- Insurance company Allstate shares are up close to 4% in 2021.

- Q3 metrics announced in early November missed estimates.

- Long-term investors could consider buying the dips in ALL shares, especially if they decline below $110.

Shares of property and casualty insurer Allstate (NYSE:ALL) are up about 3.8% year-to-date. In comparison, the Dow Jones Insurance Index returned almost 26%. Meanwhile the stock of another insurance heavyweight UnitedHealth Group (NYSE:UNH)—is up 41% so far in 2021.

The year began on an uptrend for Allstate, though returns have been more subdued as 2021 winds down. On May 26, after robust Q1 results, ALL shares hit $140.00, a record high. Then came short-term profit-taking, followed by another multi-month high that took the shares to almost $140 again.

But since then, the stock has lost about 18.5%. It's currently hovering around $114. The current price supports a dividend yield of 2.84%. The stock’s 52-week range has been $102.55 - $140.00, while the market capitalization (cap) stands at $32.7 billion.

The US auto insurance market is worth well over $310 billion. Allstate is among the leading five names in terms of market share. Similarly, it is one of the top names in the property and casualty (P&C) insurance segment.

On Nov. 3 Allstate issued Q3 financials that raised eyebrows. Revenue of $12.48 billion meant a 16.9% year-over-year (YOY) increase. But adjusted net income per diluted share missed significantly—73 cents vs the $2.87 Q3 2020 level. The significant decrease mainly reflected higher levels of non-catastrophe losses in auto and homeowners insurance.

CEO Tom Wilson said, after the earnings release:

“Auto insurance had an underwriting loss in the quarter as supply chain disruptions drove rapid price increases for used cars and original equipment parts…In addition to offsetting short-term volatility, our ongoing strategic initiatives have increased long-term value.”

Despite the upbeat sentiment expressed by management, investors were not impressed. Prior to the release of the quarterly results, ALL stock was trading around $125. Then, on Dec. 9, it hit an intraday low of $106.11. And on Dec. 24, it closed at $114.13.

What To Expect From ALL Stock

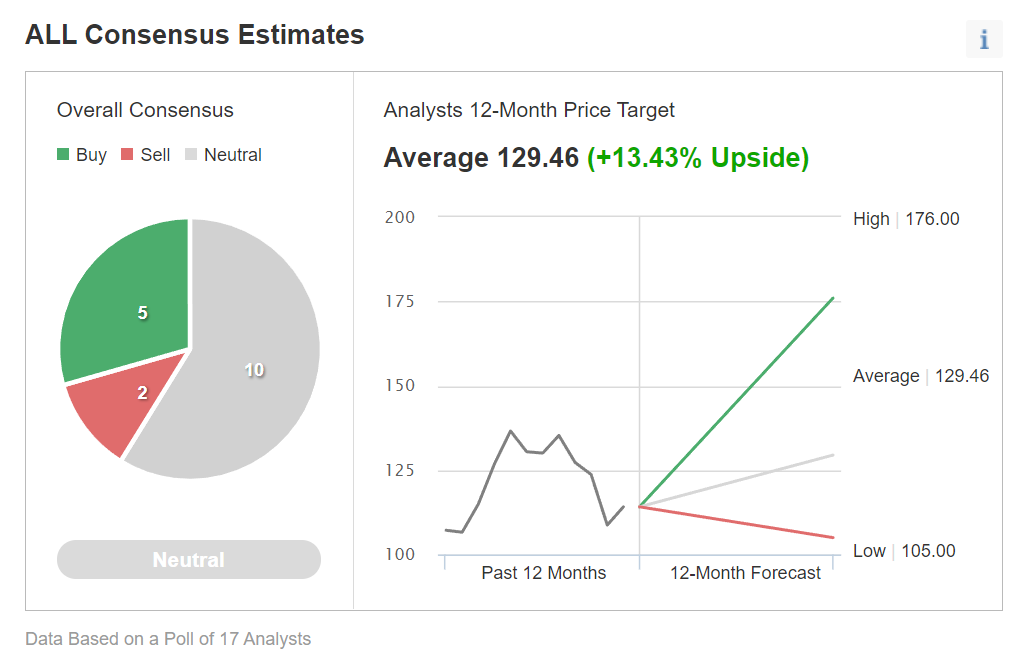

Among 17 analysts polled via Investing.com, Allstate stock has a “neutral" rating.

Chart: Investing.com

Analysts have a 12-month median price target of $129.46 on the stock, implying an increase of more than 13% from current levels. The 12-month price range currently stands between $105 and $176.

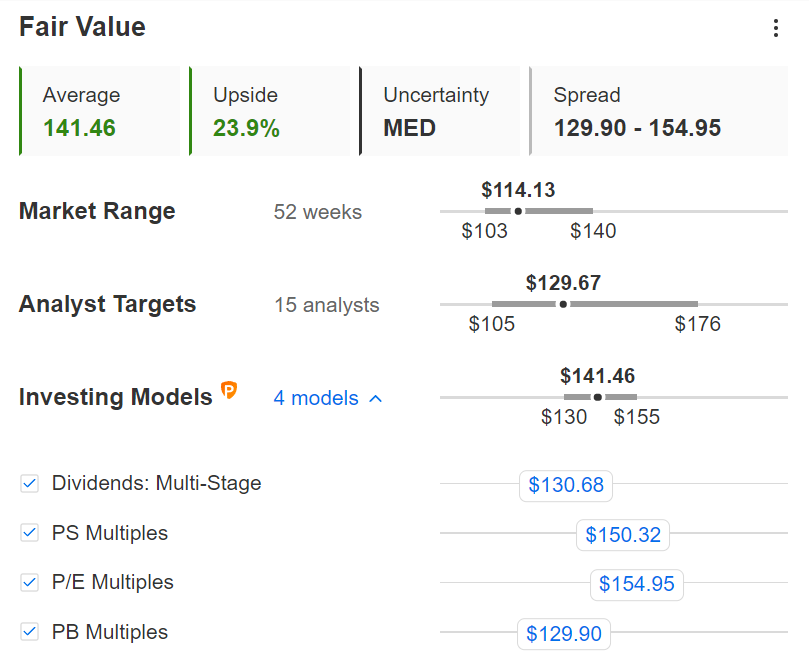

Chart: InvestingPro

Similarly, according to a number of valuation models, such as those that might consider P/E, P/B or P/S multiples or DuPont analysis, the average fair value for ALL stock, via InvestingPro, stands at $141.46, implying an upside potential of almost 24%.

Moreover, we can look at the company’s financial health determined by ranking more than 100 factors against peers in the financials sector. In terms of relative value and profit health, Allstate scores 4 out of 5 (top score). Its overall performance is rated “great.”

Trailing P/E, P/B and P/S ratios for ALL stock are 5.1x, 1.3x, and 0.6x. By comparison, those metrics for peers stand at 9.6x, 0.9x, and 1.1x. Put another way, ALL stock is potentially offering value at the current level.

Finally, those who watch technical charts might be interested to know that several of ALL's long-term indicators are pointing to oversold levels, and suggesting the decline since August might have run its course.

In the coming weeks, we expect Allstate stock to potentially trade in a range between $110 and $120, and form a base from which a new leg can start.

Adding ALL Stock To Portfolios

Allstate bulls with a two- to three-year horizon who are not concerned about short-term volatility could consider buying the stock around these levels for long-term portfolios. The target would be $141.46, the fair value implied by several models.

Alternatively, investors could consider buying an exchange traded fund (ETF) that has ALL stock as a holding. Examples would include: the Invesco KBW Property & Casualty Insurance ETF (NASDAQ:KBWP), the iShares U.S. Insurance ETF (NYSE:IAK), and the Siren DIVCON Dividend Defender ETF (NYSE:DFND).

Finally, those who are experienced with options strategies and believe there could be further declines in ALL shares might prefer to do a bear put spread.

Most option strategies are not suitable for most retail investors. Therefore, the following discussion is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Cash-Secured Put Selling

Investors who believe ALL stock could continue to reach new highs in the weeks ahead might consider selling a cash-secured put option in Allstate stock—a strategy we regularly cover. As it involves options, this set-up will not be appropriate for all investors.

Let's assume an investor wants to buy Allstate stock, but does not want to pay the full price, currently $114.13 per share. Instead, the investor would prefer to buy the shares at a discount within the next several months.

One possibility would be to wait for ALL stock to fall, which it might or might not do. The other possibility is to sell one contract of a cash-secured Allstate put option.

So the trader would typically write an at-the-money (ATM) or an out-of-the-money (OTM) put option and simultaneously set aside enough cash to buy 100 shares of the stock.

Let's assume the trader is putting on this trade until the option expiry date of 18 Feb. 2022. As the stock is $114.13, an OTM put option would have a strike of $110.

Thus the seller would have to buy 100 shares of ALL at the strike of $110.00 if the option buyer were to exercise the option to assign it to the seller.

The ALL 18 Feb. 2022 110.00-strike put option is currently offered at a price (or premium) of $2.63.

An option buyer would have to pay $2.63 X 100, or $263, in premium to the option seller. This premium amount belongs to the option seller no matter what happens in the future. The put option will stop trading on Friday, Feb.18.

The seller's maximum gain is this premium amount if ALL stock closes above the strike price of $110.00. Should that happen, the option expires worthless.

If the put option is in the money (meaning the market price of ALL stock is lower than the strike price of $110.00) any time before or at expiration on Feb.18, this put option can be assigned. The seller would then be obligated to buy 100 shares of ALL stock at the put option's strike price of $110.00 (i.e., at a total of $11,000).

The break-even point for our example is the strike price ($110.00) less the option premium received ($2.63), i.e., $107.37. This is the price at which the seller would start to incur a loss.

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company outright at the current market price. This can be a way to capitalize on any choppiness in ALL stock in the coming weeks, while building a share base.

Investors who end up owning ALL shares as a result of selling puts could further consider setting up covered calls to increase the potential returns on their shares. Thus, selling cash-secured puts could be regarded as the first step in stock ownership.