- Reports Q4 2021 earnings Tuesday, Mar. 1, before the open

- Revenue Expectation: $31.36B

- EPS Expectation: $2.85

When discount retailer Target (NYSE:TGT) reports its fourth quarter 2021 earnings tomorrow, investors will focus on the company’s ability to protect its margins in an environment where port delays, raw materials shortages, and rising labor costs all pose a significant challenge to its business.

The Minneapolis-based retail chain has already warned investors that cost pressures, caused by the pandemic-related disruptions, are hurting its gross margins as the retailer avoids passing on full costs to consumers in an effort to protect its market share.

The company’s gross margins fell 2.6 percentage points to 28% in the third quarter. Analysts had been expecting 29.9%, based on the average of analyst estimates compiled by Bloomberg. Such pressures, when consumers have otherwise been spending quite robustly, have hurt Target’s investment appeal.

The stock, which closed at $199.22 on Friday, has fallen about 25% since mid-November, signifying investors’ focus on margins which show how profitable the growth in sales is. The nation’s largest retailers benefited immensely from waves of pantry-stocking by American consumers during the pandemic.

This had resulted in massive spikes in sales of some categories, like toilet paper, snacks, and cleaning products. The demand surge was so strong that in the last fiscal year, Target increased revenue by more than it had in the previous 11 years combined.

Analysts Remain Bullish

Despite pressure on margins, the majority of analysts remain bullish on Target’s future prospects due to the company’s superior online capabilities and its market share gains during the pandemic.

The willingness of its customers to keep coming to Target stores is the result of Chief Executive Officer Brian Cornell’s efforts to turn around Target's retail outlets. He spearheaded the remodeling of hundreds of stores, introduced many affordable fashion brands and bolstered the retailer’s e-commerce offerings.

During the pandemic, Target has been using its stores more as mini distribution centers for its booming digital business, to better fulfill online orders.

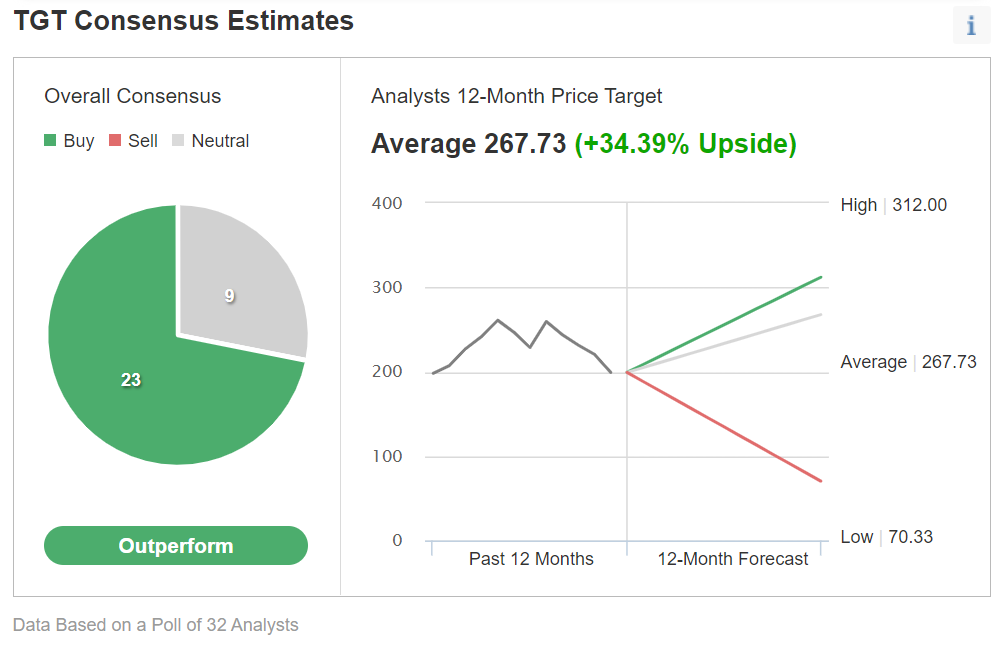

In a survey of 32 analysts by Investing.com, 23 rate TGT stock as “Outperform.”

Chart: Investing.com

Among those polled, the consensus 12-month target for the stock was $267.73, implying 34% upside potential.

In a recent note, RBC named TGT stock a top pick, saying the stock should earn a higher valuation in the months ahead. Its note said:

“We believe TGT’s investments behind e-commerce, price gaps, stores, and owned brands have driven a structural improvement that is being overshadowed by COVID noise. We see share upside via both earnings upside and multiple expansion.”

RBC, which has $278 per share price target on TGT, also said:

“There’s some concern in the market that Target’s decision to only pass on a portion of supplier price increases will result in some margin pressure near-term – especially given increased costs to expedite product. While we are modeling gross margin pressure, we believe a combination of sales leverage and productivity will enable EPS to at least meet the consensus hurdle.”

Bottom Line

During tomorrow's report, Target may again show that higher prices are hurting its margins—which have become the focus of investors’ attention during the past three months. Nevertheless, in our view, this short-term challenge shouldn’t discourage long-term investors from holding this quality retail stock in their portfolios.