Stocks bounced back following last week’s decline, with the S&P 500 rebounding by 1.7%. This week will be short, with US markets closed on Thursday and a half-day on Friday. It will also be accompanied by much data, with the Fed Minutes on Tuesday afternoon and GDP, PCE, and Jobless claims on Wednesday.

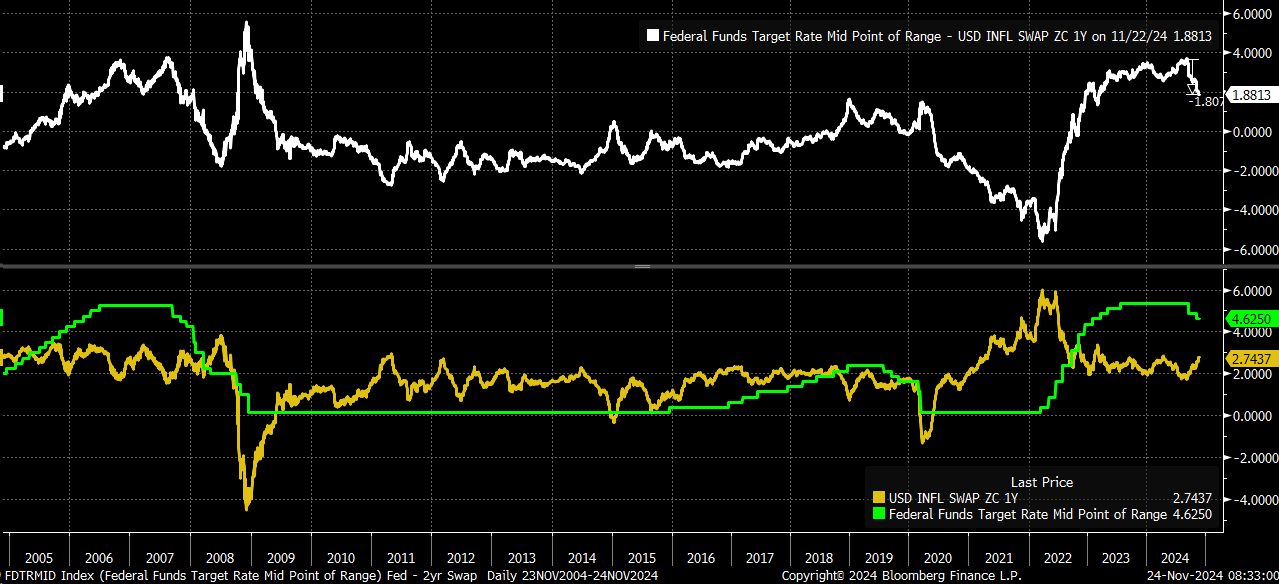

The general sense is that the Fed has backed off its “we need to cut” in-hurry policy stance and seems more in a “we can go slow pace” again. Indeed, the policy is no longer nearly as tight as it was, and with 1-year inflation swap pricing, the real policy rate right now is around 1.85%, which is about 180 bps easier than the policy was in September.

This is despite the Fed cutting by only 75 bps because the 1-year inflation swap has risen sharply since the Fed started cutting. The Fed may have very few cuts left to make, if any, depending on how inflation evolves.

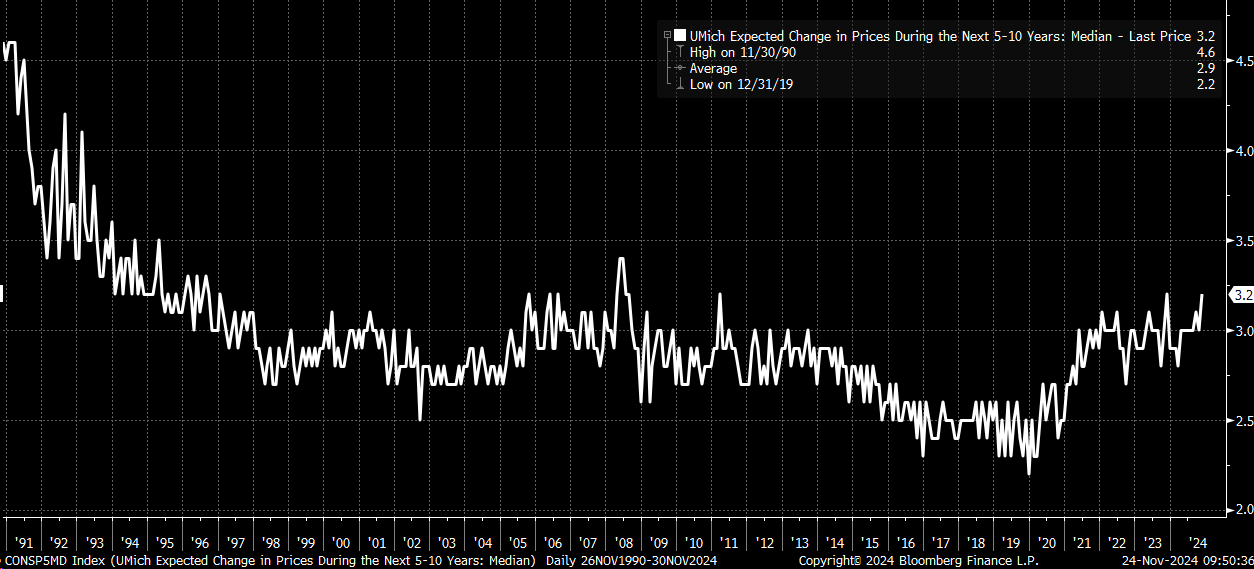

In addition, we saw the University of Michigan’s 5 to 10-year inflation expectations rise to 3.2% in November. That is at the upper end of the historical range over the past 30 years.

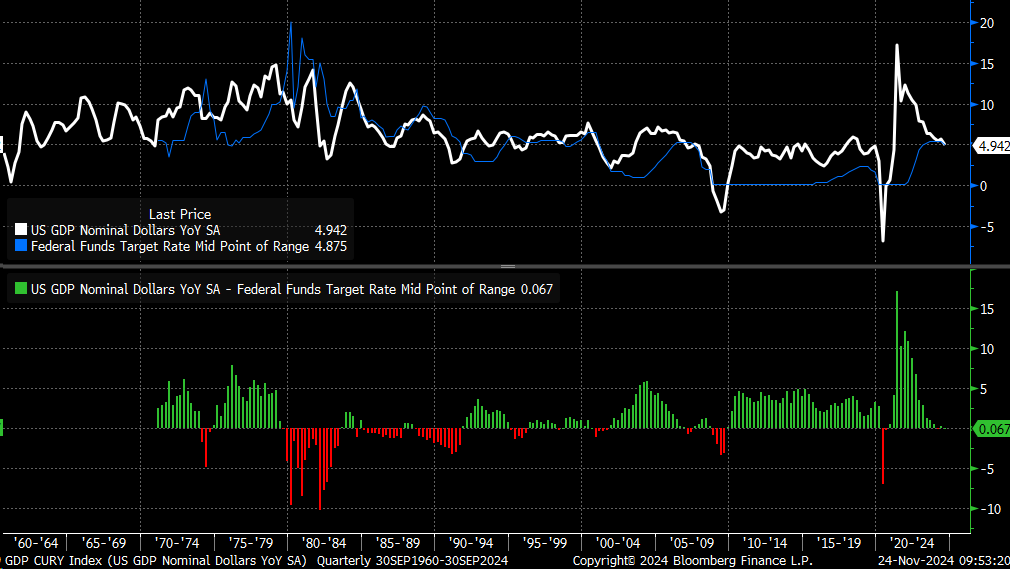

Additionally, at this point, Fed policy is about neutral with nominal GDP growth. If we assume that nominal GDP considers inflation and productivity, policy at this rate seems to be about right, and further easing may result in policy becoming loose again.

Of course, what is more interesting is what the New Treasury Secretary will have in store for markets. In June, Bessent called out Yellen for changing the pace of Treasury issuance, which resulted in easing fiscal conditions starting in October 2023.

Of course, readers of my commentary know this very well. The question is whether the new Treasury secretary will reset the cadence of Treasury issuance, resulting in tighter financial conditions.

The data shows that bill issuance is through the roof and that longer-duration issuance has fallen to low levels.

Of course, the biggest question is whether the new Treasury secretary will change issuance up to levels closer to where they have historically been.

The more pronounced the issue, the more it will mean for the stock market. In the past, when Bill issuance really ramped up, such as in the late 1990s, 2020, or even 2022, when that issuance subsided, the stock market didn’t take kindly to that shift.

So, something everyone should pay attention to going into the new year will be the Quarterly Refunding Announcement, which will come around the end of January or the beginning of February, or any comments from the new Secretary may have about issuance before that.