(Bloomberg) -- The combined weight of the coronavirus and the monetary easing trend around the world could finally persuade one of Asia’s most cautious central banks to cut rates.

Taiwan’s monetary authority is expected to cut the benchmark lending rate to 1.25% from 1.375%, according to the median estimate of 30 economists. That would be the first policy-rate move since June 2016 and on a par with the record-low rates adopted during the global financial crisis more than 10 years ago.

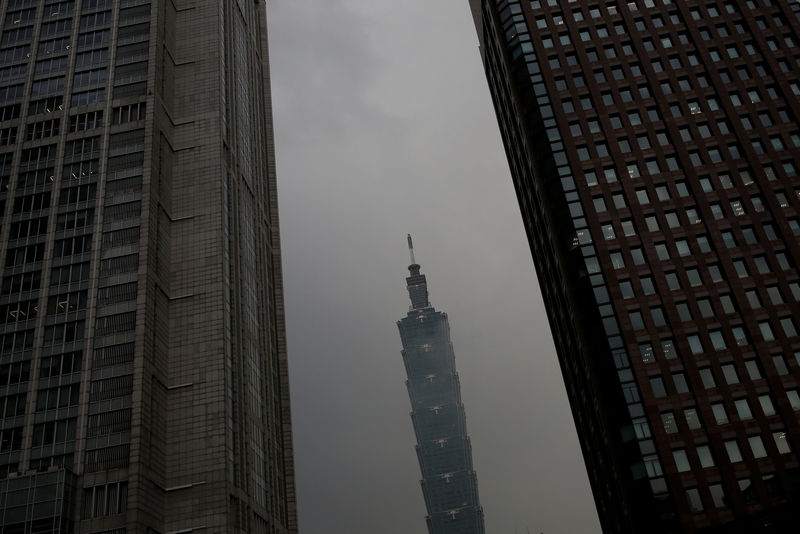

Thursday’s board meeting is scheduled to start at 2 p.m. in Taipei with a decision likely any time between 3 p.m. and 5 p.m.

Despite the growing list of central banks opting to ease, the decision for Taipei is by no means straightforward. Board members will have to examine the questionable efficacy of a rate cut in an economy already flush with cheap money as well as the impact on retirees relying on income from savings and the knock-on effect on bank deposits.

“The major central banks around the world and our main economic competitors are all easing. If we don’t cut rates, there’s a risk the Taiwan dollar will appreciate,” said KGI Securities Investment Advisory Co. economist Carl Liu. “Our economy may not be able to take that pressure. We’re essentially being dragged into this rate cut.”

Over the past decade, Taiwan’s central bank has steadily increased its sales of short-term money-market instruments to take in excessive liquidity. The sale of instruments such as certificates of deposit has also allowed it to ensure ample liquidity in the markets when needed by letting the notes reach maturity and so returning the capital to financial institutions, all the while leaving its benchmark interest rate untouched.

The monetary authority has made sure there is sufficient cash in the markets over the past week by reducing the amount of its regular short-term note sales by NT$190 billion and keeping its key overnight guiding lending rate at 0.166%, the lowest level since the bank allowed it to float in 2016.

Read more on how Taiwan uses certificates of deposit to guide money markets

Companies whose cash flows have been hardest hit by the virus, such as hotels and airlines, will need support to minimize volatility risk, said Woods Chen, chief economist of Yuanta Securities Invest Consulting.

“Companies are facing an existential crisis and banks should offer them support. The central bank is the one to take the lead,” he said. “The main thing is to ensure that companies can continue to exist. The interests of savers is secondary to that.”

The Taiwanese economy is likely to shrink in the first quarter for the first time since 2016 before rebounding the in the second half of the year, according to a Bloomberg survey of 33 economists. Should Taiwan’s central bank lower rates Thursday, analysts see no further cuts for the rest of the year.

Medically, Taiwan has remained relatively isolated from the worst of the coronavirus outbreak. It has reported 100 confirmed cases as of Wednesday, including from a cruise ship, compared to more than 200 in Singapore and over 8,000 in South Korea. But the economic risk looms large as its two largest export markets, China and the U.S., head for recession, and domestic spending is curtailed by a self-isolating public.

Central bank governor Yang Chin-long told lawmakers in Taipei last week he sees little chance of Taiwan’s economy growing more than 2% this year. In 2019, the economy exceeded expectations partly due to investment returning to Taiwan amid the U.S.-China trade war. The government’s most recent forecast, made in February, sees growth of 2.4% for 2020.

Central banks from Washington D.C. to Tokyo to Wellington have unleashed a wave of stimulus in an effort to mitigate the worst of the impending slump as the global economy shuts down in an attempt to curb the coronavirus.

(Updated with new quote, details on central bank liquidity measures, economic forecasts and coronavirus tally)

©2020 Bloomberg L.P.