By Peter Nurse

Investing.com -- President Joe Biden is set to unveil hefty federal spending in his budget, the ECB has to decide on bond buying, while the Fed’s favored inflation gauge is due. The OPEC meeting next week looms large while stocks climb on economic recovery optimism. Here's what's moving markets on Friday, May 28th.

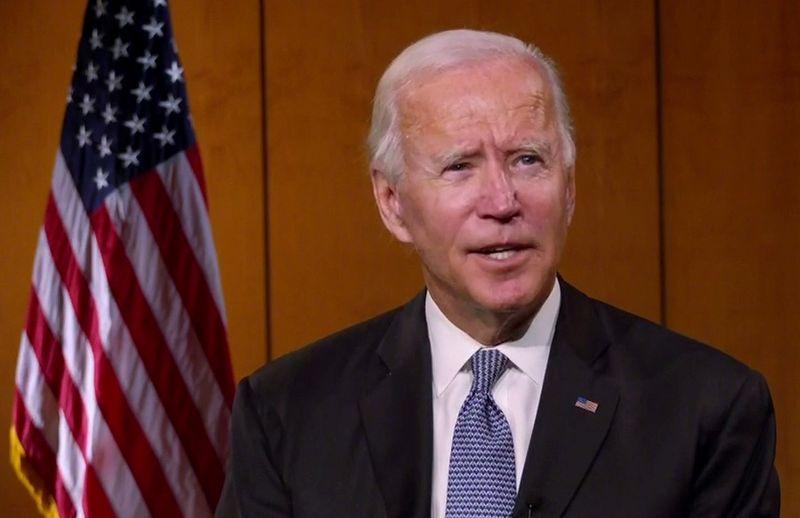

1. Big Biden budget

President Joe Biden is set later Friday to unveil a budget that would increase federal spending to $6 trillion in the coming fiscal year, according to a report by the New York Times.

Although such a proposal would have to get through a divided Congress, where the Democrats hold only narrow majorities in the House and Senate, it would take federal spending to its highest levels since World War II.

The president’s new spending is intended to fund major investments in both traditional infrastructure and in green technology, deemed crucial in raising America’s competitiveness globally, as well as boosting access to community college, family leave and child care.

The proposal is sure to raise opposition from fiscal hawks, worried that the massive increase in spending, tied with higher interest rates, will increase the country’s debt payments to uncomfortable levels.

But Treasury Secretary Janet Yellen told lawmakers on Thursday that Biden’s spending plan represents a “fiscally responsible” approach.

“The president’s proposal, you’ll see, will have a temporary period of spending and permanent increases that beyond the budget window will result in lower deficits and more tax revenue to support those expenditures,” Yellen said while testifying during a House Appropriations subcommittee’s virtual hearing.

2. Stocks set to push higher; Salesforce (NYSE:CRM), HP (NYSE:HPQ) in focus

U.S. stocks are set to open higher Friday, as optimism about the global economic recovery grows following strong employment data.

By 6:20 AM ET, Dow Jones futures were up 195 points, or 0.6%, at just over 34,600, S&P 500 futures were 0.4% higher and Nasdaq 100 futures climbed 0.3%.

The major indexes are all on track to close higher this week. The broad-based S&P 500 is up 1.1% so far this week, the blue-chip Dow Jones Industrial Average is up 0.8% higher, while the NASDAQ Composite has gained nearly 2%.

Earlier in Europe, the pan-European Stoxx 600 index gained 0.4%, setting a new intraday record high, as the European Commission's economic sentiment index rose to 114.5 points in May, a three-year high, from 110.5 in April.

Confidence is growing about the strength of global economic improvement, helped by first-time jobless claims in the U.S. falling to a new pandemic low, a positive indication of the health of the world’s largest economy.

Adding to the optimism are reports that the Biden administration's fiscal year 2022 budget is set to take federal spending to levels not seen since World War II.

Salesforce (NYSE:CRM) will be in focus Friday, with its stock up 4.5% premarket, after the software company raised its full-year forecasts, following increased demand for its cloud-based software due to a pandemic-led shift to remote work.

HP (NYSE:HPQ) stock fell over 5% premarket despite the company’s better-than-expected second-quarter results, after it warned the ongoing computer chip shortage could impact their ability to meet demand for laptops this year.

3. Fed’s favorite inflation gauge

The economic data slate is pretty packed Friday, but the most closely watched release will be the Federal Reserve’s preferred gauge of inflation, the core personal consumption expenditures price index, at 8:30 AM ET (1230 GMT).

Economists expect core PCE to have jumped 2.9% year-on-year in April, way above the Fed’s nominal target of 2%, compared with a year-on-year rise of 1.8% a month earlier.

Fed officials have been at pains to make it clear that they are prepared to look through a period of high inflation as they see it as being temporary - this was particularly the case after the latest consumer price index showed a year-on-year jump of 4.2%.

However, a hefty rise in the core PCE index would be sure to cause some discomfort to the U.S. policymakers, potentially accelerating the time frame before the central bank chooses to act.

In other economic data, personal income is set to slide 14.3% as stimulus checks disappear, and personal spending is expected to gain 0.5%. The Michigan consumer sentiment index is also due, and is expected to slip to 82.8 in May.

4. ECB bond buying program

The Federal Reserve is coming under increasing pressure to give the market more guidance as to when it plans to start tapering back its bond-buying program. However, in Europe, these voices are much more quiet.

In fact, the European Central Bank is increasingly expected by market participants to extend the elevated pace of its emergency bond-buying at its next meeting on June 10, despite a likely economic rebound.

These purchases were ramped up in March when the Eurozone was in a double-dip recession and global borrowing costs were climbing.

Europe has started to grow again as ramped-up vaccinations programs have led to businesses reopening. That said, borrowing costs are still on the rise, with German 10-year yields climbing to a two-year high last week, and there has been a growing chorus of policymakers calling for a steady flow of stimulus, fearing that the recovery might otherwise falter.

European Central Bank board member Isabel Schnabel, the head of the ECB’s market operations, has taken a more benign view on the rise in yields, saying that should be expected as the economy recovers and financing conditions remain favorable.

“We continue to think the ECB will decide in favour of continuing the current pace of asset purchases at the June meeting,” said analysts at Nordea, in a note, “but expect the net purchases under PEPP to end in March 2022, as we judge it will be increasingly difficult to argue at that point that the coronavirus crisis phase would still be ongoing.”

5. OPEC meeting looms large

Crude oil prices were marginally higher Friday, with traders wary of picking sides ahead of a meeting of top producers early next week and with the return of Iranian exports still a distinct possibility.

By 6:20 AM ET, U.S. crude was up 0.5% at $67.15 a barrel, while Brent was up 0.4% at $69.47. The contracts are both on track to post weekly gains of 5% to 6%.

Iran and global powers are continuing to negotiate in Vienna over steps that Tehran must take regarding its nuclear activities to return to full compliance with the 2015 nuclear pact the Persian Gulf nation signed with world powers.

If agreement can be reached and sanctions on its oil exports are lifted, primarily by the U.S., Iran could add around 1 million barrels a day of crude to the market.

This is something the Organization of the Petroleum Exporting Countries and allies including Russia, a group known as OPEC+, have to take into account when they get together on Tuesday.

That said, most experts expect the grouping to stick with the existing pace of gradually easing oil supply curbs, ratifying the 840,000 barrels a day increase scheduled for July.

Ahead of the meeting, oil is on course for another monthly gain in May, the fourth of five this year, as investors wager that progress in combating the Covid-19 pandemic, particularly in the U.S. and Europe, will spur energy consumption.

Later Friday, traders will focus on the latest weekly update from Baker Hughes of the number of oil rigs, while the CFTC will release its weekly commitments of traders report.