TSX lower amid U.S.-EU trade deal announcement

This post was written exclusively for Investing.com

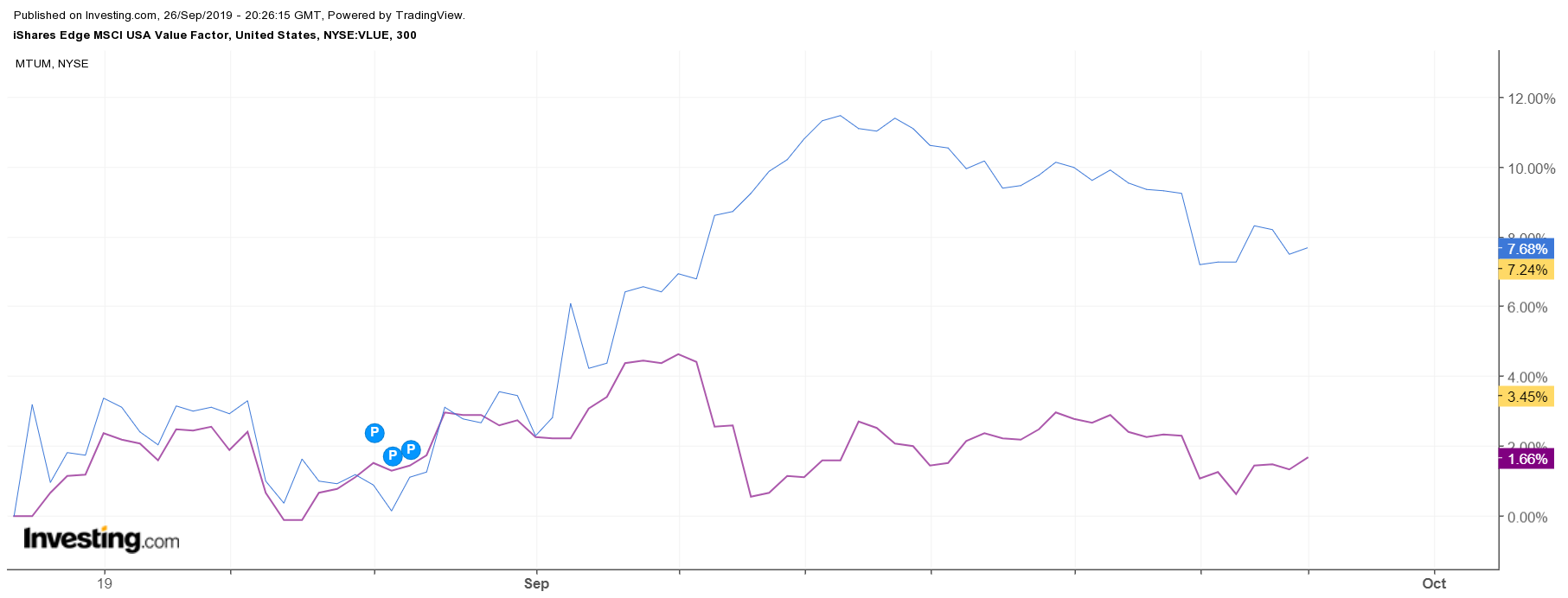

For a short time, it seemed that momentum stocks were falling out of favor as investors rushed into value names, as measured by the iShares EDGE MSCI USA Value (NYSE:VLUE) and the iShares EDGE MSCI USA Momentum ETF (NYSE:MTUM).

But suddenly the value trade seems to be fading, with the value ETF showing signs that a steeper 7% decline may lie ahead, based on the technical charts.

There is likely a good reason why that trade is fizzling out: the companies that represent value have little to offer investors in terms of future growth, when using consensus analysts’ estimates.

Companies such as AT&T (NYSE:T), Intel (NASDAQ:INTC), IBM (NYSE:IBM), Pfizer (NYSE:PFE), and General Motors (NYSE:GM) all represent some of the biggest weightings in the value ETF. When considering their growth rates, these stocks seem overvalued based on forward earnings multiples.

Value Rising

Since the middle of August, the value ETF has risen by over 7.6% versus the momentum ETF’s decline of 1.6%. However, the value ETF peaked on Sept. 11, when it was up nearly 11.5%, while the momentum ETF has traded virtually sideways.

The Break Down Nears

The technical chart shows that the value ETF has been rising and falling in a well-defined trading channel since May. Now, the ETF is resting on a level of support around $81.70. A decline below that price could result in the ETF falling back to the bottom of the trading range around a price of $76.50—a decline of about 6.75% from its current price of approximately $82.03 on Sept. 26.

Overvalued Value Stocks

One reason for the group’s sharp rise may be due to a big jump in AT&T, which represents an almost 10% weighting in the ETF. AT&T has seen its stock jump meaningfully in recent weeks since Elliott Management Corp. announced it built a stake in the company. Because AT&T has such a big weighting in the ETF, the sudden rise in its shares price may have helped to pull the whole group higher.

When digging into AT&T, one must wonder what value the company represents. Shares trade for roughly 10.3 times 2020 consensus earnings estimates of $3.61 per share. Those current earnings estimates represent growth of just 1.95% versus estimates for 2019 of $3.54 per share. But even worse, analysts are forecasting earnings to decline in 2021 to $3.57 per share.

Intel is another company that has seen its shares rise sharply, along with the rest of the semiconductor space in September. However, like AT&T, analysts estimate that earnings will rise by just 1.3% in 2020, followed by a flat 2021. Meanwhile, the stock trades with a one-year forward PE ratio of 11.4.

IBM, Pfizer, and General Motors all fit into a similar camp. The three companies combined represent almost a 9% weighting in the ETF. IBM is forecast to have earnings growth of just 5% in 2020, Pfizer is forecast to have its earnings decline by 3.6%, and General Motors earnings are expected to fall by 2.5% based on the latest consensus estimates.

It is true that all of these companies trade at earnings multiples that are less than the S&P 500’s 2020 PE ratio of 16.5. However, the S&P 500 is also forecast to see its earnings grow by almost 10% in 2020. So one must wonder, just how much value do any of these companies provide when compared to the growth of the S&P 500.

Perhaps in this low-interest-rate environment, with 10-year Treasury rates below 2%, valuation can be supported by some of these companies' very attractive dividend yields. However, the value trade is likely not to last unless these companies can begin to present investors with better underlying fundamentals.

Otherwise, all investors would be left with is overvalued companies disguised as value stocks. For that reason, any rally in this group is likely to fade fast.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.