Things are getting ugly, especially in rates and FX. Significant decoupling is occurring, indicating a potentially massive flight out of the U.S. and severe liquidity constraints now hitting the market. Rates rose sharply yesterday as Fed speakers Mary Daly and Austan Goolsbee discussed the inflationary impact of tariffs. Perhaps the budget deficit of $1.3 trillion didn’t help things either.

I’m not sure whether the Fed speakers’ lack of urgency to cut rates or the inflation talk drove rates higher, but rates certainly jumped, especially for the 10-year and 30-year, which rose by approximately 9 and 13 bps, respectively.

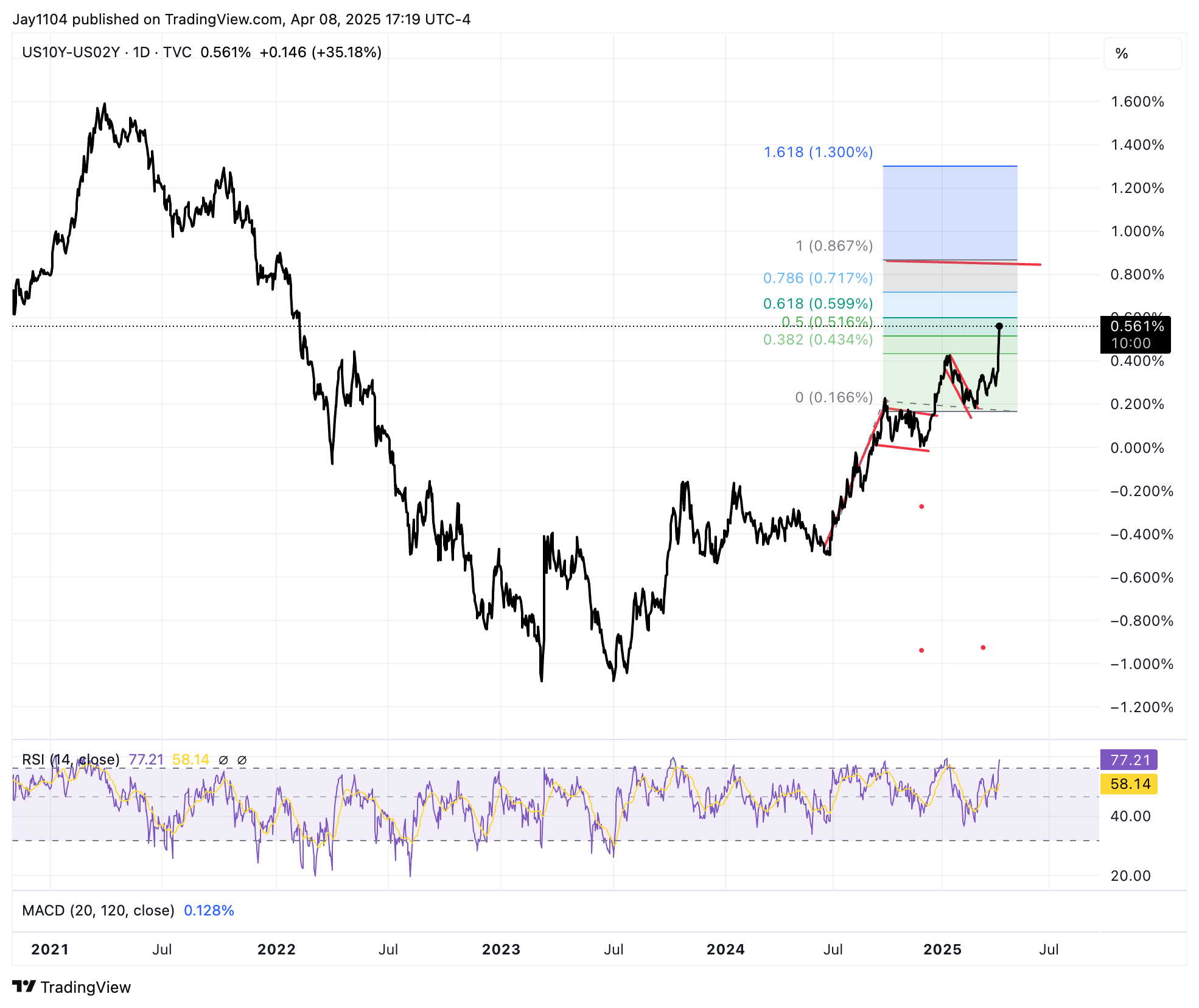

This led to the 10-2 spread rising by 15 bps through some serious bear steepening, bringing the spread to 56 bps. At this pace, the spread could reach the 85 bps region that the bull flag suggested a few weeks ago. More concerning, of course, is that today we have a 10-year auction, followed by a 30-year auction on Thursday.

The rapid rise in 30-year nominal rates has sent the 30-year SOFR Swap spread to around -100 bps, the lowest on record, and we are seeing similar moves across the treasury curve. However, my general understanding is that it is a sign of liquidity constraints.

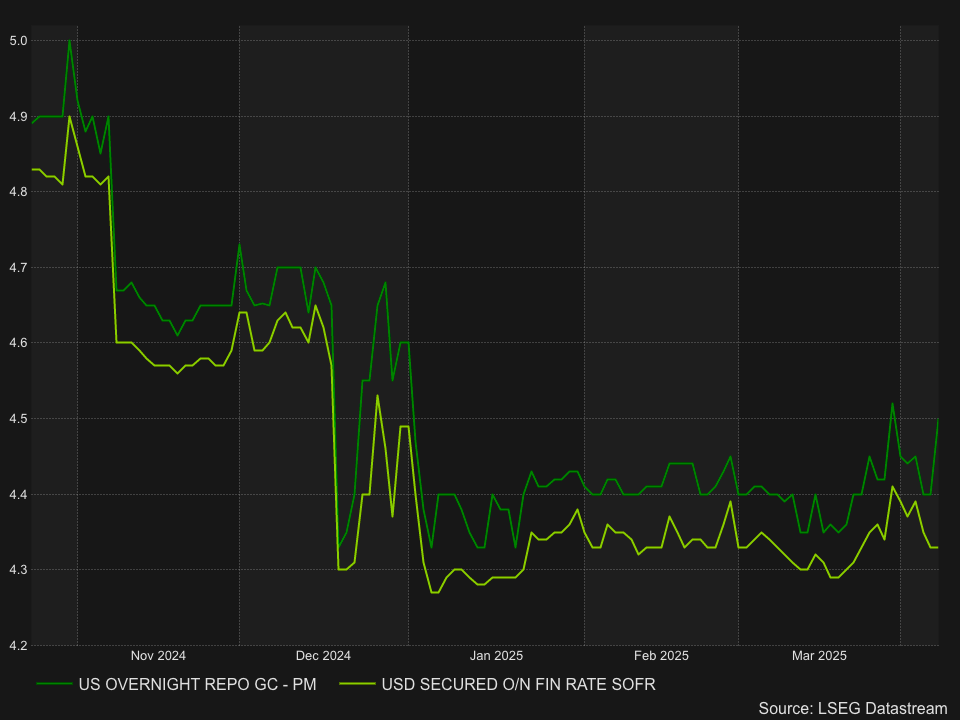

Indeed, it could be a case of liquidity tightening, as we also saw repo rates trading higher yesterday. Overnight repo rates reached 4.5%, just below the 4.52% level on March 31. This suggests we should see secured overnight financing rates move higher today morning, suggesting tighter liquidity conditions, similar to what we see at quarter or month end.

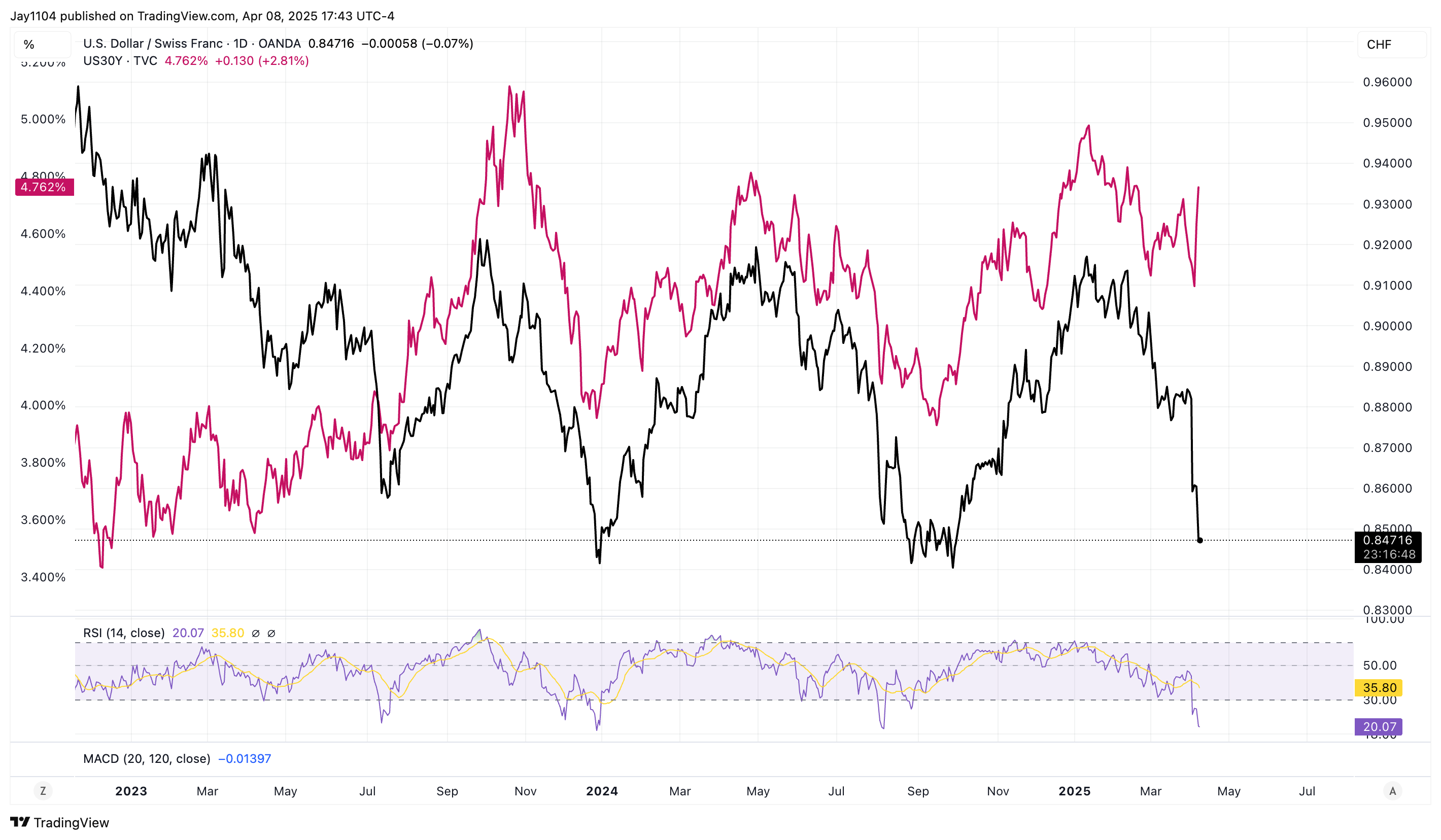

Additionally, we saw some huge and more critical divergent moves in USD/CHF, which was firmer by 1.5%. What is important here is that it has wholly decoupled from nominal Treasury rates. Higher rates in the US typically lead to a weaker CHF, not yesterday and not the past two days.

It was notably the same with the USD/JPY, which was stronger on the day by more than 1%.

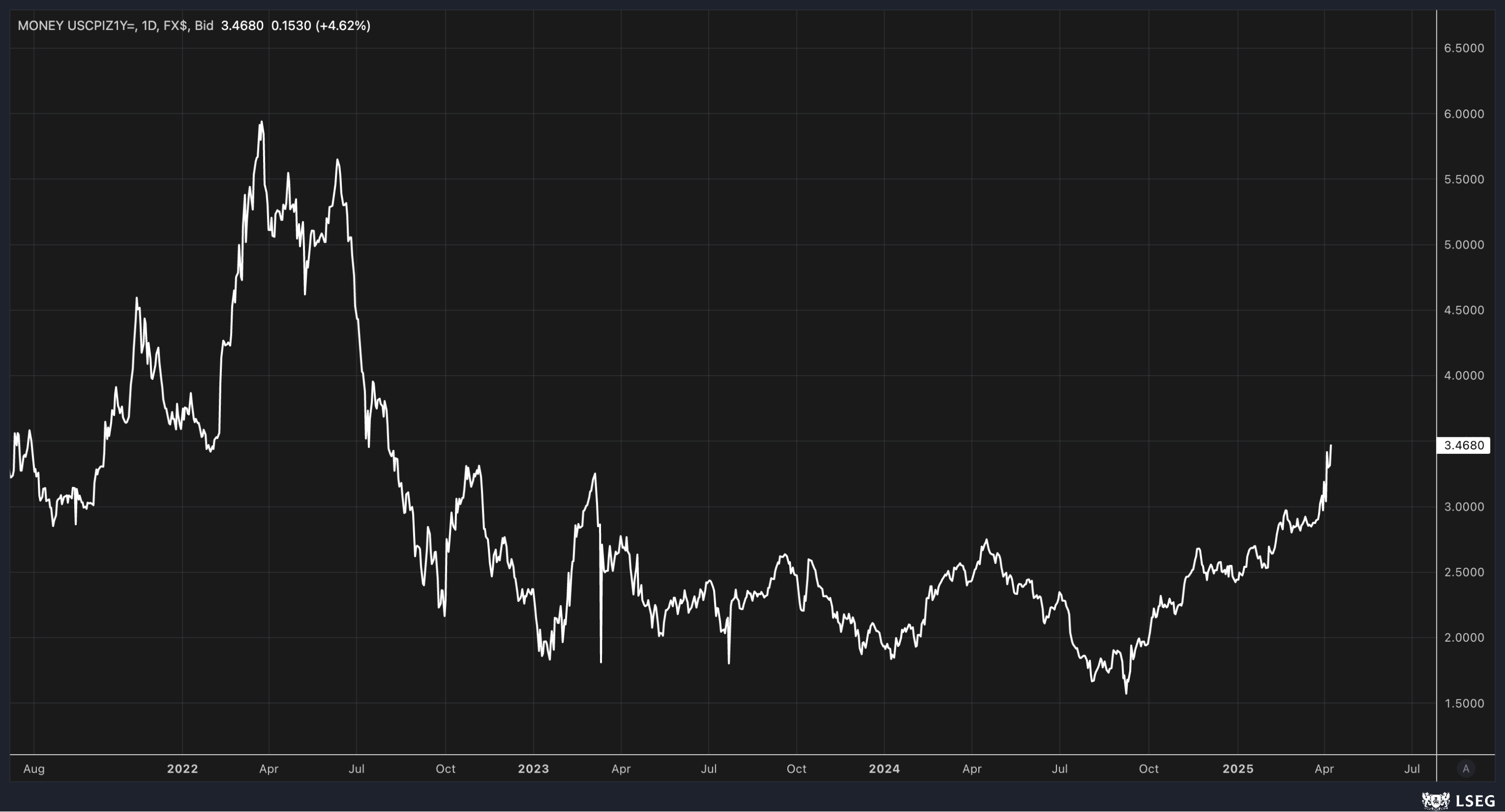

When rates rise and the dollar gets smoked, only two thoughts come to mind: either a capital flight out of the US or investors are starting to focus on the rising prospect of a stagflation hitting the US economy. Yesterday, we saw the 1-year inflation swap rise to 3.47%, which could indicate the markets’ worries over stagflation.

Unfortunately, I am merely an observer of the market, an outsider looking in, so I can’t know what is taking place. But as an observer, I can tell that none of it looks good. It is most certainly not bullish for risk assets.

As a result, the S&P 500 saw an intraday reversal of nearly 6%, finishing the day lower by 1.5% after being up about 4% this morning.

If this wave is three down, I could argue for the index to hit 4,680, the 1.618% extension off the bear flag cited about two weeks ago. The move to this point is too impulsive to be corrective.