-

Tesla's stock plummeted this week amid worries about layoffs and a drop in first-quarter deliveries.

-

Investors are wary of further delivery declines and increased competition and will closely monitor Tesla's upcoming earnings report.

-

Despite the stock's recent downturn, Tesla's solid financials suggest a potential rebound, contingent on a positive earnings report.

- Invest like the big funds for less than $9 a month with our AI-powered ProPicks stock selection tool. Learn more here>>

After several years of market outperformance, it seems like the tables have turned for the EV giant, Tesla (NASDAQ:TSLA), in 2024.

Since the start of the year, concerns about industry growth, new rivals joining the fray, occasional tech glitches, and a gloomy outlook hinting at a possible slowdown in the company's expansion due to cost-saving measures have dragged down its stock price, making it the worst performing stock in the S&P 500 YTD.

This week kicked off with news of layoffs at Tesla, causing a 5%+ slump in its stock as investors reacted poorly. Earlier this month, the company announced an 8.5% year-on-year dip in first-quarter deliveries, adding to the downward trend.

Despite attributing the drop in orders to external factors, investors harbored concerns, fearing further delivery declines. They remained cautious of Tesla's competition, especially China's BYD (SZ:002594), and its recent price-cuts, which could further dent Tesla's sales.

Tesla Stock Plummets in 2024

In the last quarter of 2023, TSLA, known for its volatility, bucked the overall downward trend and climbed upwards. From October to December, it soared nearly 40%, reaching a peak of $265. However, this peak fell short of previous highs seen in 2023.

As the new year rolled in, TSLA faced challenges, causing its shares to plummet to $161 today, marking a 40% loss since the year began. This drop brings it back to the low levels of April last year, erasing gains from the previous bullish cycle.

During the first quarter, rumors circulated that Tesla had halted its price-cutting efforts to compete and abandoned plans for affordable electric vehicles. These rumors weighed heavily on the share price, further contributing to downward pressure.

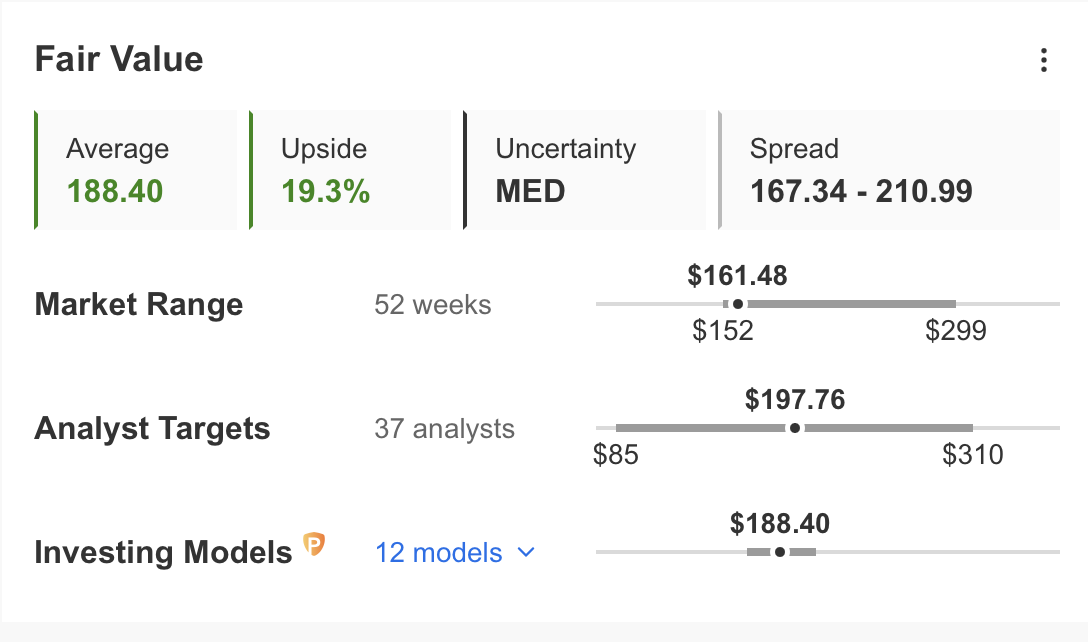

What is Tesla's Fair Value?

The stock's value has dropped significantly, but when we look at its solid financials, the fair value analysis shows a somewhat positive outlook for the stock.

Source: InvestingPro

InvestingPro's analysis, based on 12 financial models, currently pegs TSLA's fair value at $188.4. This suggests the stock is trading at a discount of nearly 20% compared to its current trading price.

Despite this, analysts' collective target price for TSLA sits slightly higher at $197. However, amid knee-jerk reactions to negative news surrounding the company, pinpointing the exact moment for a potential turnaround proves challenging.

A shift in momentum could hinge on positive developments for Tesla. The upcoming first-quarter earnings report, slated for next week, holds particular significance.

Shareholders will scrutinize this report for signs that Tesla continues to uphold its financial strength. While concerns linger over first-quarter delivery woes potentially denting revenue margins, the impact of competitive pricing strategies on profitability also looms.

Tesla's recent decision to trim its workforce by 10% could be viewed as a strategic cost-saving measure, timed to bolster profitability.

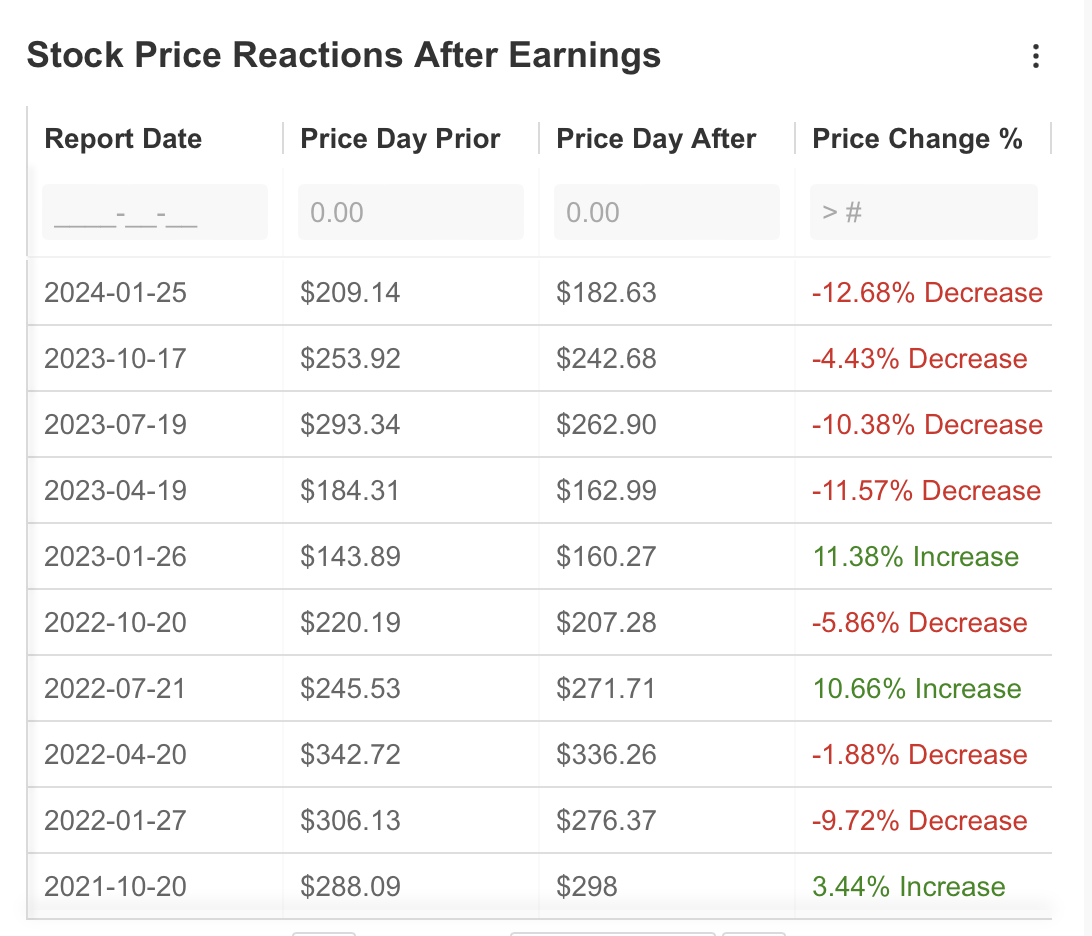

Source: InvestingPro

Analysts have revised down their revenue and earnings per share expectations for the first quarter. The expectation is that earnings per share will be announced as $0.56 and quarterly revenue as $23.32 billion in the earnings report to be presented on April 23.

TSLA shares dropped by 12% last quarter because its earnings and revenue didn't meet expectations. There's a chance it could fall even more in the future. If we look at the prices on InvestingPro after the last earnings report, we can see that investors took Tesla's financials seriously.

Source: InvestingPro

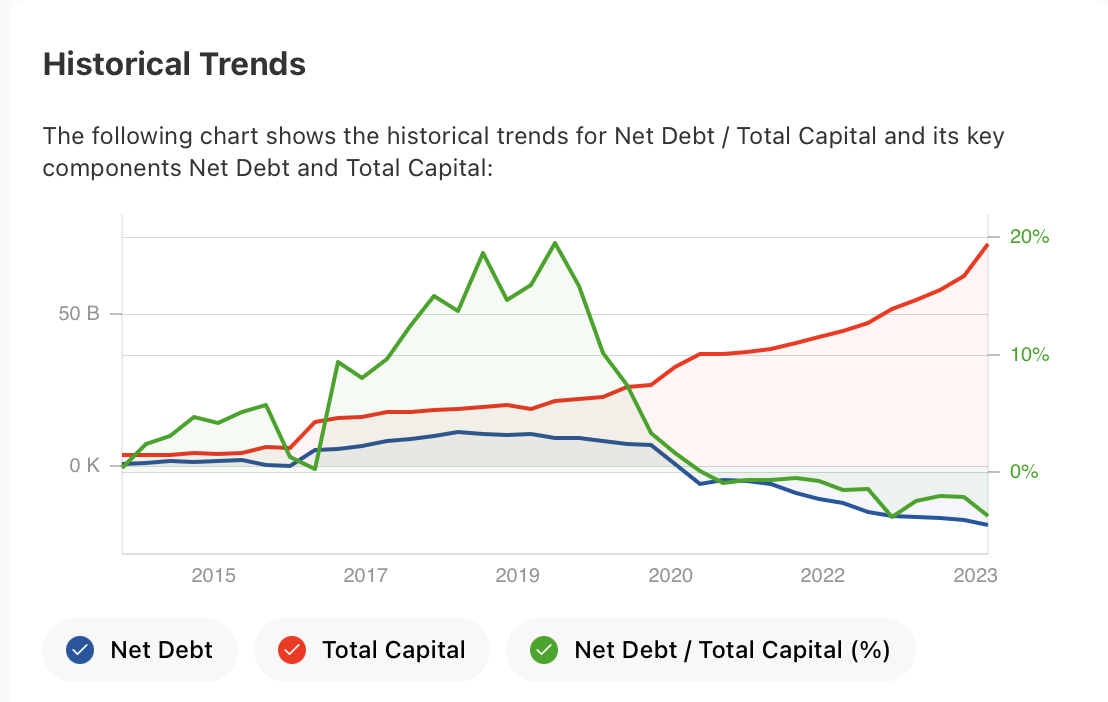

Tesla's Financial Health: Still Solid?

Although Tesla has experienced several negativities such as the decline in deliveries, vehicle recalls, negative rumors, loss of share in its largest market such as China, and finally cost-driven layoffs, the strongest trump card is its financial strength.

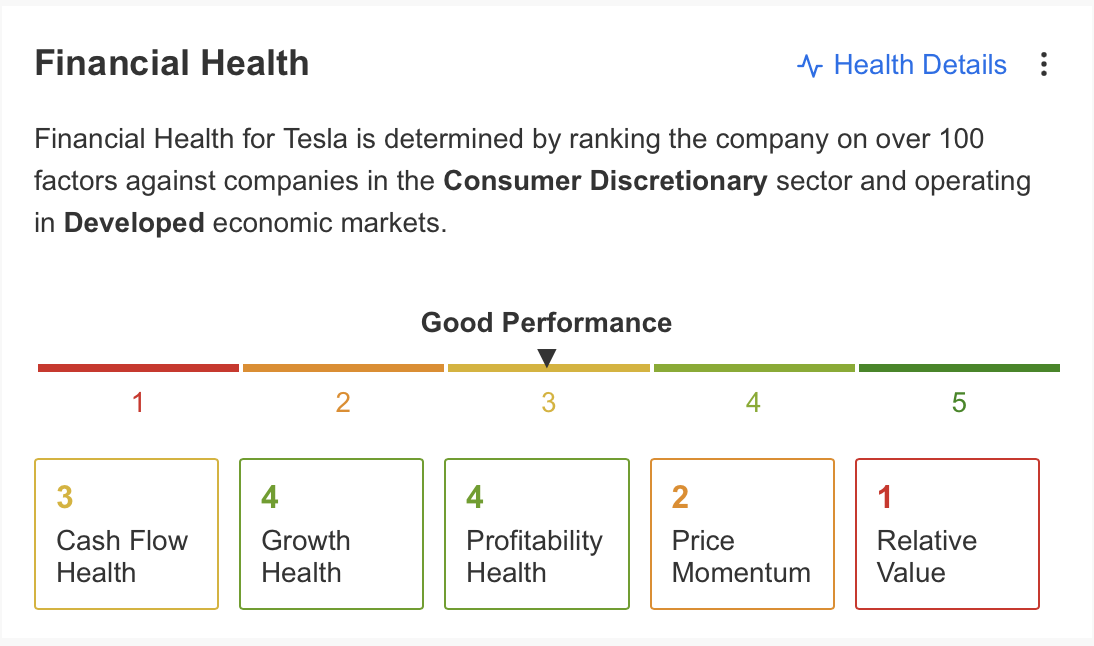

Source: InvestingPro

If we look at Tesla's positives; the fact that its cash flow is healthy and the amount of cash on its balance sheet is far above its debt provides the company with significant room for maneuver. This will be the company's biggest weapon for growth in the long run. In addition, the company may manage to stay ahead of competitors by showing resilience in a recession.

Source: InvestingPro

In this context, the fact that the growth and profitability criteria in Tesla's financial health report on InvestingPro continue to perform very well according to the 2023 earnings report can be considered as another plus.

From a broad perspective, Tesla, with its existing technology, global operations and strong financial structure, has the potential to make a rapid breakthrough in the electric vehicle and autonomous vehicle market and even in the power generation sector with its solar energy technology. If the company can be successful in the cost-cutting business, which it has focused on for 2024, this could have a positive impact on its profitability and eliminate other risks.

The biggest obstacle for the company is that its competitors have a similar reflex to develop better and more affordable electric vehicles. This is the most important problem that could affect profitability by implying price cuts.

TSLA Technical Outlook

When we look at TSLA shares technically, we can see that the price is under heavy selling pressure in the long-term outlook.

TSLA, which continues along the falling channel, cannot see reaction purchases from the bottom line of the channel this time, as repeated 3 times before. This may be due to the company's successive bad news.

The share, which has a support line up to the $ 160 level, may accelerate its losses if it closes the week below this region. However, investors will want to see the earnings report before making an investment decision on the stock.

This may cause TSLA to increase its volatility again according to the first quarter results after moving sideways in the next week.

Based on the technical analysis, if the price drops below $150, it could fall back to $110. On the flip side, if buying activity picks up from where it stands now, the price might climb toward $200.

But first, it needs to break through the $183 mark, which is the initial resistance level, and close above it for the week.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,745% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Disclaimer: This content, which is prepared purely for educational purposes, cannot be considered as investment advice. We also do not provide investment advisory services.