Markets have been a bit of a mixed bag from markets since my last update.

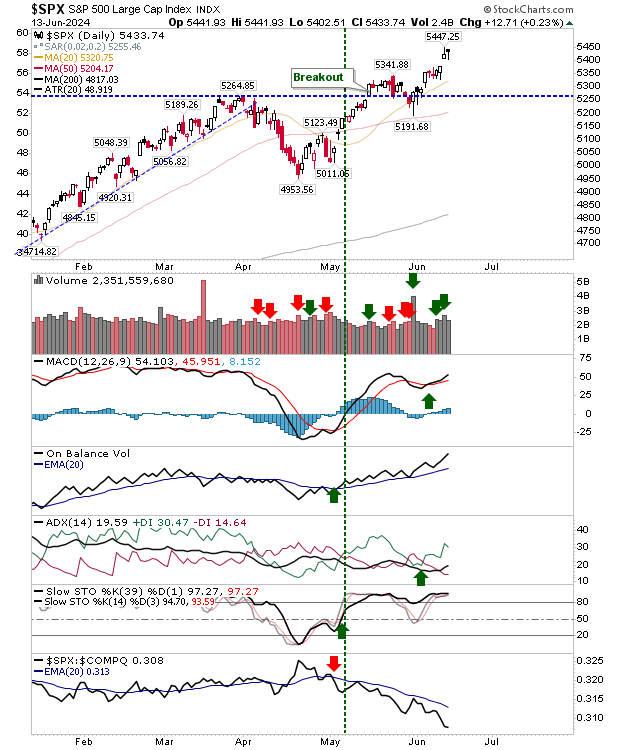

The S&P 500 closed with a neutral setup. Yesterday's close finished within yesterday's range, but the candlestick was a little more bearish. Watch for a closure of the breakout gap, as happened with the Russell 2000.

However, significant breakout gaps (i.e. gaps that are followed by major trend moves - higher here) don't close. So, if this is to prove true then ideally, we can't violate yesterday's (or yesterday's) lows.

Day traders can be aggressive and expect an open near yesterday's close (buying pre-market weakness), but protect yourself from today's Fed comments if in the green.

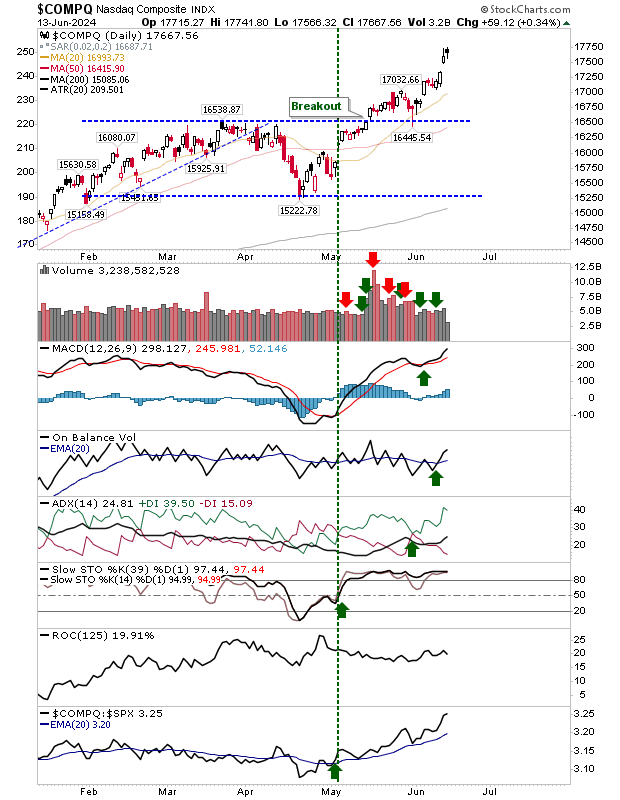

The Nasdaq is in a similar predicament as the S&P 500, although yesterday's action did attempt to follow new highs it got caught in the general sell-off malaise.

If today's pre-market leads to a gap down, then look for a move to close Tuesday's gap a la Russell 2000 ($IWM). However, if the Nasdaq can open near yesterday's close, then bulls can be aggressive as there will be no overhead resistance to contend with.

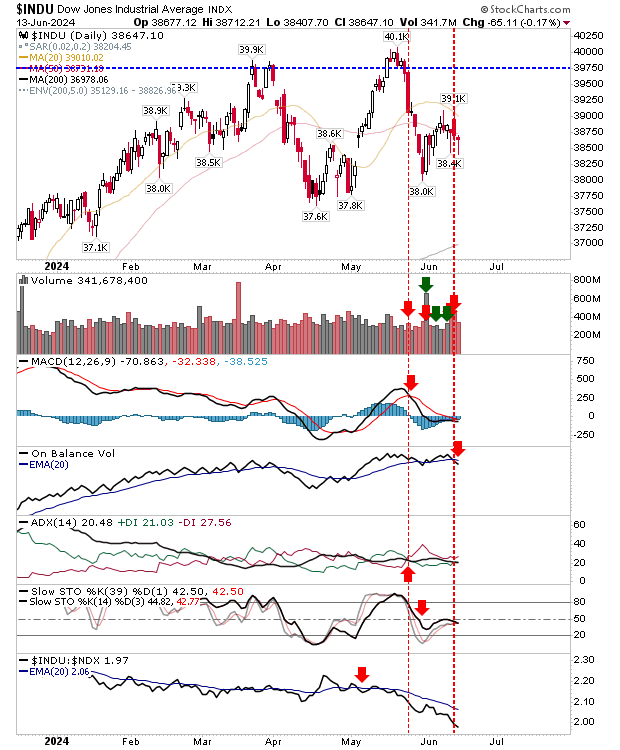

The Dow is interesting. It finished with a doji, not one in an oversold state that could mark a bullish reversal, but one well off its highs.

If you are looking for a more cautious long opportunity, then this may be the index to work with and premarket moves should be watched closely. Unlike peer indices, it's technicals are net bearish.

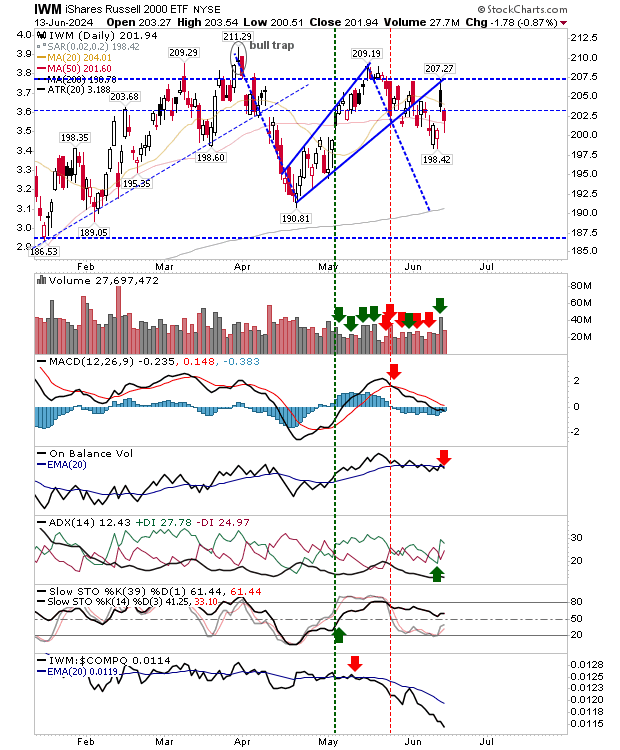

The Russell 2000 (IWM) burst out of the bag on Monday's bullish setup but most of the action was premarket, and by the time the market opened it was in decline.

This continued into Thursday with the resulting closure of the breakout gap. However, because this occurred inside the trading range, its significance - and the potential for a bullish bounce today - is reduced.

Today offers a mixed bag. The Dow offers the best chance for bulls to gain, but if there is a soft open, then the Nasdaq has the most downside on offer.