The CPI report came in hotter than expected for the headline and core CPI metrics. CPI swap pricing did a good job of predicting the headline inflation rate. As a result, yesterday’s report has led the swaps market to price higher CPI inflation rates for October and November.

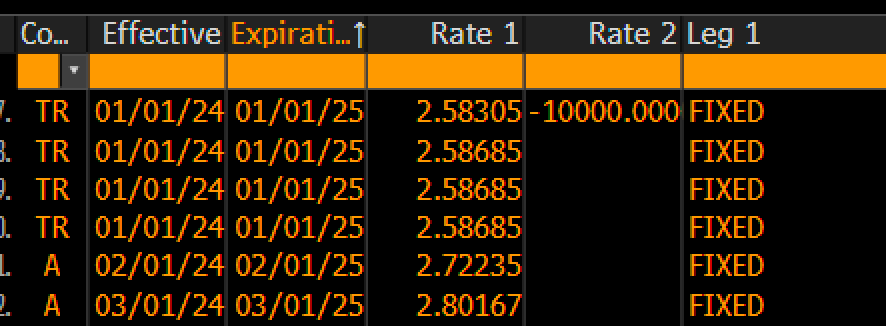

The swaps market is now pricing the year-over-year increase for October at 2.58%, November at 2.72%, and December at 2.8%. These are up from 2.46%, 2.55%, and 2.5%, respectively.

(BLOOMBERG)

Again, this takes us back to the jobs report and the 4% wage growth figure, which, assuming a 1% productivity rate, suggests inflation is running around 3%. The swaps market doesn’t seem far off from that view either.

Initial jobless claims came in much higher than expected, rising by 258,000 compared to estimates of 230,000, which likely caused some confusion in the market.

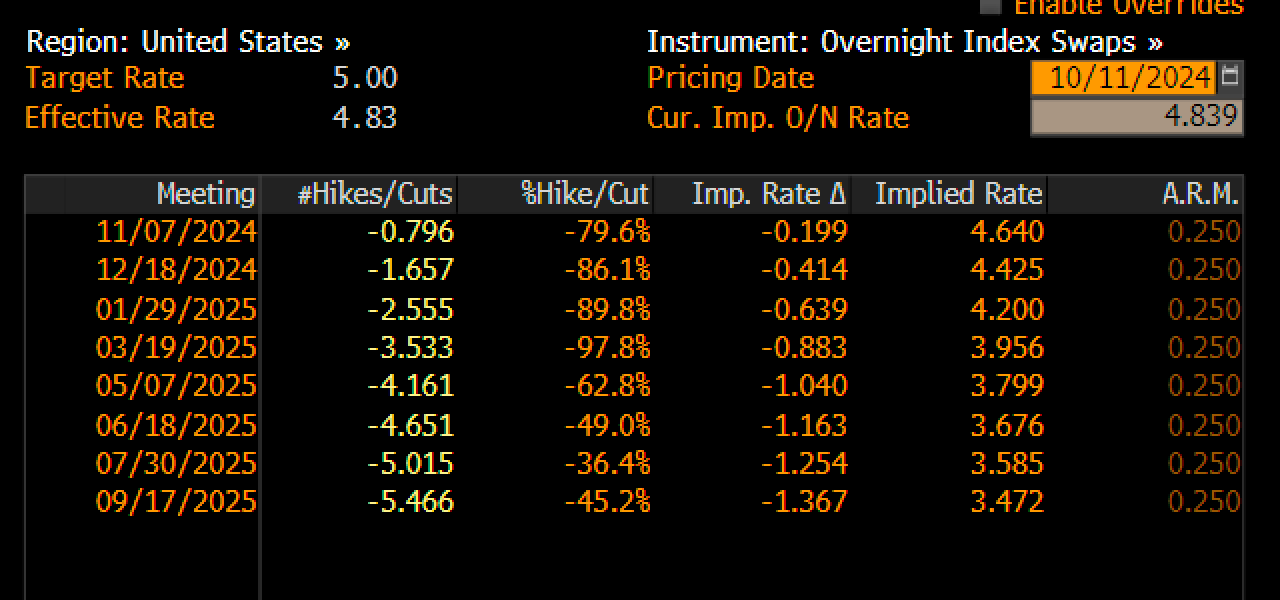

Despite the hotter CPI, Fed Fund swaps are still pricing in about an 80% chance of a rate cut in November.

Today’s PPI report will help us gain a better handle on the PCE report, and that PPI report will likely provide more clarity regarding the odds of a November rate cut.

If the swaps market is right and we are only going to see rates get down 3.5% on the Fed Funds, the 2-year rate is probably at a point where we are going to see much downside from here.

The real risk is now on the back of the curve. Because if inflation still is a thing, then the back of the curve could rise a lot.

In fact, the 10/2 curve typically peaks in the 200 to 300 bps range and more commonly in the 250 to 300 bps range, so a 2-year that settles out around 3.50% could mean a 10-year in the 5.5 to 6.5% range.

The BLS data has been so inconsistent recently that it’s hard to have confidence in any view. Heading into the September jobs report, the unemployment rate showed signs of increasing, and non-farm payrolls looked weak.

But then the September report came with all these unexpected revisions, and suddenly, everything changed.

Given the recent rise in the 10-year yield, it’s starting to look like the next move could be higher. This type of yield curve shift is called a bear steepener, which happens when the back of the yield curve rises away from the front.

The important thing to remember is that the Fed has no control over the back of the curve unless it’s conducting QE.

So, while the Fed can cut rates, the long end of the yield curve can move independently. If the market believes the Fed isn’t handling policy correctly, the back of the curve could rise significantly from here.

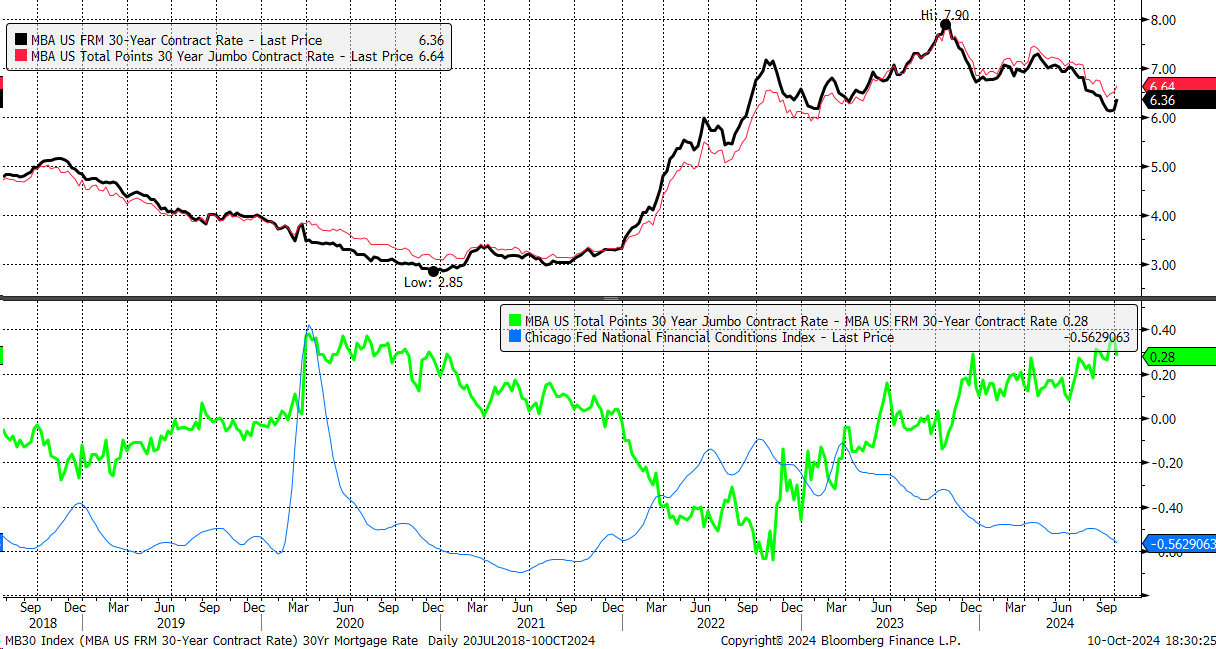

If the Fed made a policy error and long-term rates move higher, mortgage rates will also increase, as they’re largely tied to 10-year Treasury yields. This is why mortgage rates have risen even after the Fed cut rates.

This is also why the HGX Housing Index has declined by almost 5% since the middle of September.

This should be bullish for the dollar, and the dollar index has managed to bounce off the 100 level.

This likely won’t be good for small caps or high-yield dividend stocks. Usually, we think of utilities and staples, but the XLU has been acting strangely, likely due to the ‘AI’ mania. The XLU has broken its uptrend.

The XLP staples ETF seems to have already formed a head and shoulders pattern and is now sitting just below the neckline after a retest.

Healthcare is another sector with some higher-yield stocks, and we’ve clearly seen it roll over as well. It is now nearing its uptrend.