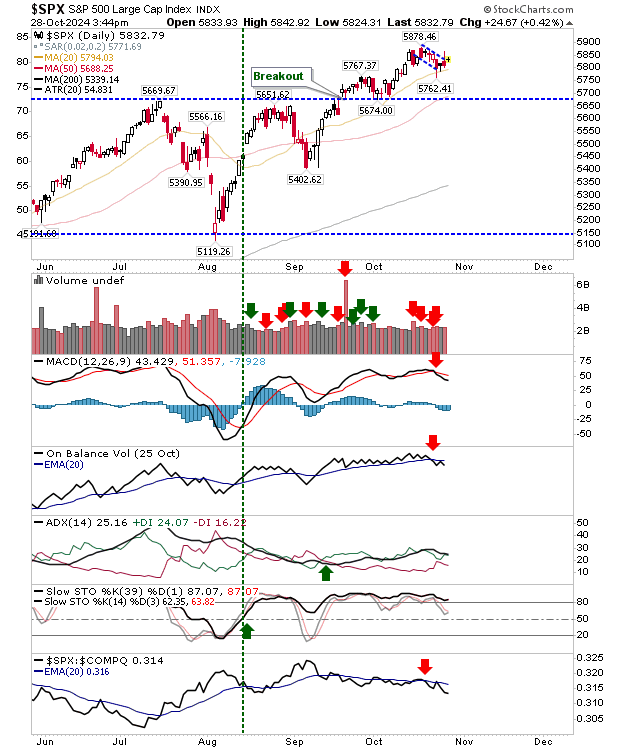

The S&P 500 could not clear the narrow 'bull flag' it looks to be shaping - as long as the 20-day MA remains as support.

A worrying expansion in the 'sell' trigger for On-Balance-Volume indicates a shift toward distribution that price action has yet to confirm. The MACD is on a 'sell' signal, but this signal has occurred well above the bullish zero line, so it's not a strong signal.

ADX and Stochastics are firmly bullish, so broader momentum still lies in the bulls' favor. However, I would like to see a solid white candlestick today, because this apathy will only lead to downside.

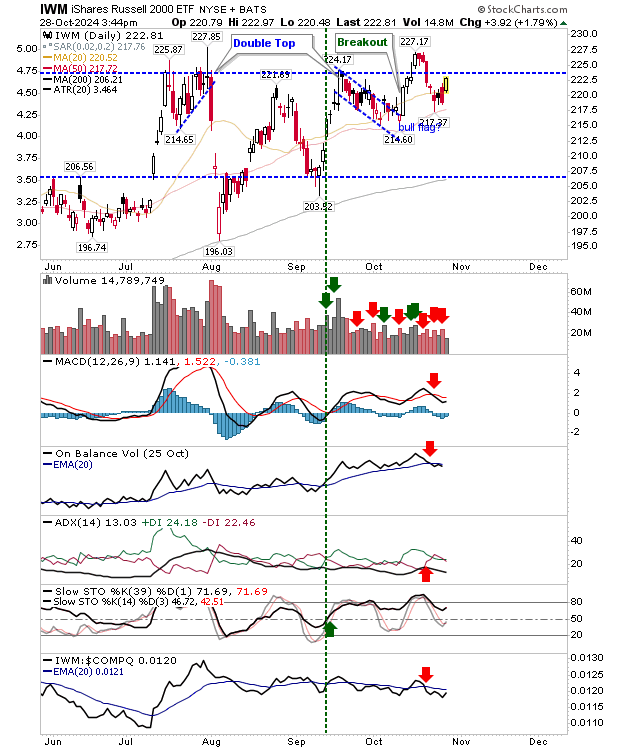

It was a bit of a so-so day for markets. The Russell 2000 (IWM) had the best of the action as it negated a nasty bearish engulfing pattern from Friday, and now has a new opportunity to make a run at the $225-7 zone that delivered the October reversal.

It will need an improvement in supporting technicals for the challenge to succeed as the MACD, On-Balance-Volume and +DI/DI all on 'sell' signals, along with an underperformance relative to the Nasdaq.

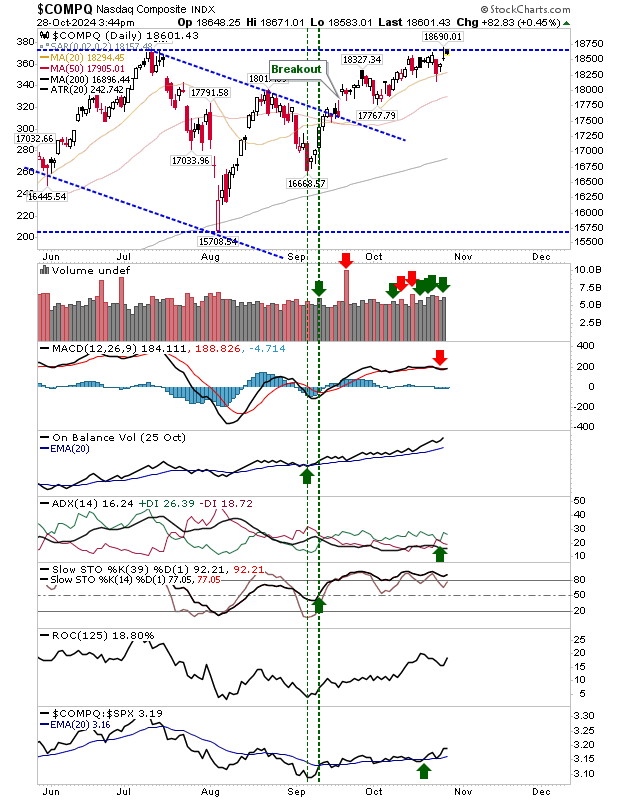

The Nasdaq finished with a bearish 'black' candlestick just below resistance. It's still on a 'sell' trigger on the MACD, but this trigger has effectively flatlined.

Other technicals are positive, feeding into the possibility of a break to new highs soon. Despite yesterday's trading, I still think a break higher is in the works.

With U.S. elections next week there is a "wait-and-see" aspect to current action, although in J.C. Parets latest newsletter, he is of the opinion markets have priced in a Trump win. If Harris wins, then can we expect a "sell off"? Or will see a general sell-the-news in markets on election results.