It will be a strange week, given the calendar’s lunar eclipse on Monday and the market’s closure on Friday. Add to that a PCE report on Friday, the day the market is closed, and a Jay Powell interview on the same day.

I can’t see why Jay Powell would opt to interview on the same day as the PCE report and when the market is closed. It seems odd. I also can’t see why the market should be closed on the same day as a significant economic report. I get it is a holiday, but it is not a federal holiday, so data from the government will be released regardless of the market calendar.

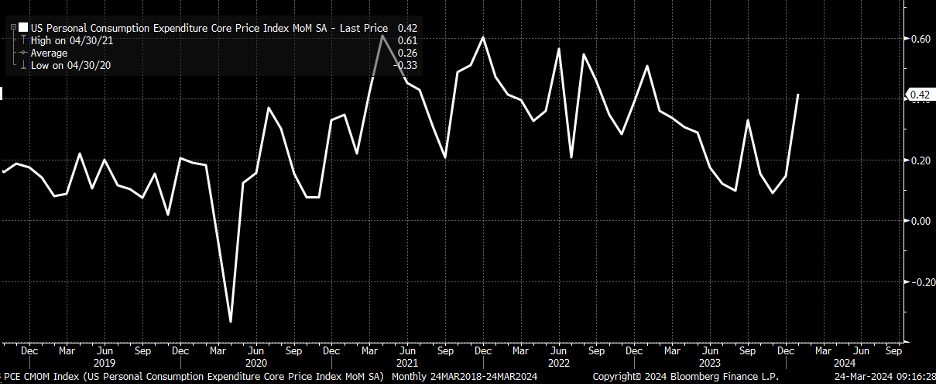

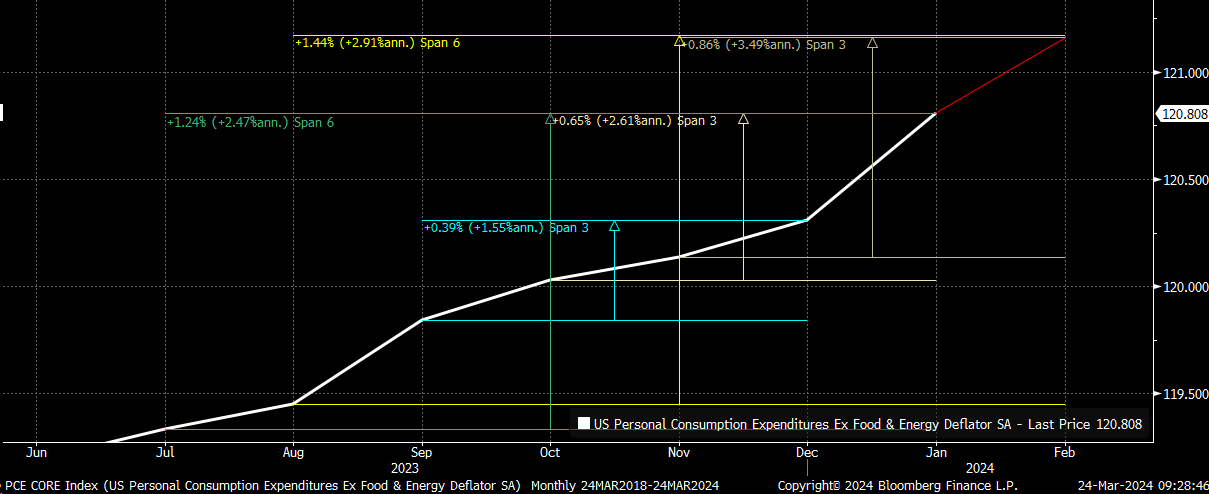

The PCE report is expected to show a gain of 0.4% in February, up from 0.3% m/m in January, and a rise of 2.5% y/y from 2.4% last month. Core PCE is expected to drop to 0.3% from 0.4% m/m and is in line with the previous month at 2.8% y/y.

It is pretty tough to say that the slowing in inflation has continued on the core PCE with the second month in a row above 0.2%.

If the estimates come in as expected, it would push the 3-month rate of change up to 3.5% from 2.6% and the 6-month rate of change up to 2.9% from 2.5%. This is probably why Atlanta Fed Governor Bostic was out on Friday and now only sees one rate cut in 2024, down from his previous expectations of 2.

This is pretty much what the Fed has done the entire cycle since they first started raising rates in March 2022, which was to overpromise and under-deliver. The Fed, in its dot plots as rates were rising, also seemed to be low, and those dots just continuously rose throughout 2022 and 2023 until they finally hit the end of the cycle.

At this point, it seems like the Fed is promising more rate cuts than what is likely to be given and that, over time, they will continue to walk those rate cuts back. My guess is that by we get to the May meeting, most officials will be hinting at just two rate cuts, and by the June SEP, it firmly shows two cuts, not this mixed bag that the Fed gave this past month.

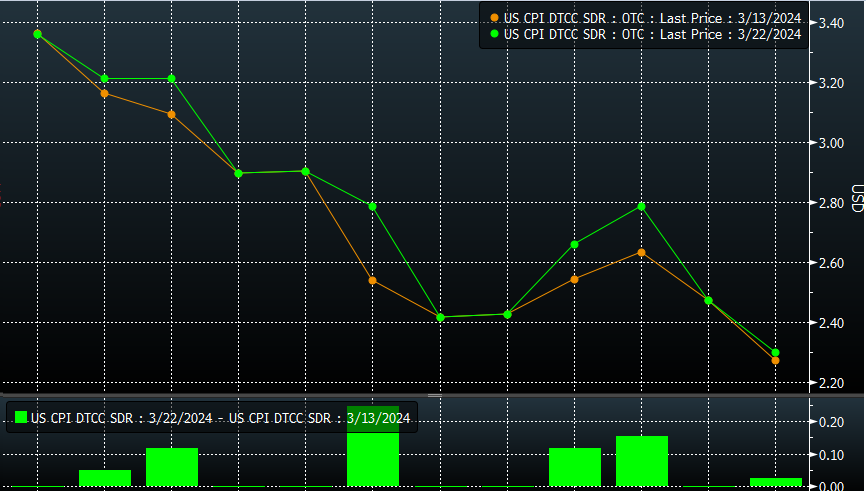

The other trouble is that since the CPI report, the inflation swaps market has been pricing in hotter CPI prints for April and May. Beyond that, it is too far off into the future to get an accurate feel for where inflation will be since the numbers all build upon themselves.

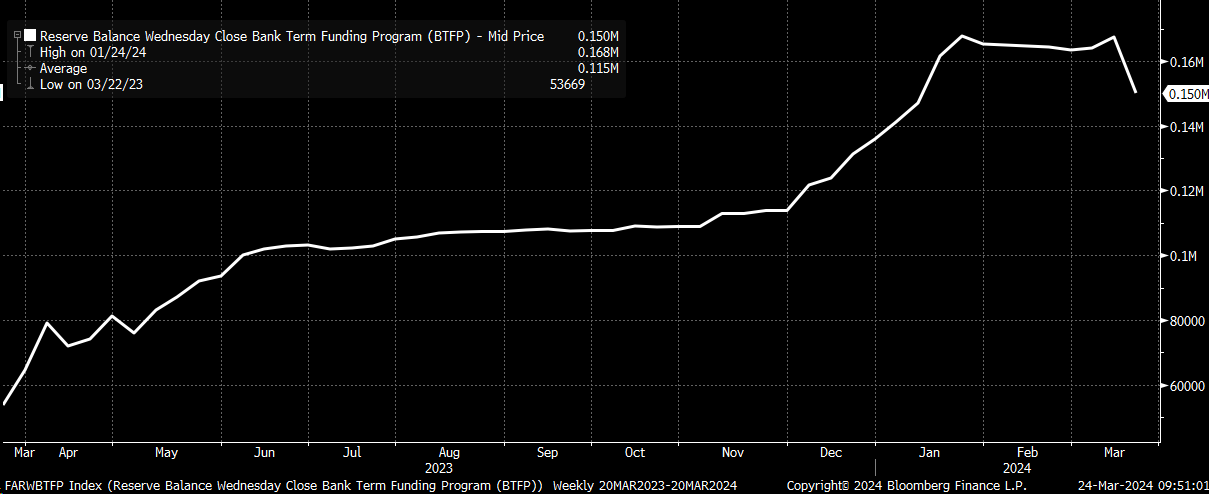

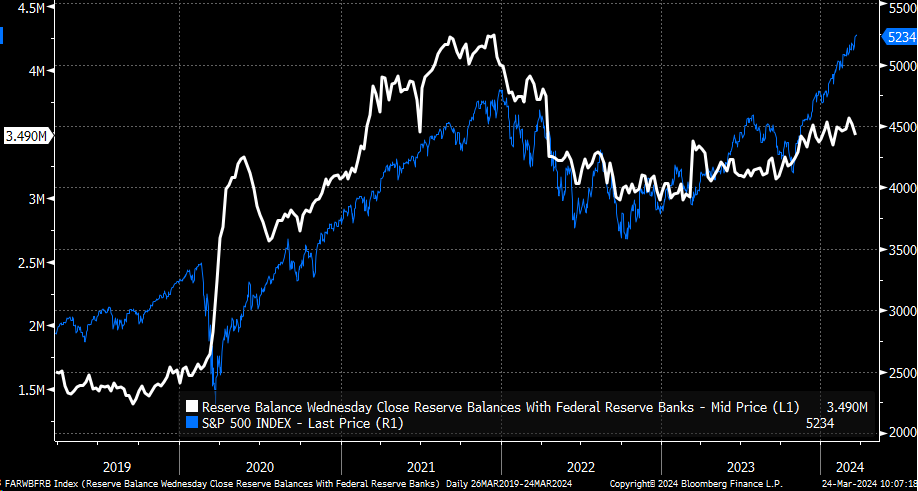

It also seems clear that the Fed wants to slow the pace of QT because it knows that banks’ reserves aren’t as high as they appear.

Now that the Bank Term Funding Program is over, loans on the books will start to roll off, and there is still about $150 billion on loan. That number started coming down this past week. Most of the $150 billion still on the books arrived in the first few weeks, so one would think a good portion of that liquidity will leave over the next few weeks.

This means that reserves are currently $150 billion overstated, pushing them closer to $3.35 trillion than the $3.49 trillion values stated on Thursday.

So, if one believes that excess liquidity drives this market higher, one must be mindful that draining liquidity could push this market lower. It is also worth noting that reserves could fall in the weeks to come, as tax season is now underway, and taxes are likely to send the Treasury General Account higher. A rising TGA drives reserves lower.

The S&P 500 moved above the upper Bollinger band on Thursday and returned under it on Friday.

Additionally, the index hit the upper end of the channel late last week. The rising channel is strong, but given the overbought reading on the Bollinger band and the sell signal from moving back within that band, we could move to the lower end of the channel at 5,180, which is already around the 20-day moving average, which has been serving as support since the beginning of January.

The ascending broadening wedge is still in place in the NASDAQ, so we need to continue monitoring. There have been an apparent three touches to the upside, and now there should be another move lower still coming here to take it back to the NDX to the lower trend line.

One final note is that investment grade spreads started to rise in the past few days, and high yield spreads followed on Friday. If the spreads widen, it will be because financial conditions are beginning to tighten again. Stocks won’t do well if spreads start to widen again, so we can add this to our list of things that must be monitored closely.