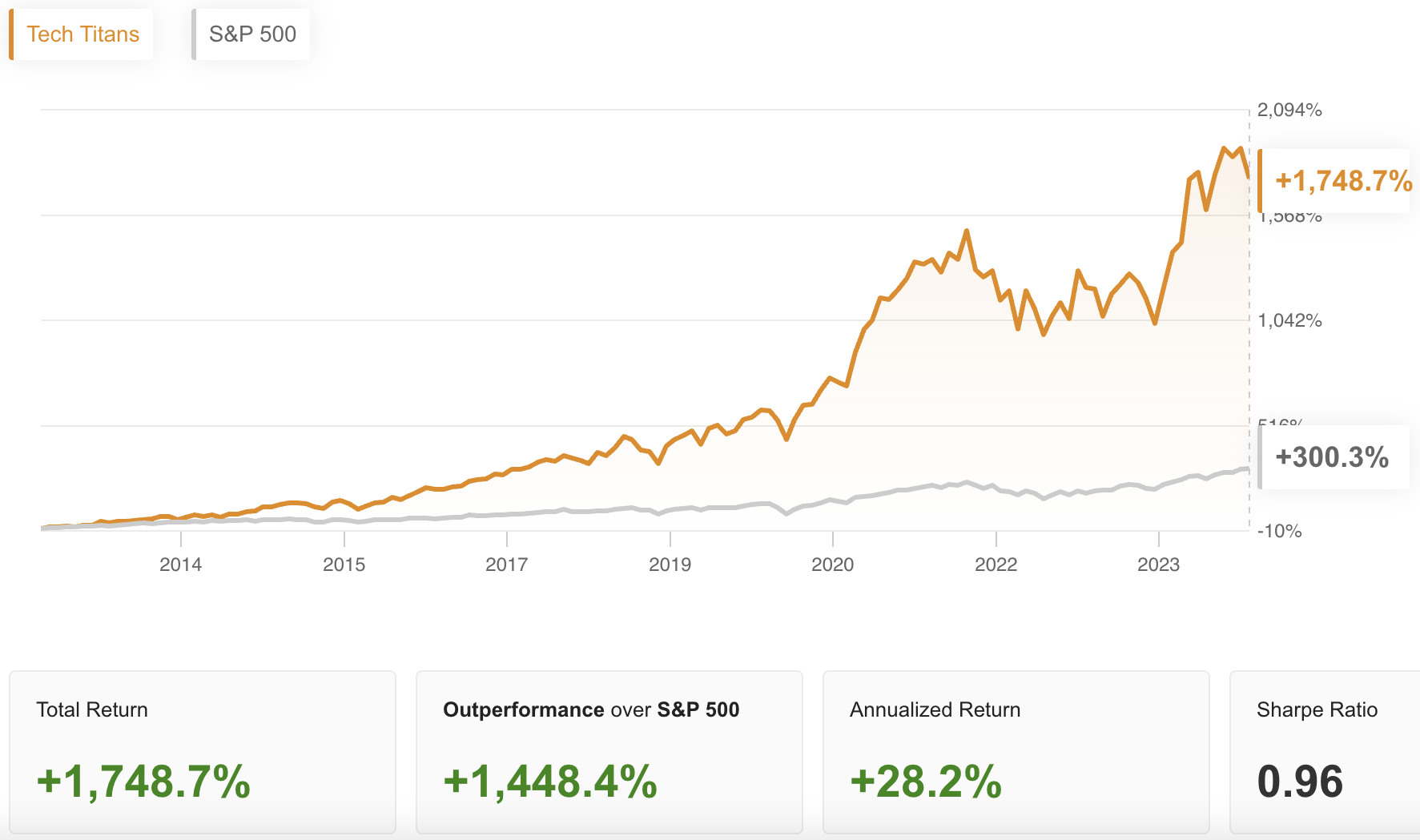

Year-to-date, however, Tech Titans remains the top-performing ProPicks AI stock strategy, with a phenomenal 37.14% return - that's 16.33% above the S&P 500.

In fact, as we inch closer to our first full year of live performance, Tech Titans has, so far, yielded a mind-blowing 80.3% return - a 44.3% outperformance against the benchmark.

This is not a backtest. This is real-world performance unfolded right in front of everyone's eyes!

So, what are you waiting for?

As October gets off on the wrong foot due to rising geopolitical tensions, this might be the perfect time to find new undervalued names that will deliver even more impressive returns in the month ahead.

In fact, against the current backdrop, our AI has just run one of its largest updates on record, providing our premium users with a plethora of new winning names for the month ahead.

Subscribe here for less than $9 a month using this link and get them before it's too late!

Already a Pro user? Then, jump straight to the updates via this link.

- But how does our AI do it so consistently?

Unlike other models, our AI identifies undervalued names before they become too expensive.

Instead of relying solely on momentum models, our approach integrates decades of comprehensive stock market fundamental and technical data, channeling a multitude of data sets to provide out premium users with market-beating stock strategies.

In fact, our backtest suggests that going for the long run will give you even heftier gains. See chart below for reference:

Source: ProPicks

Source: ProPicks

This means a $100K principal in our strategy would have turned into an eye-popping $1,848,800K by now.

So, will you risk going another month without the super-human power of AI data processing?

For less than $9 a month, that decision has never been easier.