Stocks continue to get crushed, with the S&P 500 dropping below 3,700 for the first time since the winter of 2021. While stocks may be due for a corrective bounce, there remain very few signs that there is a meaningful bottom to be had.

Strong Negative Trends

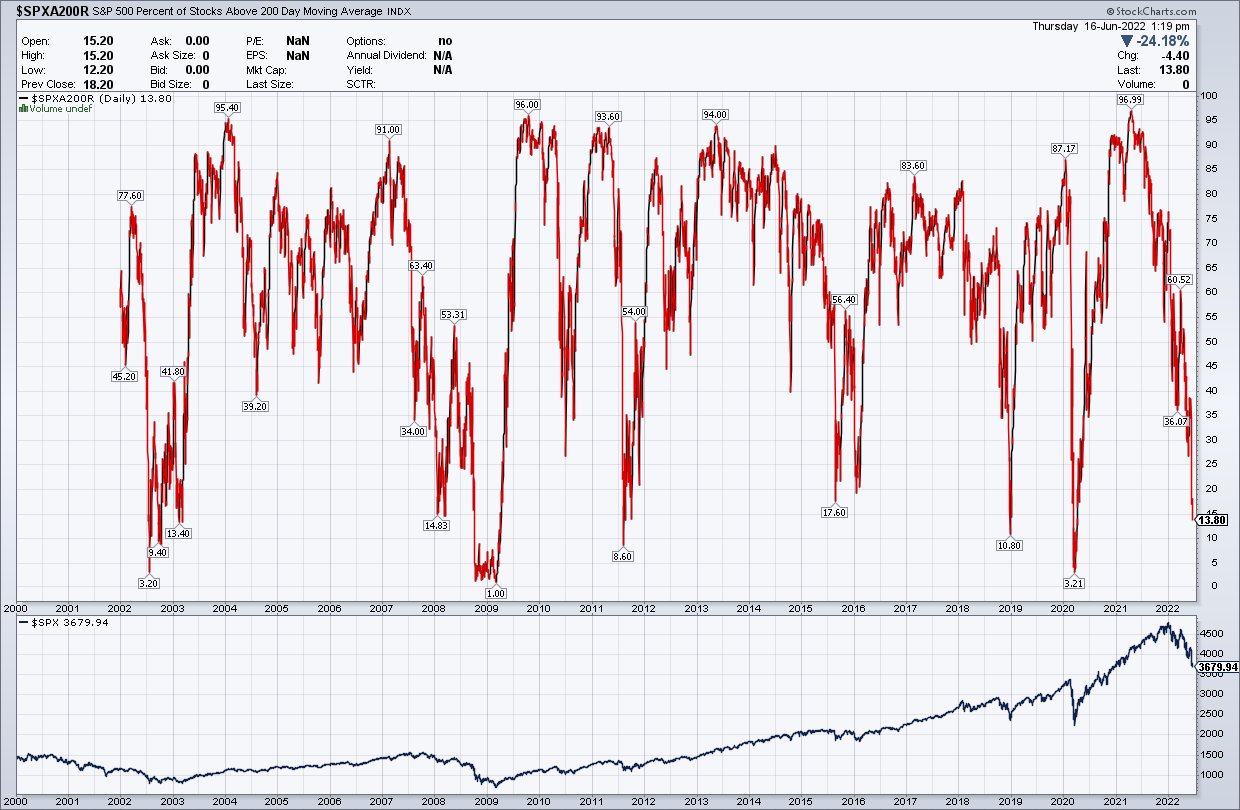

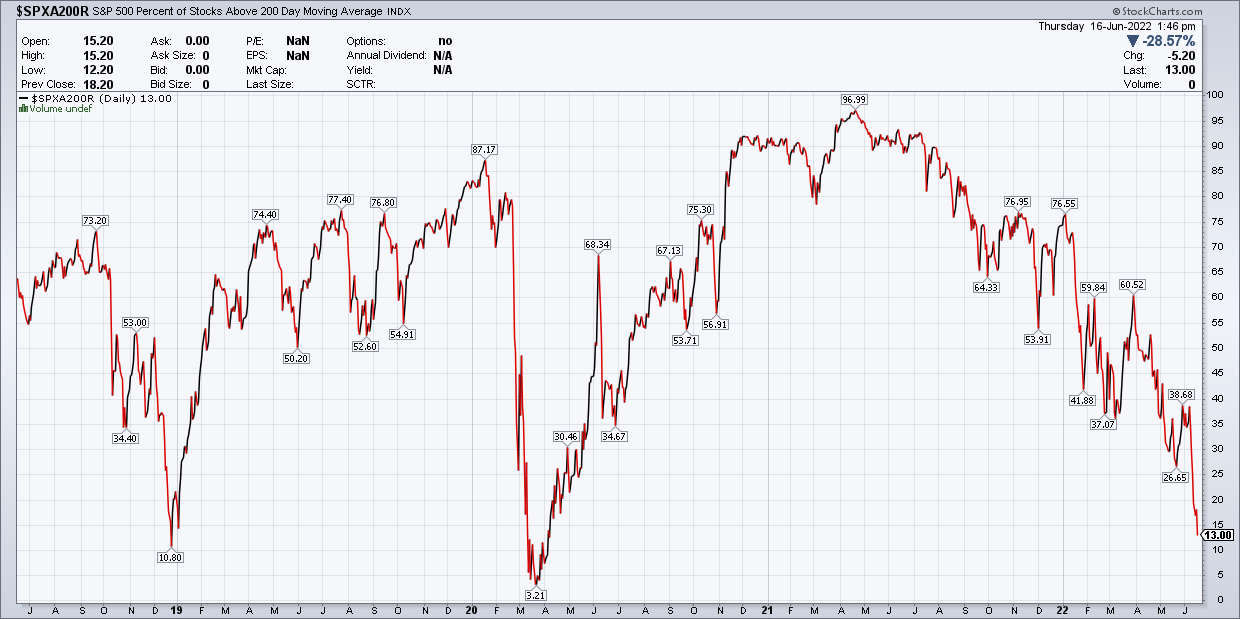

Some technical indicators can help give investors a sense of the market's health and how trends are taking shape. For example, the percentage of stocks above their 200-day moving average in the S&P 500 is now just around 14%. However, that tends to go much lower during significant drawdowns that are often climactic; in some cases, the number has gone below 10%.

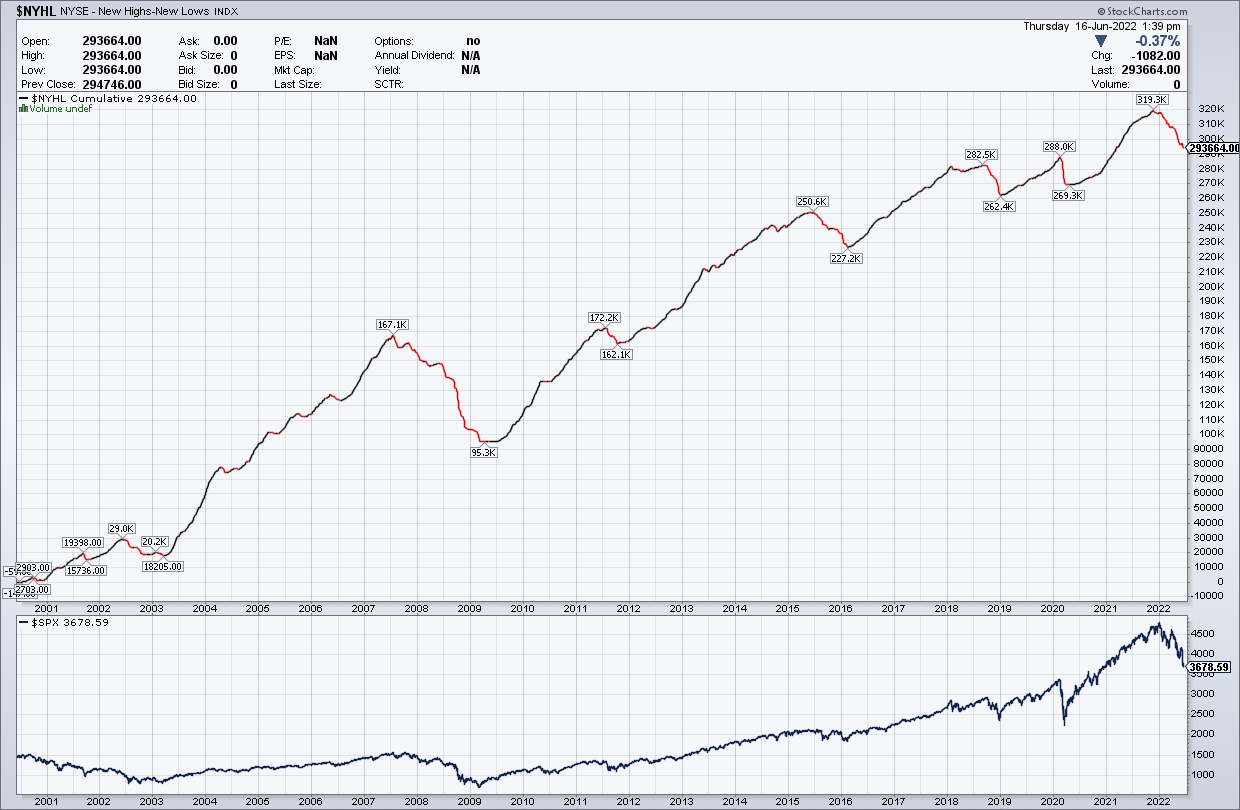

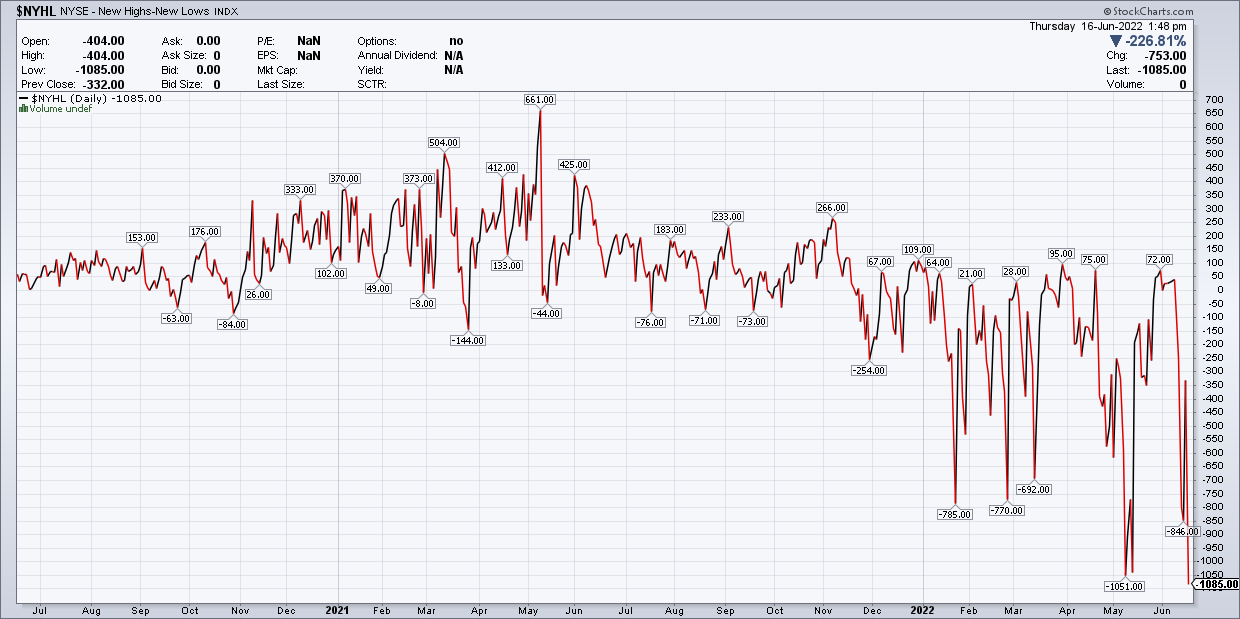

On top of that, the number of stocks making new lows has been steadily outpacing the number of stocks making new highs on the NYSE and the NASDAQ. When looking at the number of new highs minus new lows on a cumulative basis, we see that typically when markets are near bottoms, this cumulative number tends to bottom first, which has not happened yet; it is still falling.

Market Breadth Looks Weak

These two indicators tell an exciting story of a market that is already down a lot and has yet to wash out. This means there is still more room for these two metrics to fall further, and overall for market trends to remain weak.

A sign of a market bottom might come when the trend for the percentage of stocks above their 200-day moving average begins to rise. The indicator shows the trend is still sloping down, suggesting additional room for the measure to fall. This metric has been trending lower since peaking in the summer of 2021.

Additionally, it would be ideal to see the number of stocks making new highs begin to be equal to or rise above the number of stocks making new lows. Even in recent rally attempts by the stock market, the number of stocks making new highs has only barely outpaced the number making new lows. When that happens, it doesn't tend to occur for more than a few days. Additionally, the number of stocks making new lows appears to be growing instead of contracting.

While widely overlooked by many, these two indicators can tell a powerful story about what is happening beneath surface of the S&P 500 and, more importantly, if there are trend changes taking place from within that index. While the readings are both low, they do not show a divergence or trend change. This would suggest that while the overall stock market may be down a lot or even short-term oversold, there is a good chance that the bottom has not been reached yet.

Stocks will eventually find a bottom; the question is always where and when. At least based on market breadth, that time doesn't appear to be in the here or now.