Stocks finished flat yesterday, following the slightly stronger-than-expected retail sales and weaker PPI data. Overall, yields and the dollar rose, which helped hold the S&P 500 to a gain of only 16 bps.

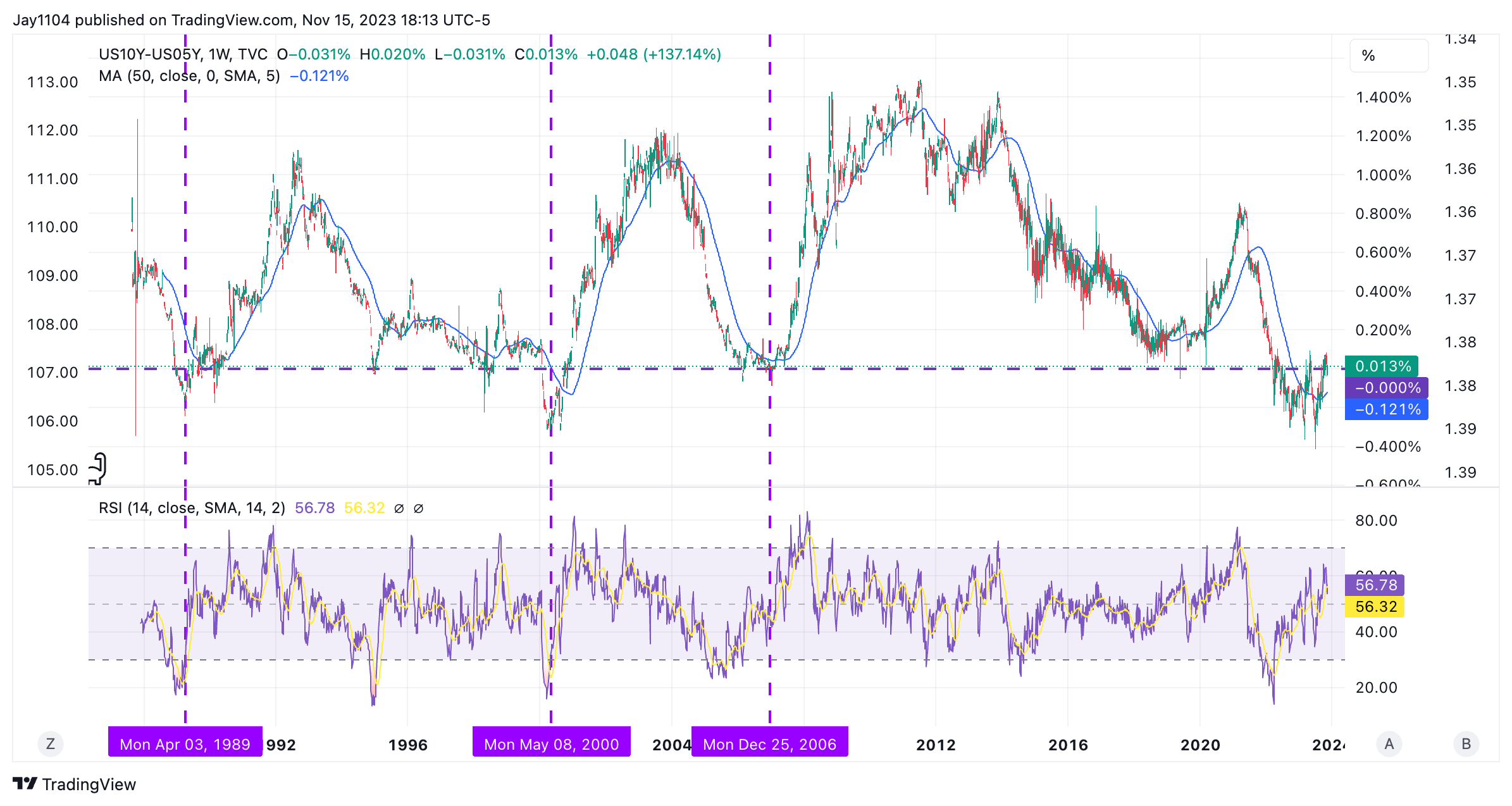

Additionally, we continue to see yield curve normalization as the 10-year rate moved higher than the 5-year rate and back into positive territory. This isn’t the first time this has happened but appears that the process of a normalized yield curve is happening.

I think this process will continue, as the 2/10 inversion has already lasted longer than 2000 and within a month or so of surpassing the inversion before 2008 and within 100 days of the 1990 inversion.

So, the days of the yield curve remaining inverted seem limited at this point based on historical standards.

Even the 10-5 inversion is getting old and has already far surpassed the inversions of 2000 and 2008. The inversion of 1990 seems to have lasted a few days longer than the current inversion.

The only thing that could spark a steepening at this point will be the jobs data and a rise in the unemployment rate.

Today we will get the initial jobless claims, and we will want to pay close attention to how the yield curve responds to the data not just the direction of rates.

Obviously, data that comes in higher than expected would move this steepening of the curve further along.

S&P 500 Comes Across Fibonacci Resistance

The S&P 500 hit some solid fib levels yesterday, at the 78.6% retracement level from the July to October decline. It also reached the 61.8% extension of wave A. The structure from July to October is a clear five waves, and the structure off the October lows is a straightforward three waves.

If the rally stops here, this marks the end of wave 2, and we will be entering wave 3, which would mean we would easily surpass the lows of October at 4,100 on the S&P 500. Of course, this could all be invalidated with the index reaching the July highs. But at this point, I don’t have a count for that.

Nasdaq: Are Year-End Rally Hopes Fading?

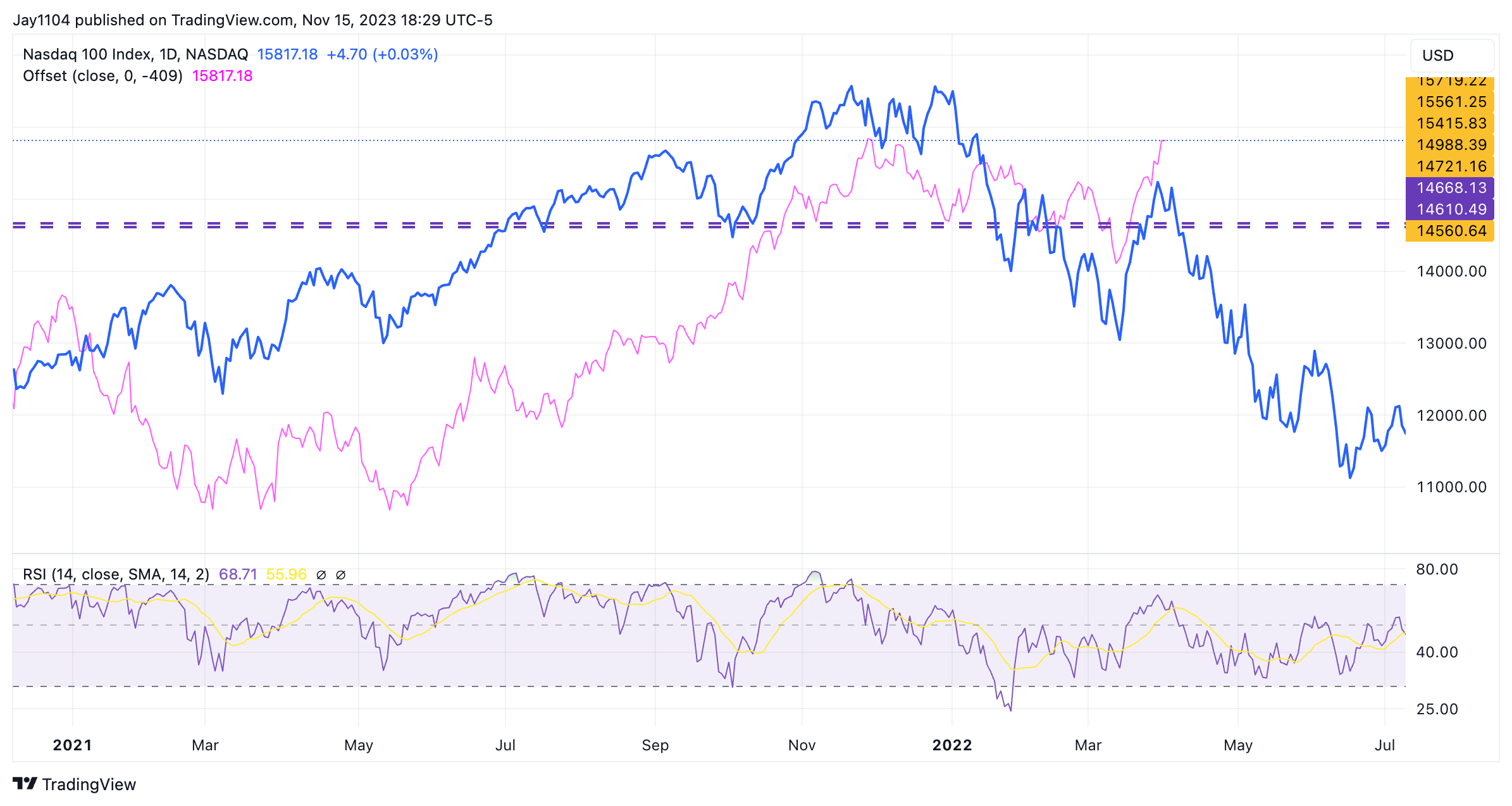

I know my analysis doesn’t go with the seasonality charts plastered all over the internet. However, this comparison of the Nasdaq 100 of yesterday with 2022 could just as easily be made to fit as all those seasonality charts.

The point is to remain open to the possibility that markets don’t always go up, and just because it is the fourth quarter, it doesn’t mean we will have a solid finish to the year.

Another reason is that it is OPEX this Friday, and it is not unusual to see a trend change around the time of OPEX.

Finally, if the yield curve is steepening, the days of stock price movement are closer to the end than the beginning based on historical data.

Cisco Plummets Following Earnings: More Downside Ahead?

Cisco (NASDAQ:CSCO) is trading down yesterday by more than 10% after giving ugly guidance as companies cut back on spending. The company saw fiscal second-quarter revenue of $12.6 billion to $12.8 billion versus estimates of $14.2 billion.

The stock in the after-hours has cut through multiple layers of support, and if it opens down as indicated, it probably needs to trade to around $45.30 to find its next strong level of support.

Palo Alto Falls 6%, Breaks Uptrend

Meanwhile, Palo Alto (NASDAQ:PANW) was trading down around 6% after it provided fiscal second quarter bulling guidance of $2.34 billion to $2.39 billion versus estimates of $2.43B.

The company also cut fiscal year billing guidance from $10.7 billion to $10.8 billion versus prior guidance of $10.9 billion to $11.0 billion.

The company noted customers have been seeking deferred payment terms or discounts driven by a more cautious view of the economy and higher interest rates impacts on budgets.

The stock has been trending higher but has stalled out more recently, it also appears to have broken a significant uptrend in after-hours trading. If that uptrend’s break persists at today’s opening, the stock eventually moves lower to fill the gap to around $210.