Yesterday was not a great day for bulls; what looked promising for all indexes intraday, was cooked by the close. The percentage loss for the day was not the issue, it was the intraday spread that caused the problem.

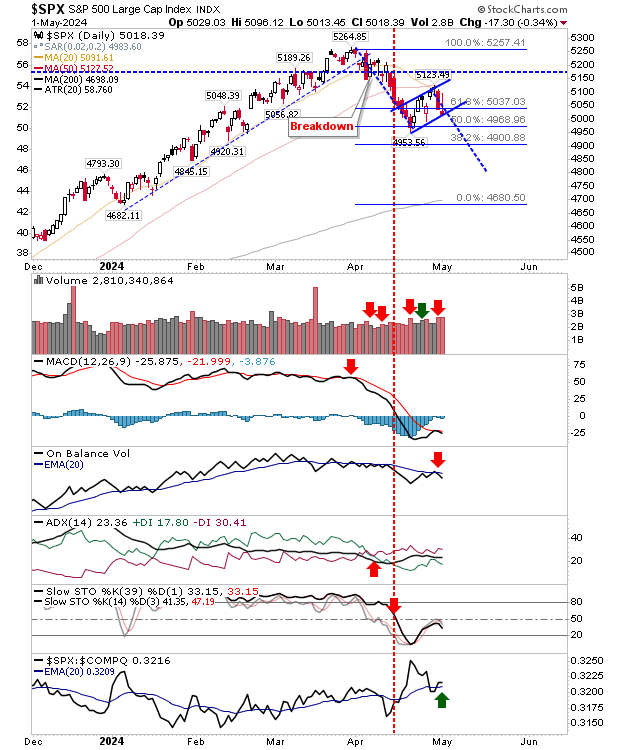

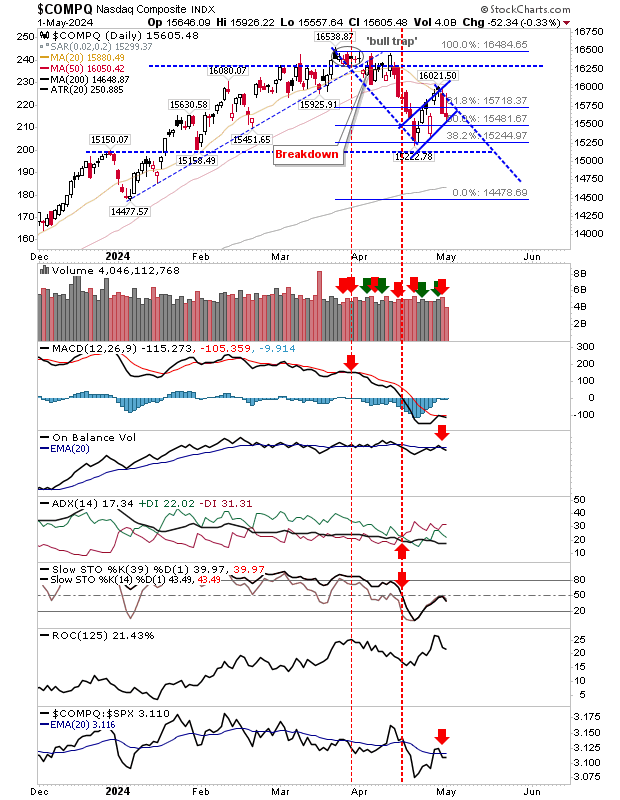

In the case of the S&P 500 and Nasdaq, current action since April lows has the look of 'bear' flags, and if they play out as such, then we need to look for measured moves lower (again, bringing the 200-day MAs into play).

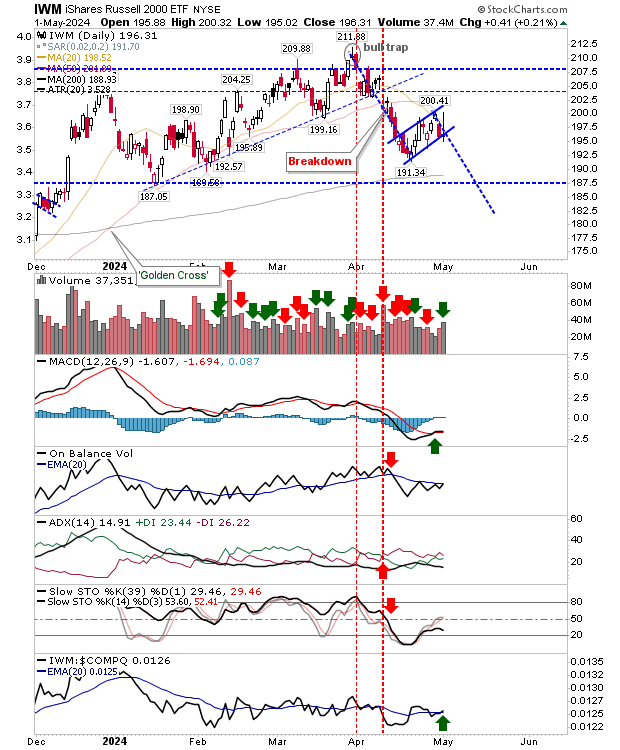

If we do see measured move targets, then the Russell 2000 (IWM) won't be finding support at its 200-day MA. Certainly, if the 200-day MA doesn't play as support for the Russell 2000, then the S&P 500 and Nasdaq are more likely to reach their measured move targets.

The broad sweep of yesterday's reversal on the back of Fed news is not one for optimism. I don't think it will lead to a major loss for markets, but further downside seems likely - particularly for the Nasdaq and S&P 500.

However, the chance for 200-day MAs to play as support for latter indexes increases substantially.