With the election over the hangover has kicked in.

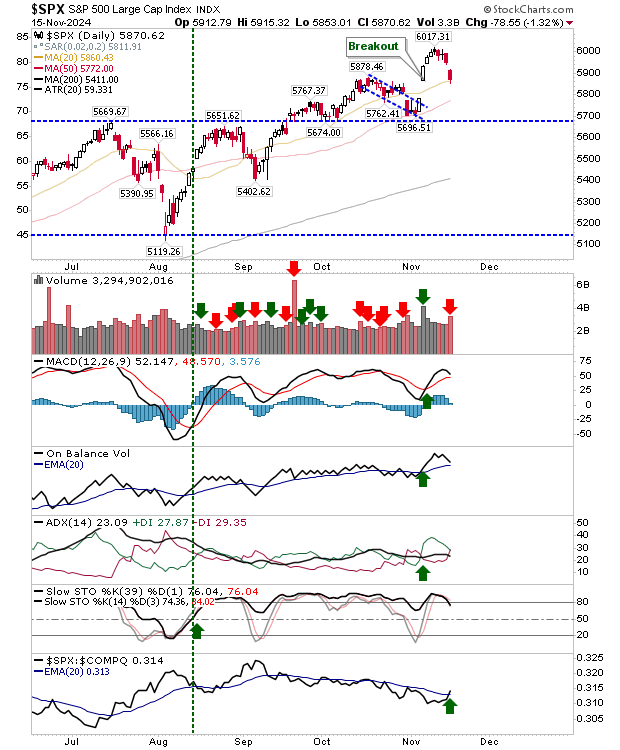

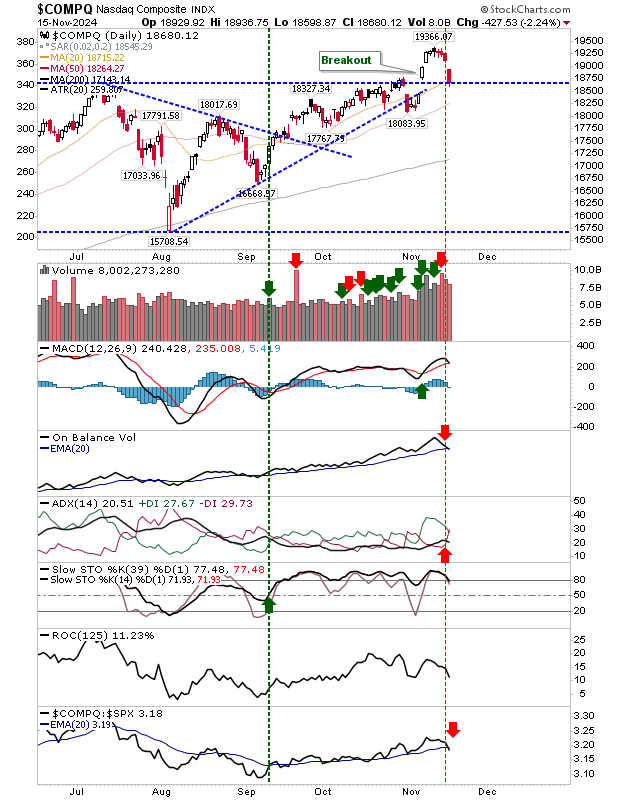

Markets liked the result, but it was too much too fast. Sizable breakout gaps have delivered moves back into these zones. True breakout gaps don't close, so the losses we have seen can't go much farther if we *are* looking at breakouts, and I think these are true breakouts.

The Russell 2000 (IWM) has the most room to move before it closes the gap. the 20-day MA is there to help and technicals are mostly bullish. Small Caps should do well under Trump as deregulation kicks in.

The S&P 500 is back at its 20-day MA and has returned to bullish net technicals. Volume picked up in distribution. Given Friday's finish, there is a good chance for a positive.

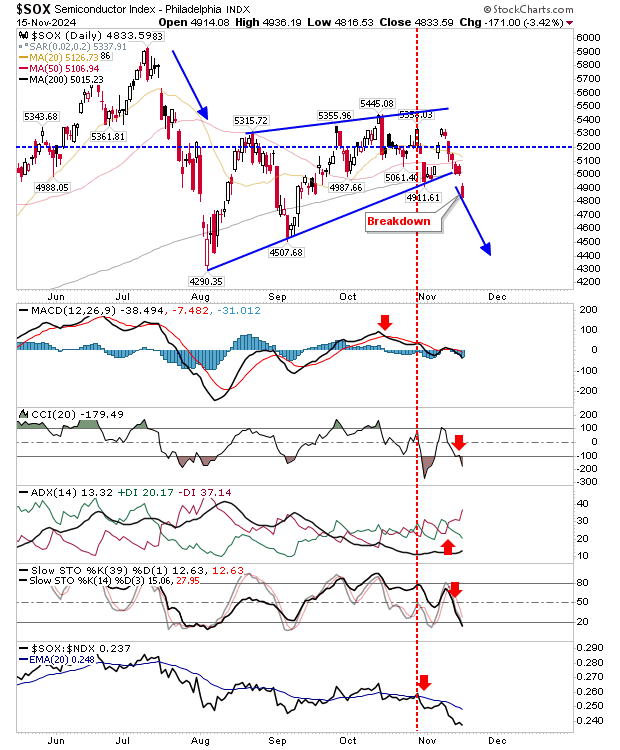

On the other side, the Semiconductor Index has broken through its moving averages and the bearish wedge, in a clear gap down. Technicals are net bearish with little cause for optimism. We may see a retest of August lows before the year is out.

Not surprisingly, the Nasdaq is under pressure from weakness in Semiconductors. On the plus side, the tech-heavy index finished on the 20-day MA and breakout support, but with the loss of support in Semiconductors, it's going to be hard for this breakout to hang on.

Technicals are mixed. Despite the 'sell' trigger in On-Balance-Volume, the trend still points to accumulation as the index outperforms against the S&P 500.

With the result of the election established there will be a realignment of the sectors that will outperform (or underperform) under the next administration. The marriage of Trump and Musk is unlikely to last given their differing priorities and egos, but until then, let price action be your guide.