The holiday-shortened trading week will focus more on digesting data from last week than on anticipating new data. The key data to watch this coming week is the ISM Services Index, expected to be released on September 6 at 10 AM. Analysts predict that the services composite will dip slightly to 52.5 from 52.7.

More importantly, data from the past week seemed to alleviate concerns about an immediate economic slowdown. As a result, GDP models, including the Atlanta Fed’s GDPNow model, have remained largely unchanged. The GDPNow model currently predicts a 5.6% growth rate for the third quarter, down slightly from the previous estimate of 5.9%.

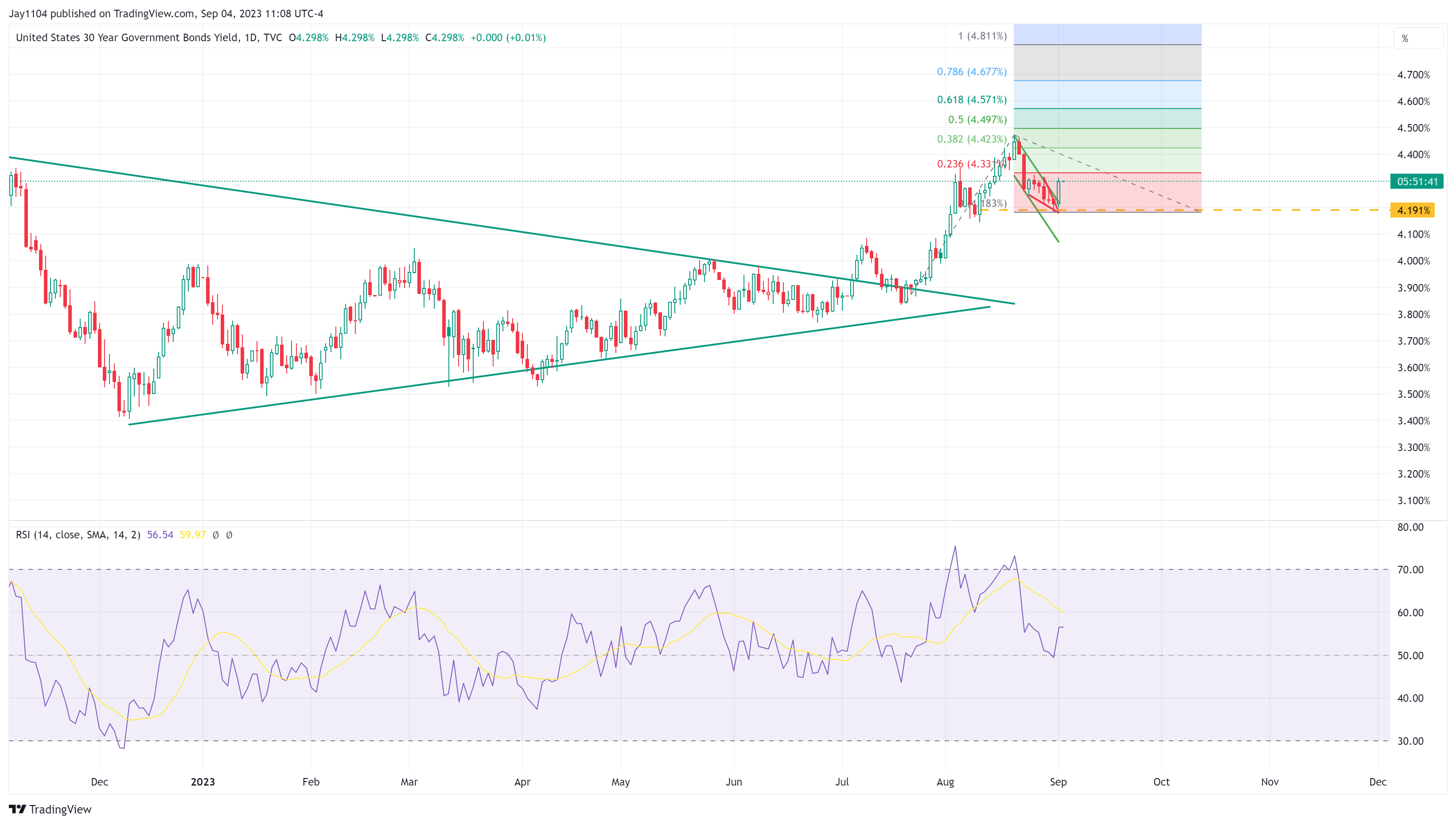

This contributed to higher yields on Friday, continuing the trend observed over the previous few weeks. The 30-Year yield led the way higher once again. It seems that the 30-year yield is poised for its next upward move as it breaks free from a short-term bull flag pattern. This could potentially lead to a significant jump, possibly reaching around 4.8% over the next few weeks.

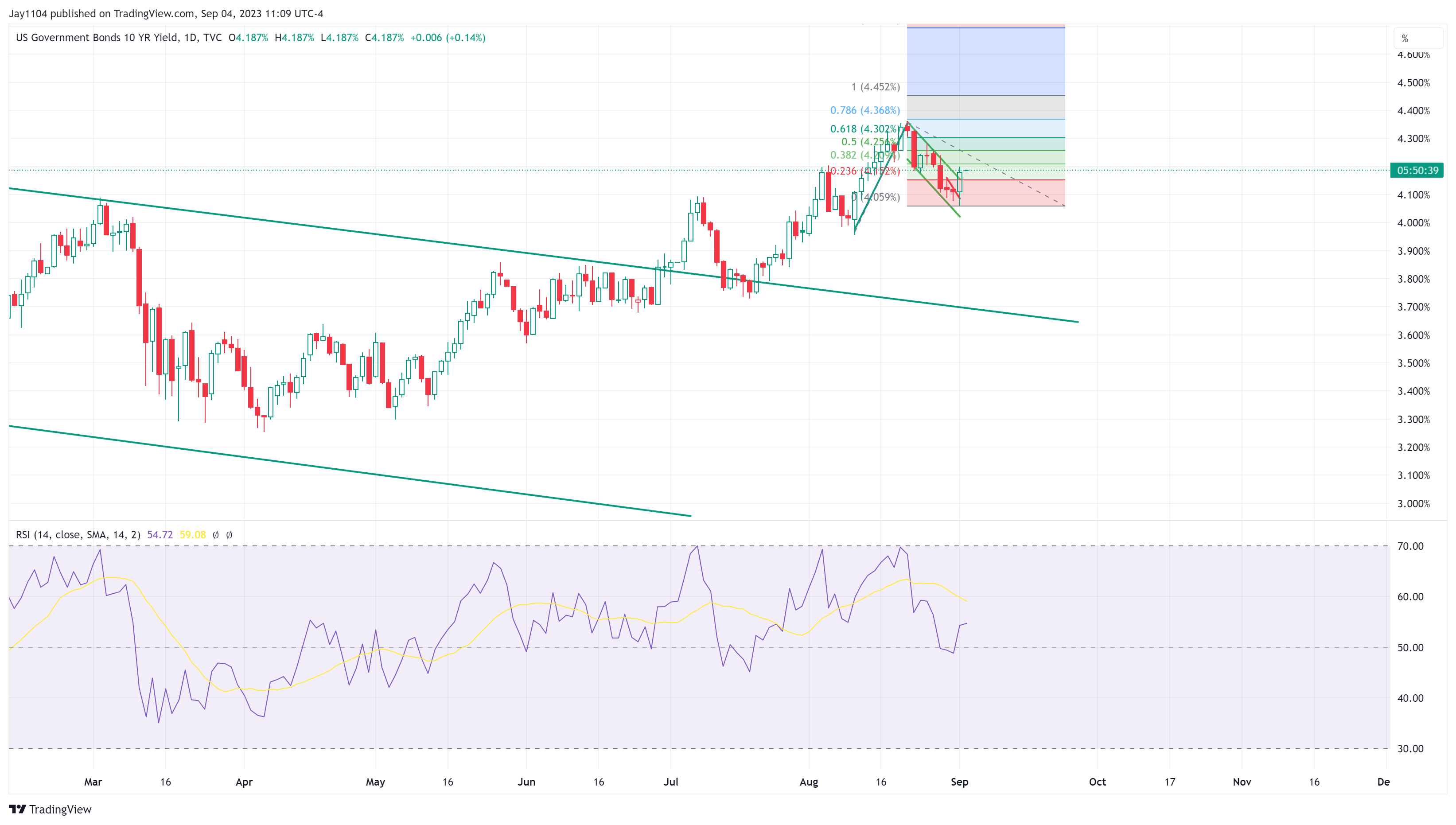

A similar pattern is present in the 10-year rate, which could lead to the Treasury rising to around 4.5% in the near term.

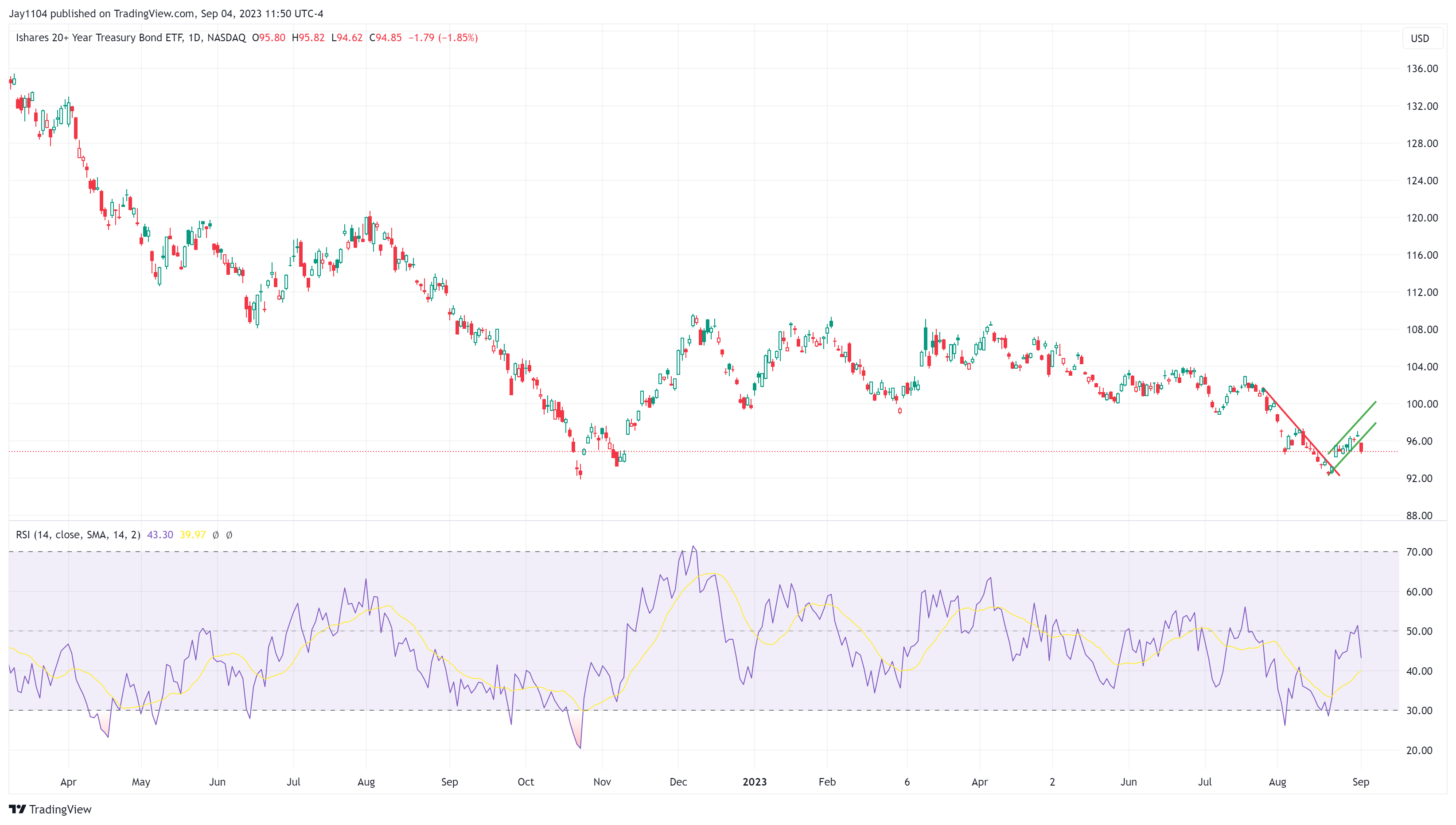

This is obviously bearish for the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) as long-end rates move higher, meaning the TLT heads lower and likely surpasses the recent lows of around $92.50 and pushes the ETF well below the October 2022 low of $91.85.

Higher interest rates are likely to be fueled by a stronger-than-expected US economy, prompting the Federal Reserve to maintain more restrictive rates for an extended period. Additionally, rising oil and gasoline prices could bolster headline inflation for the remainder of 2023.

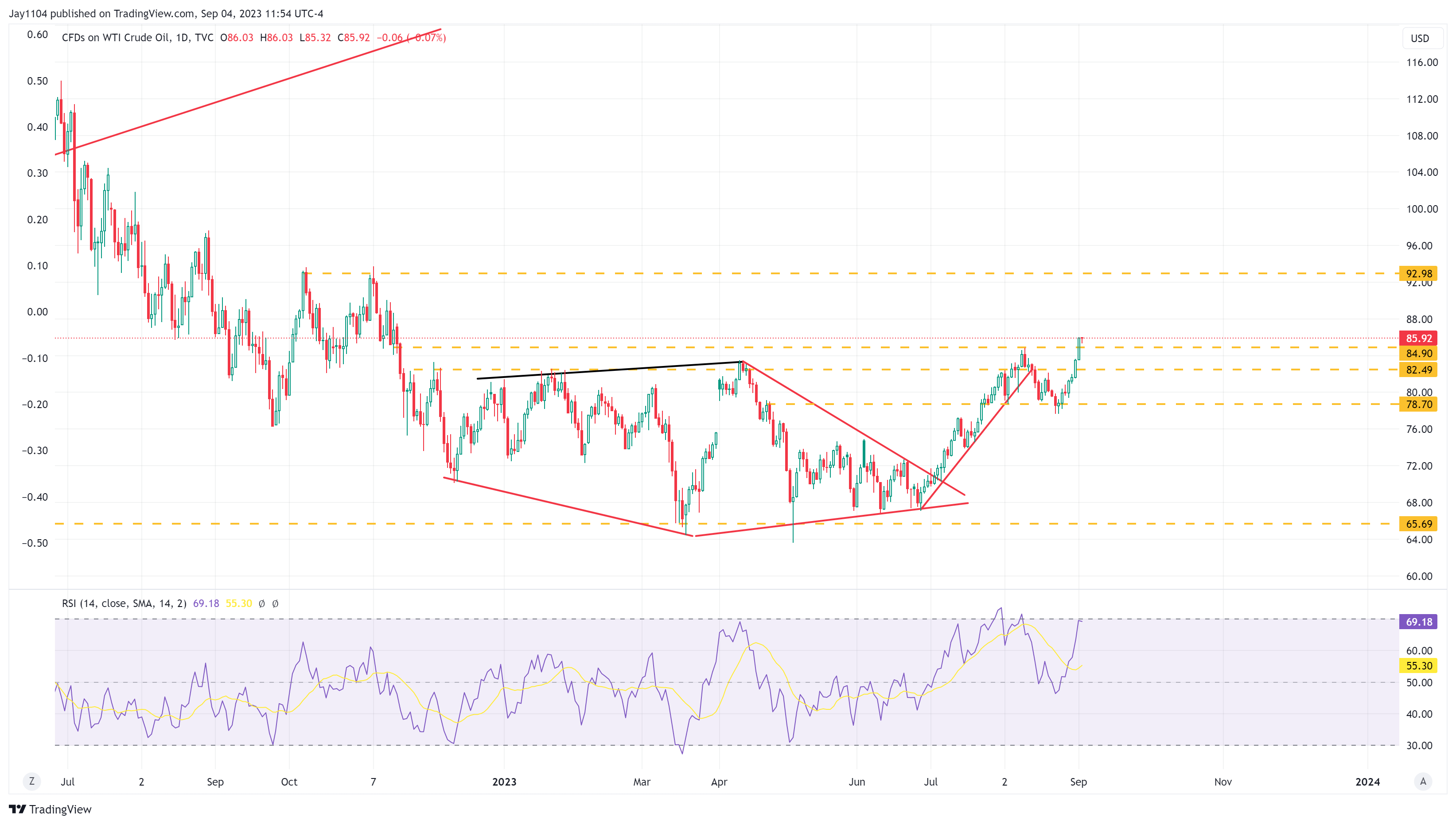

Oil prices climbed above $85 per barrel on the WTI index, driven by OPEC+’s pricing objectives, the depletion of the US Strategic Petroleum Reserve, and the potential for additional stimulative measures from China. These factors could push oil prices back to around $92 per barrel in the coming weeks.

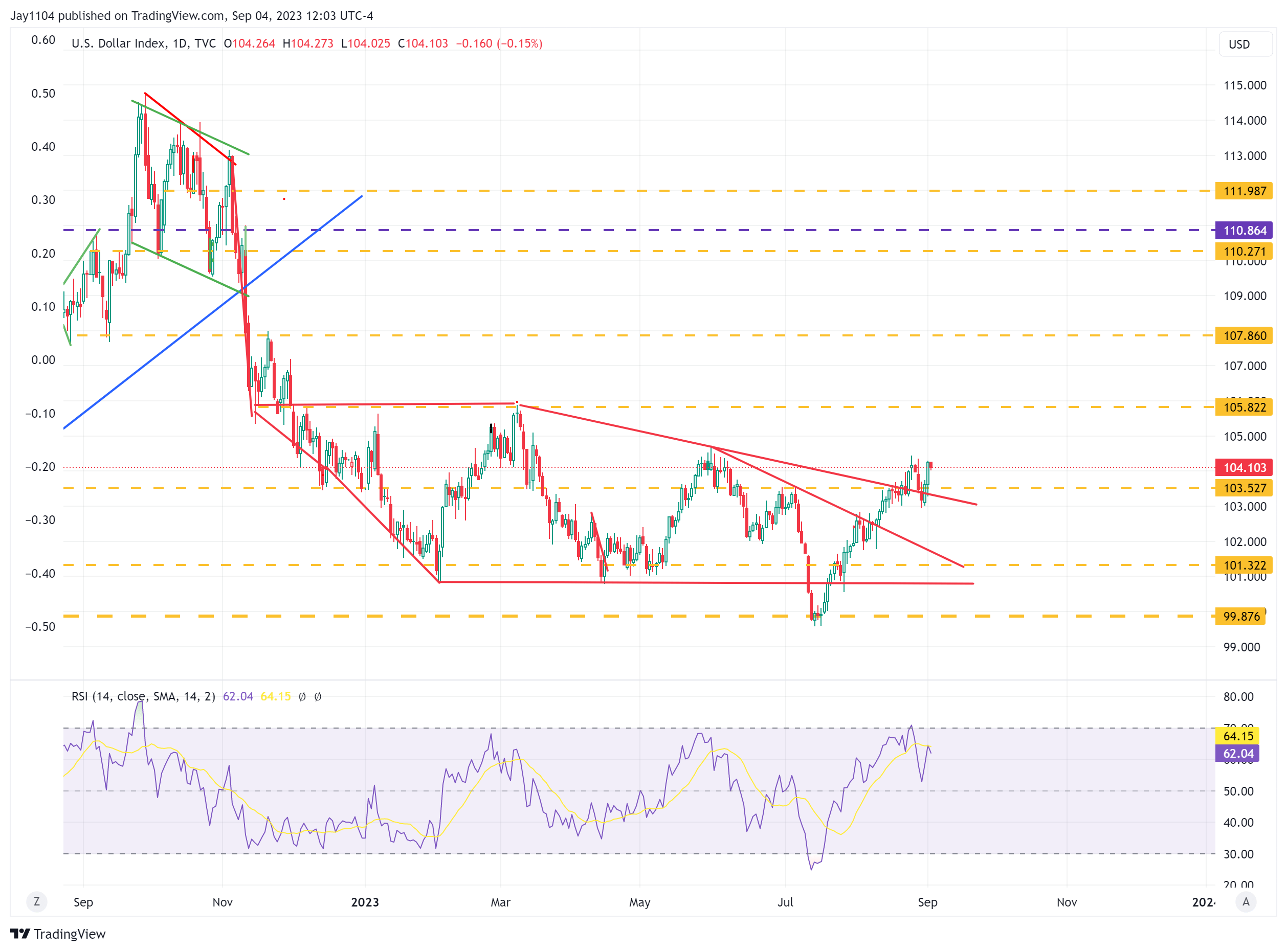

This confluence of factors will likely further strengthen the US Dollar, which is already poised for its next meaningful upward move. Currently trading at 104.20, a push above 104.50 could trigger the next leg higher towards the 106 level, setting the stage for a subsequent move towards 108. Over the next several weeks, the dollar has the potential to climb all the way back to around 111.

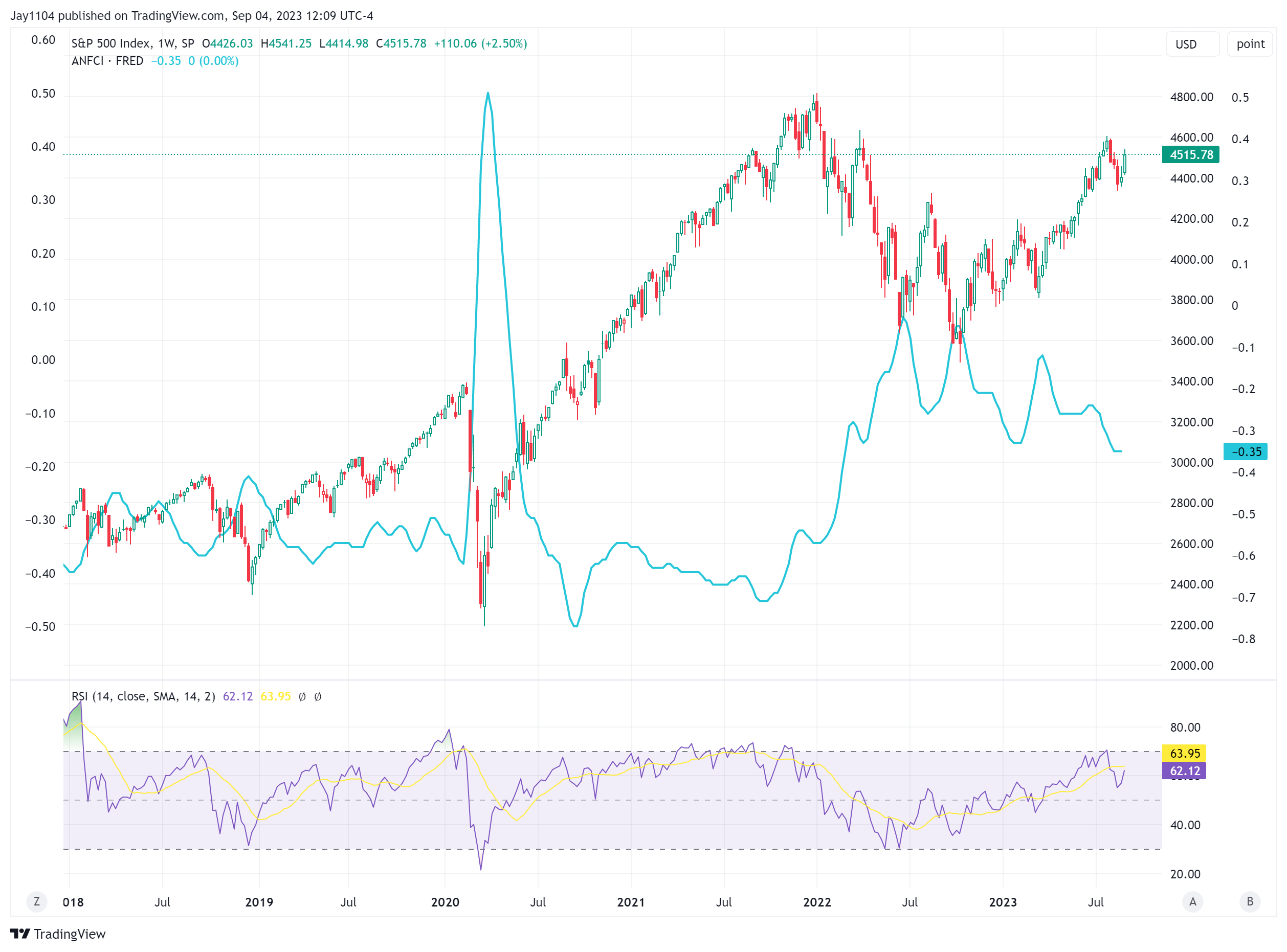

Higher interest rates, rising oil prices, and a strengthening dollar will likely exert significant downward pressure on stock prices as financial conditions tighten. Tighter financial conditions have historically acted as a headwind for equities. The primary driver for stocks rising following the SVB (Silicon Valley Bank) was easing financial conditions. As these conditions tighten, they will constrain stock prices, reduce market liquidity, and likely push equity markets lower.

I expect this trend to persist in the coming weeks, and it has been a broader theme I’ve been focusing on for some time now. I continue to believe that the S&P 500 is in the process of relinquishing its entire gains since June 1. This will likely result in the index retracing back to the 4,100 to 4,200 range.

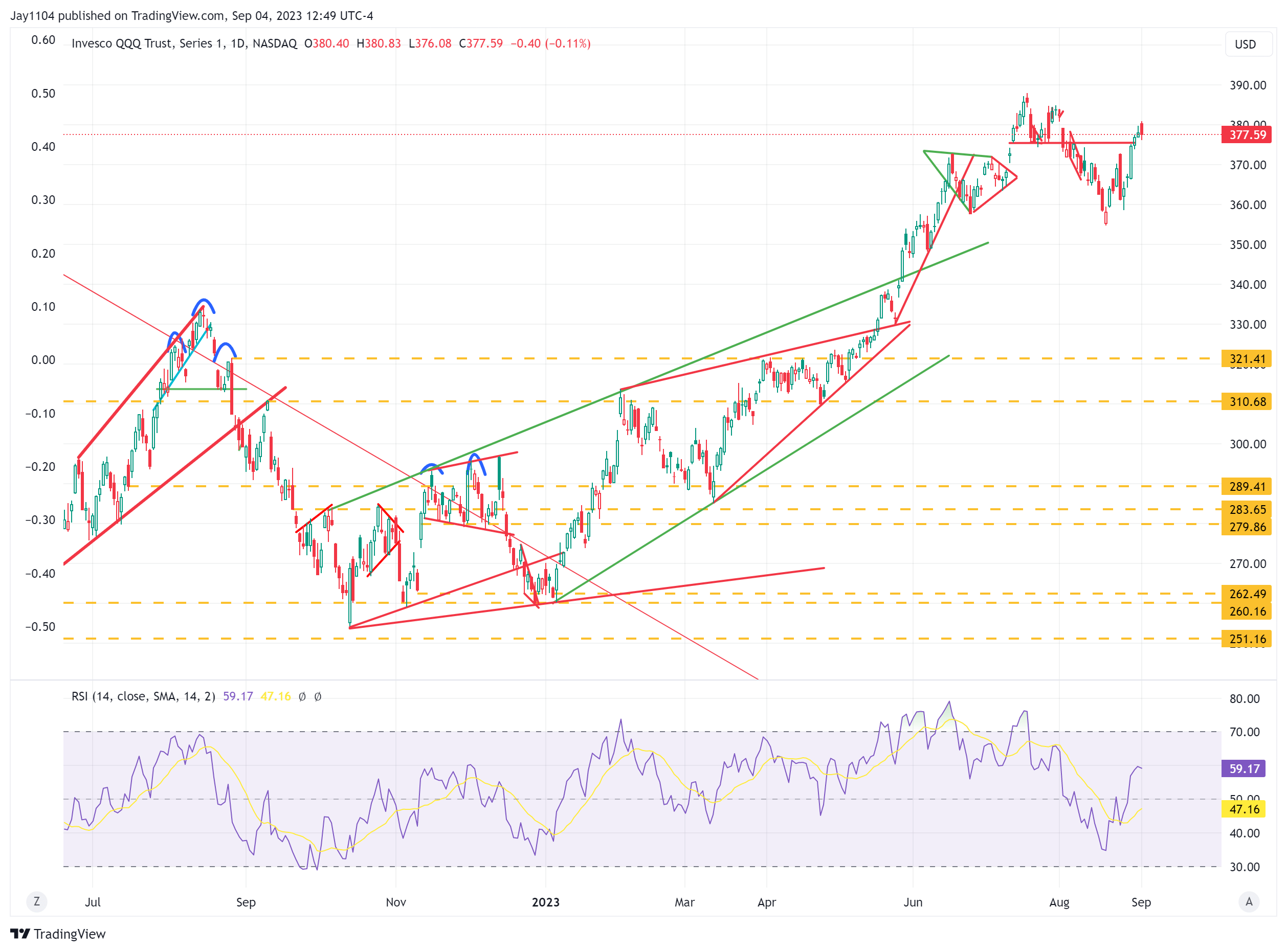

These same market dynamics will also cause the QQQ to trade down, potentially falling below $330 over the next several weeks.

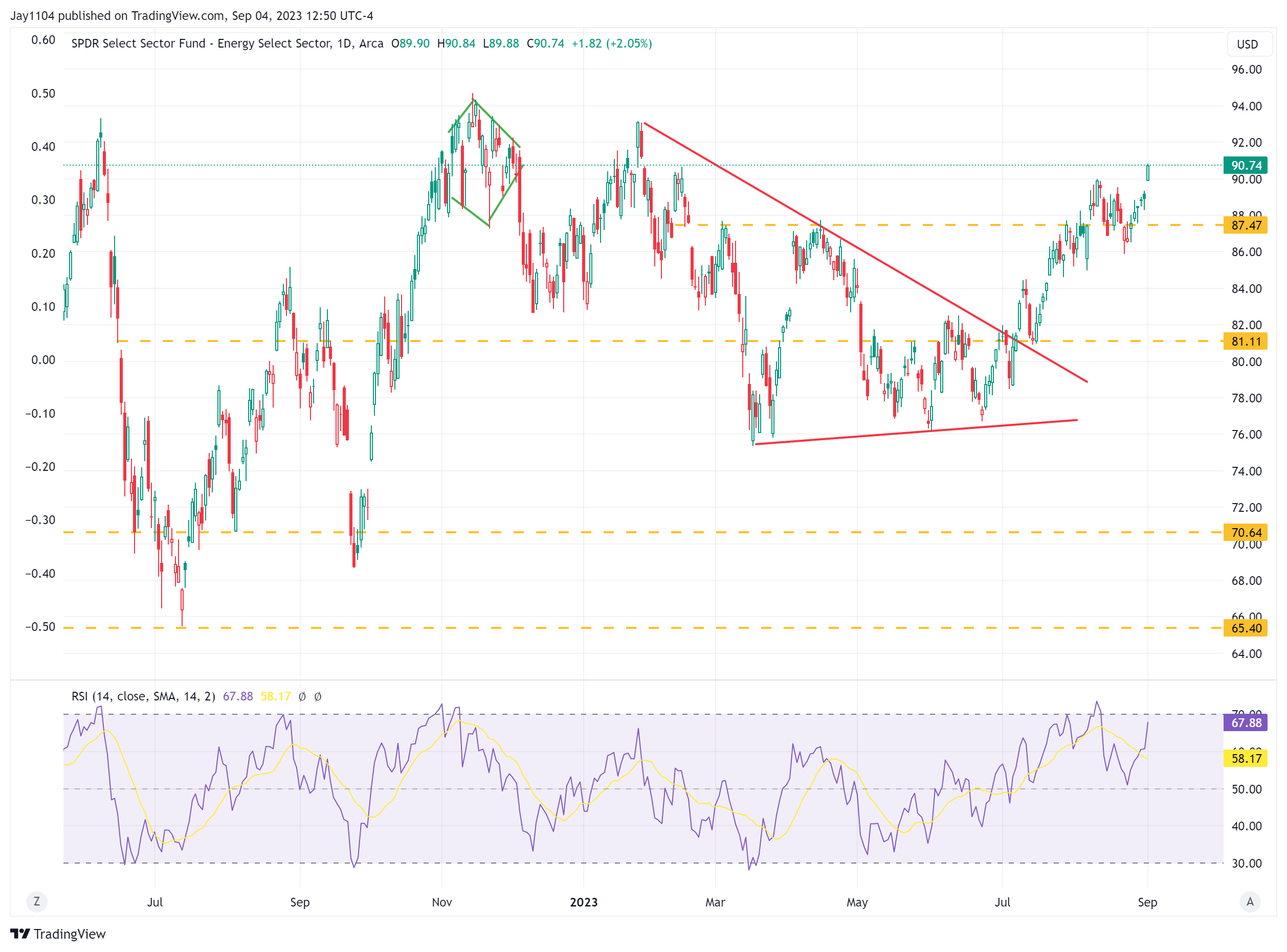

However, higher oil prices could lead to the XLE trading higher and testing its previous highs around $94.

Meanwhile, Meta (NASDAQ:META) remains a stock to watch closely, as it was one of the market leaders to bottom out in early November, almost two months before the Nasdaq 100 hit its closing low at the end of December. Meta has already broken several trends, and its Relative Strength Index (RSI) is clearly on a downward trajectory.

Additionally, Meta filled a gap from February 2022 but failed to advance further; it also filled a gap from July 2023, which is now acting as resistance. There remains an unfilled gap around the $200 mark dating back to late April 2023. If Meta fails to break above $305 and instead breaches the trend line around $290, it would likely trigger a larger drop toward $235. Such a move would also be a negative indicator for the Nasdaq 100.

This week’s Free YOUTUBE video:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.