- Walmart will release its next quarterly results on Thursday

- Yesterday's session saw the company break out toward new historic highs

- Walmart stock looks like a promising investment for long-term investors, but wait for a correction before buying

- Secure your Black Friday gains with InvestingPro's up to 55% discount!

This week, Wall Street is abuzz with anticipation surrounding earnings reports from the retail sector. Investors are eager to gauge whether consumers have sustained robust purchasing patterns despite challenging economic conditions.

While several of the industry's giants are set to disclosure results, including Home Depot (NYSE:HD) today and Target (NYSE:TGT) tomorrow, the spotlight is particularly intense on Walmart (NYSE:WMT), which reports on Thursday after the bell. The retail giant surged to new historical highs in yesterday's session, signaling strong expectations from investors and the possibility of a sustained upward trend.

Looking at the bigger picture, the markets are riding on a wave of optimism. The Nasdaq 100 has surged by a solid 8% over the past 10 days, outperforming the more modest gain of less than 5% in the S&P 500.

In the current economic landscape, if you're thinking about long-term investments, Walmart could be a great choice.

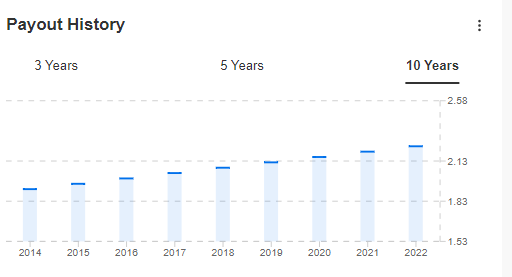

It's got a stable, regularly paid dividend and exposure to the resilient food sector, which tends to hold up well during economic slowdowns or recessions.

Source: InvestingPro

Upcoming Holiday Season Is Crucial for the Retail Sector

The upcoming holiday season holds paramount importance for the retail industry, marked by increased turnover and the need for strategic stockpiling, especially in the lead-up to Christmas.

However, there's a looming risk of overstocking, considering forecasts indicating a modest 3-4% increase in American consumer spending compared to the previous year.

Despite this challenge, Walmart, positioned as a retail leader with a strong focus on food, benefits from a favorable macroeconomic situation. This positivity is mirrored in the company's stock price dynamics.

Encouragingly, the e-commerce segment brings very positive news, witnessing an impressive 24% year-on-year increase in the first two quarters.

This growth is particularly notable in the post-pandemic period, where many companies are experiencing natural declines in this sector.

The surge in e-commerce is likely attributed to consumers actively seeking attractive price offers, especially within grocery and household items. This trend gains significance amid elevated inflation, impacting household budgets.

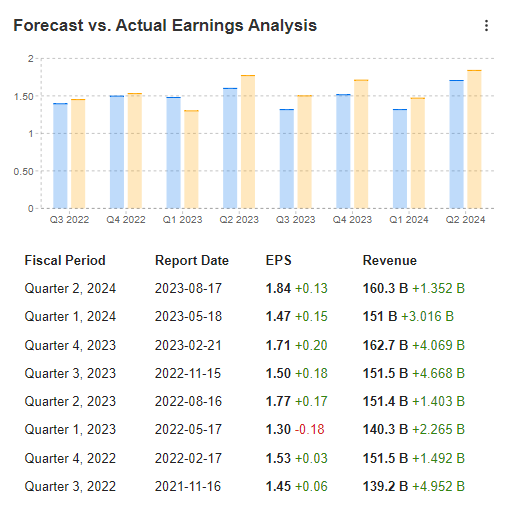

Walmart Earnings Have Regularly Beaten Forecasts in the Past

The market benchmark on Thursday will be earnings per share of $1.52 and revenues of $158.5 billion.

Source: InvestingPro

Looking at actual results versus forecasts for the past eight quarters, only once have readings been below consensus, which is certainly an impressive statistic.

Source: InvestingPro

It's important to note that the surge in e-commerce success hasn't consistently translated into immediate increases in stock prices during trading sessions.

However, several other factors, particularly forecasts for future quarters related to net profit and sales volume, have come into play.

Walmart Stock Technical View: Wait for a Correction to Hop on the Bandwagon

While the breakout to new historical highs is undoubtedly a robust signal of the uptrend's continuation, it may not be the most opportune time to enter a position from a technical standpoint, considering the risk of buying at elevated levels.

Therefore, a potential pullback could present an excellent opportunity to join the ongoing trend at a more favorable price.

The immediate support levels are situated in the price range of $166 and $164 per share, indicating that any potential correction may not extend too deeply.

This inclination towards a shallow correction is further substantiated by the fair value index, which currently points to a target level near $165 per share.

It's essential to note that we're discussing a localized discount, and the outlook remains positive for further increases in the medium and long term.

***

Buy or Sell? Get the answer with InvestingPro for Half of the Price This Black Friday!

Timely insights and informed decisions are the keys to maximizing profit potential. This Black Friday, make the smartest investment decision in the market and save up to 55% on InvestingPro subscription plans.

Whether you're a seasoned trader or just starting your investment journey, this offer is designed to equip you with the wisdom needed for more intelligent and profitable trading.

Disclosure: The author holds no positions in any of the securities mentioned in this report.