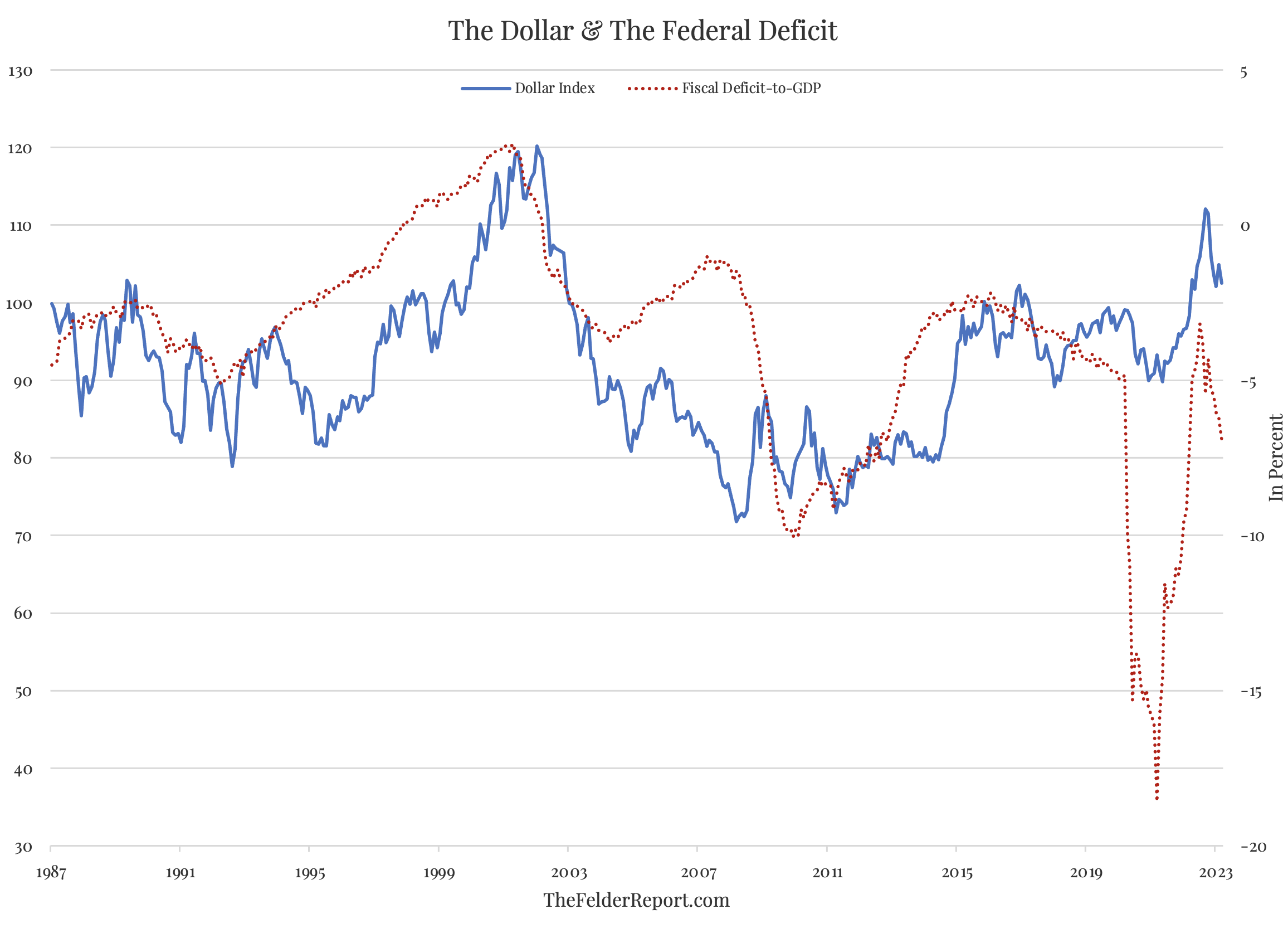

Last week, the Treasury Department revealed that the federal deficit hit $1.1 trillion in the first half of the fiscal year ending in March, $432 billion larger than the same period a year earlier. Moreover, most of this expansion came in the month of March, as spending rose 36% year-over-year (not in small part due to rapidly rising interest costs).

Longer-term, there is a clear widening trend that began back in 2015 that appears to now have resumed after some pandemic-inspired gyrations. And, if history is any guide, this deteriorating fiscal trend should represent a structurally bearish influence on the US dollar in the months and years to come.

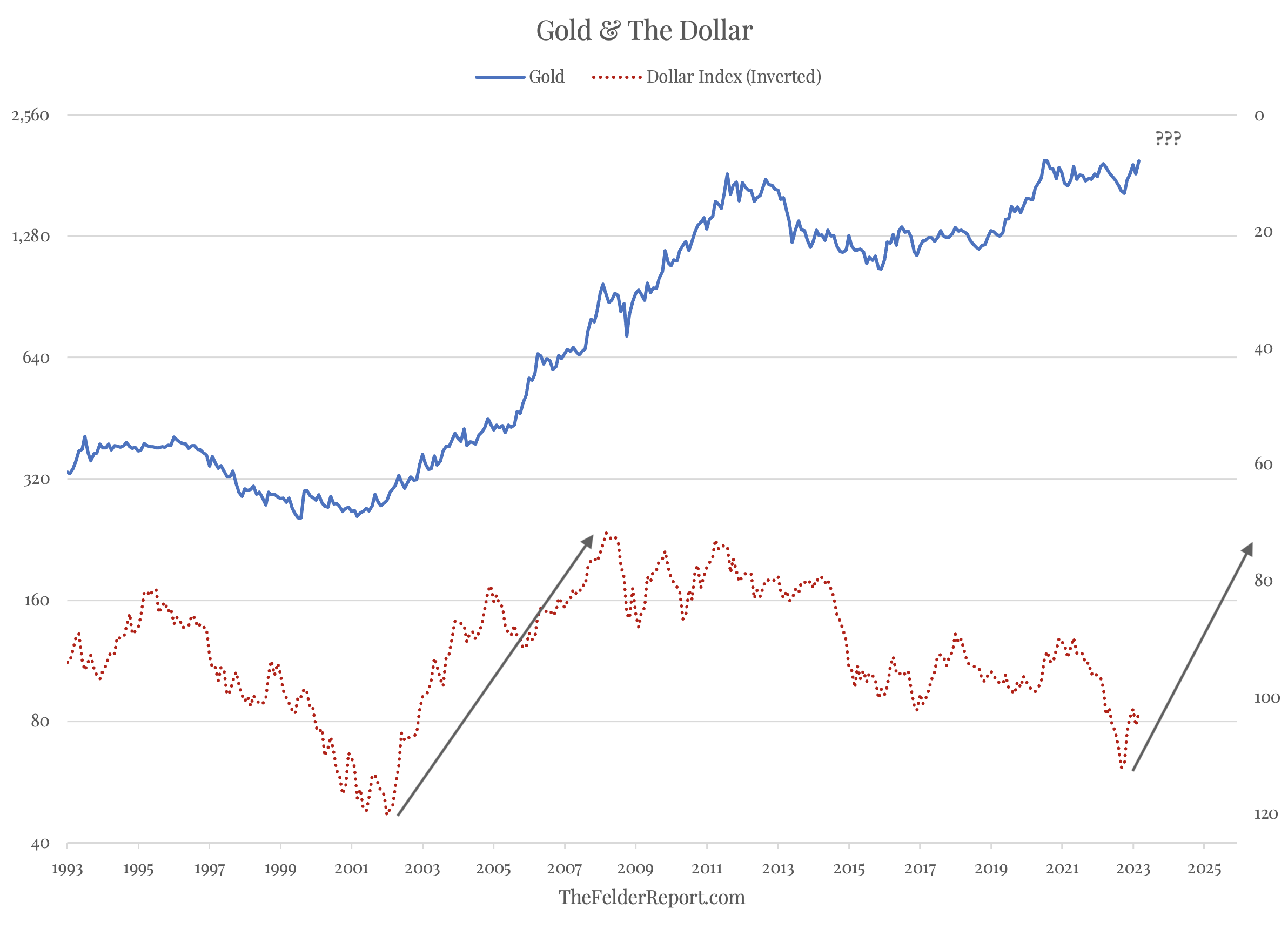

Moreover, if history is any guide, the best protection against a deteriorating fiscal situation (mathematically guaranteed by rapidly growing social security and medicare spending) is gold. The last time the deficit reversed from a narrowing trend and began a major widening trend, back in the early-2000’s, it coincided with a major top in the dollar index which evolved into a major bear market for the greenback (inverted in the chart below) that lasted roughly a decade.

This was one of the primary catalysts for a major bull market in the price of gold which rose from a low of $250 in 2001 to a high of nearly $2,000 a decade later.

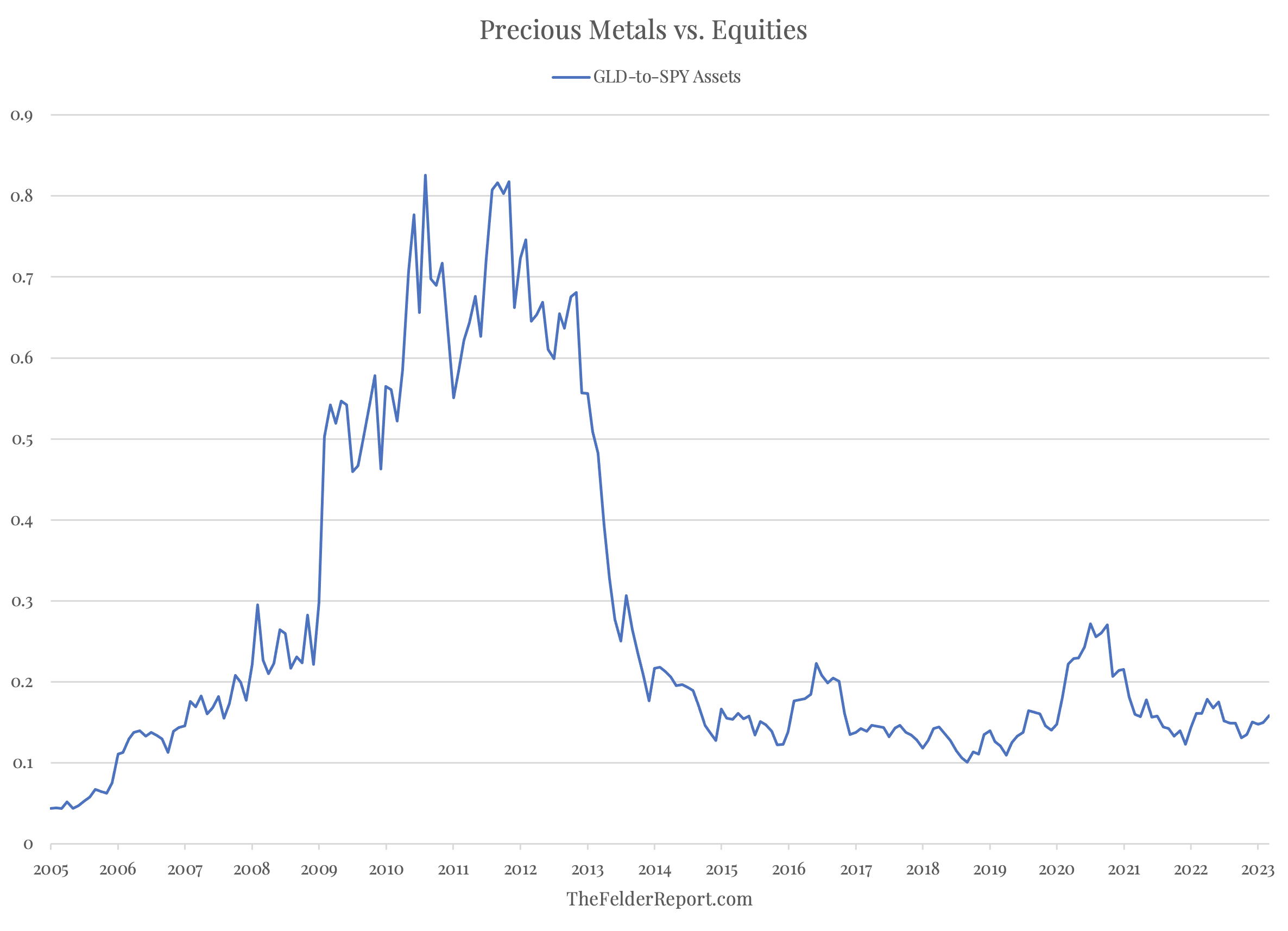

Currently, investors have little to no interest in owning gold (which is a bullish contrarian sign in my book). As my friend Callum Thomas recently pointed out, assets in gold ETFs like GLD (NYSE:GLD) are a tiny fraction of those invested in equity ETFs like SPY.

However, there’s a good chance that the deteriorating fiscal situation will, over time, light a fire under investor appetites for precious metals relative to financial assets, just as it did two decades ago. And that’s exactly the sort of thing that could power another major bull market for the precious metal.