Stocks moved sharply lower yesterday after opening sharply higher. It was, as expected, a reasonably volatile day, with many surprise turns, given that Nvidia (NASDAQ:NVDA) was up nearly 10%, and the S&P 500 finished lower by around 75 bps. There was a 1.4% reversal in the S&P 500 overall intraday, while the NASDAQ 100 saw a reversal of about 1.5%.

Things started to unravel for the equity market after the S&P Global PMI came out; bond yields rocketed higher, the dollar strengthened, and credit spreads widened, which sent in motion the reversal in the equity market.

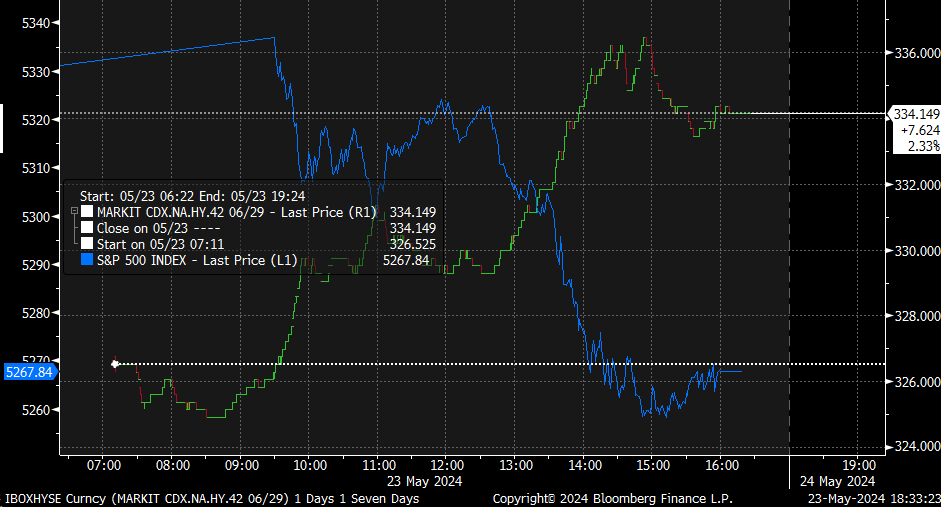

The CDX High Yield Index started the day lower but finished the day higher, with high yield spreads widening overall.

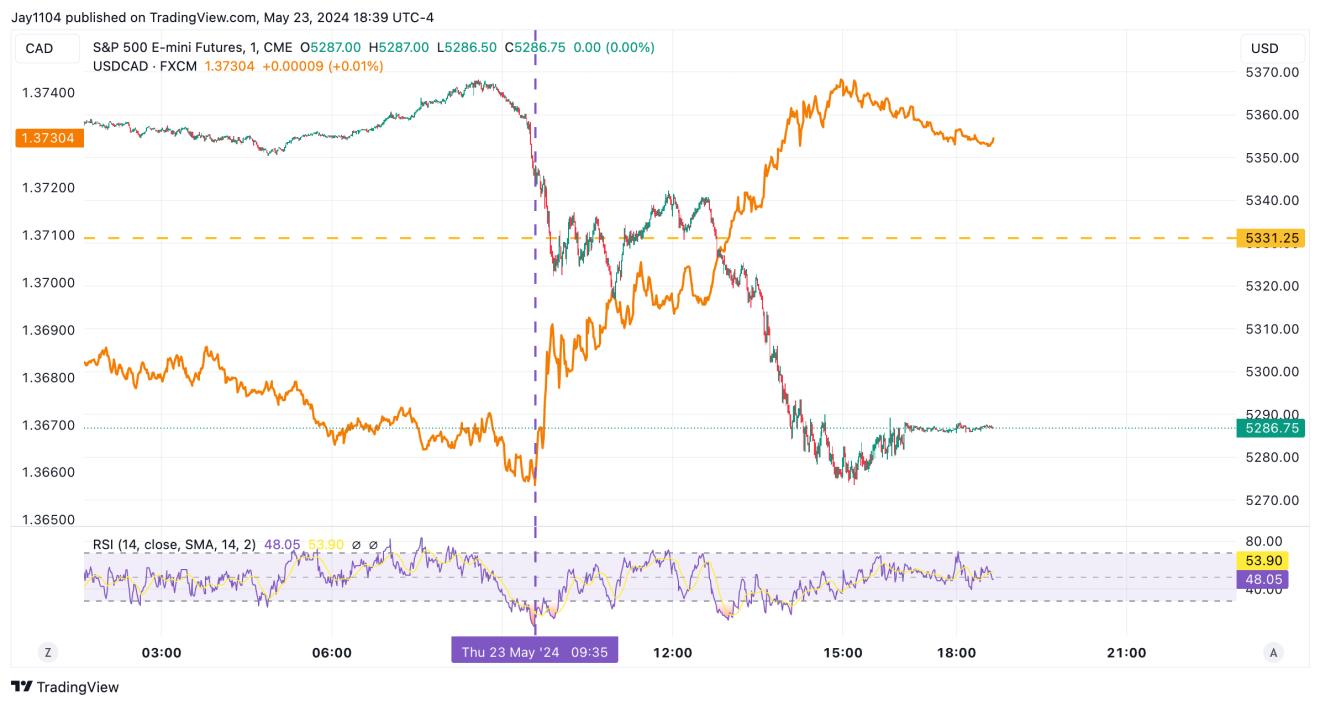

The same thing was also seen in the S&P 500 futures and the USD/CAD, with the USD/CAD moving sharply higher right after 9:30 a.m. and the equity market selling off.

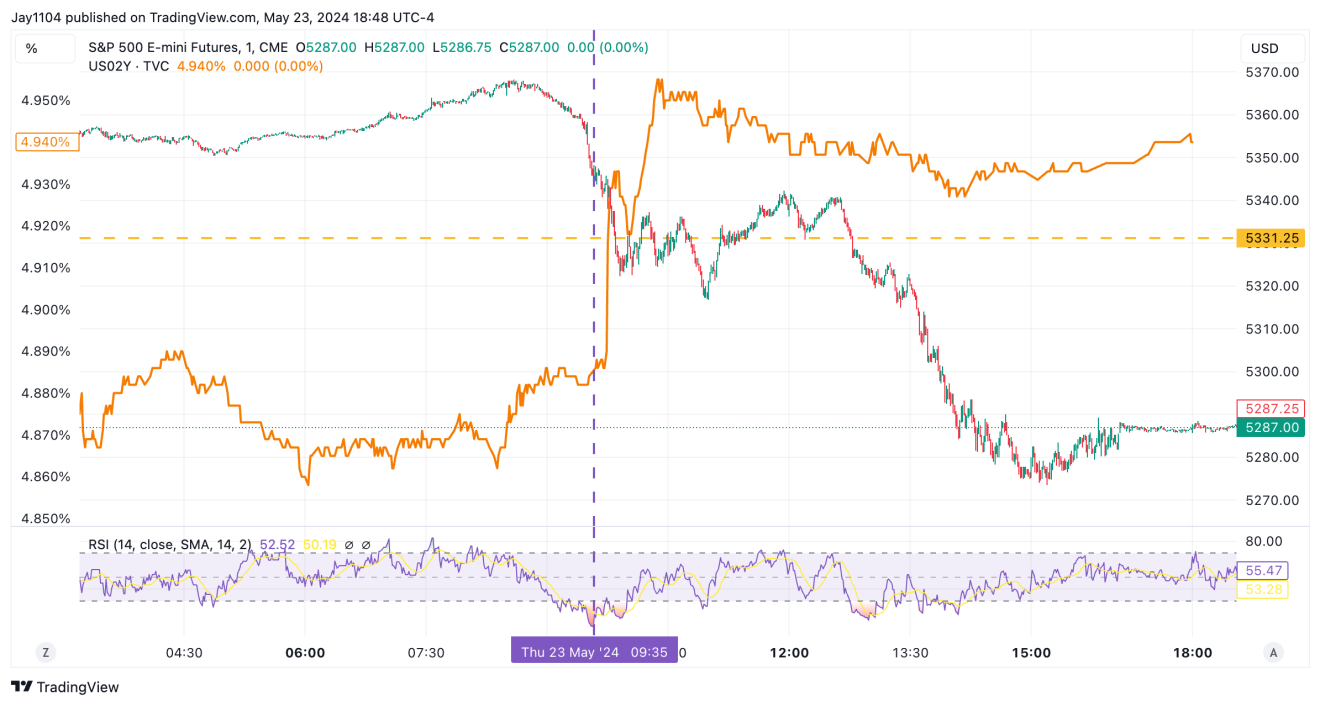

We saw the same price action with the S&P 500 and the 2-year Treasury rate.

Yesterday’s economic data pointed to a strong economy and inflation that won’t go away. Couple yesterday’s PMI data with a slew of Fed speakers this week and the Fed minutes, and investors have realized that either the Fed has no idea what it is doing when it comes to inflation and the path of monetary policy or investors are starting to sense that the Fed rate hiking cycle may not be over.

For a long time, I thought that the 10/2 spread would steepen and swing positively. But suddenly, the curve seems to have stalled out, and it looks like it wants to restart the inversion process again. By that, I mean the 10/2 falling back to -80 bps or so from its current -46 bps.

An inverted yield curve could happen by the 10-year falling faster than the 2-year or the 2-year rising faster than the 10-year. In this case, given that the Fed is likely not to cut rates in 2024, and the term “rate hikes” has a pulse again, thanks to the Fed minutes, it seems more likely that it’s the 2-year rising faster than the 10-year, that is likely to transpire.

This would suggest that the 2-year rise back to 5.25% or higher. The 2-year rate is now back to trading at around 4.95%, which is knocking on the door of 5%. Of course, once we clear that 5% level of resistance, 5.25% may not be too far behind.

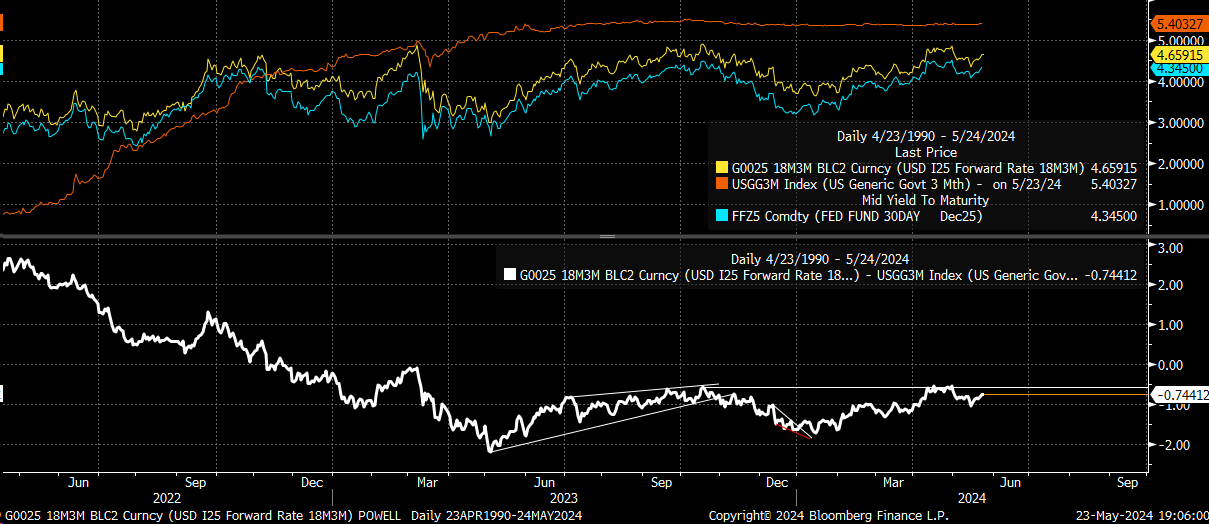

Another clue that we could see the 2-year rising again is the Powell Indicator, also known as the 3-month 18-Mo. Fwd minus the 3-Month Treasury rate spread is now moving higher, and that is because the 3-month 18-month Fwd. is moving higher, and it is moving higher because the December 2025 Fed Fund Futures rates are moving higher.

So yeah, a lot is happening in the market and lots to consider. But today is Friday, and the markets are closed on Monday, so enjoy the long weekend.