Stocks rallied following the CPI report, as falling energy prices offset the rise in the net benefit of health insurance and other medical impacts. Energy and gasoline prices fell sharply, and so did owners’ equivalent rent.

There was disinflation in the used car prices and lodging. A 1/10 miss doesn’t seem like much, but rates are so highly leveraged and short that is all it takes to ignite another short-squeeze in bonds, not that different from what we saw in the Treasury refunding on November 1.

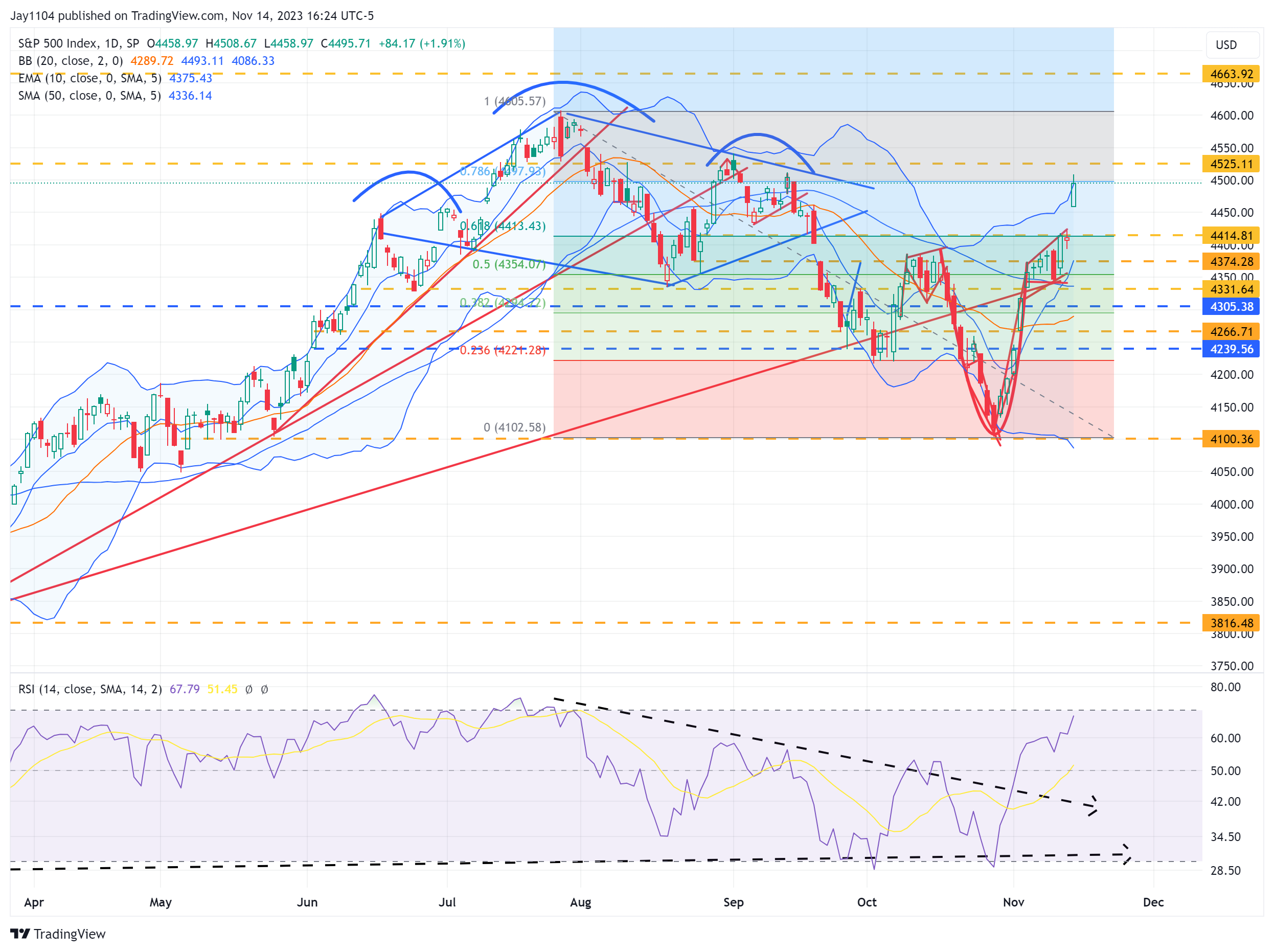

The options market yesterday was only pricing an 80 bps move in the market, in the S&P 500, and generally, the options market does a pretty good job at pricing event risk. Still, this time, it underestimated the implied move. Because the S&P 500 rose by roughly 1.9% and closed around 4,490.

As noted yesterday, the call wall had shifted to 4,450 and was at 4,450 again yesterday. However, the decrease in yields proved too much, and the S&P 500 was able to move beyond the call wall and rally to up the next significant resistance level in options ahead of Friday’s OPEX at 4,500.

Additionally, it overrode what, in my experience tends to be a relatively bearish technical pattern. But analysis is about a game of odds and managing expectations around the odds. We make the best decisions and conclusions based on the information we have.

It is about a process and the same process that I used to predict a rise in the inflation rate in August and September, the rise in rates, and the move down in equity prices, was the same process that didn’t work this time. Such is life.

The move higher yesterday certainly was not what I expected, given the historical trends for this CPI report and how the technical setup appeared to be positioned.

Being aware in October when the S&P 500 reached 4,100, I even suggested that conditions had reached oversold levels and were due for a bounce. But this bounce has been far more than most have expected, including myself.

Using the same standard to identify the overbought conditions in the S&P 500 in July and oversold conditions in October. The index is now quickly approaching or has approached over-bought levels as the index trades through the upper Bollinger band and the RSI approaches 70. Of course, just because something is overbought doesn’t mean it can’t go higher.

By the way, it is worth pointing out that gold had a similar pattern. In that case, it worked as I would have expected.

The Nasdaq 100 has also moved above its upper Bollinger Band as the RSI approaches 70.

We saw rates fall dramatically yesterday, as this is one of the market’s more highly leveraged and short parts. The move down in the 2-year rate likely continues as the market begins to price in rate cuts; the question, of course, is what the Fed will do regarding rates.

But at this point, what matters more is the reshaping of the yield curve. As that morphs, it seems to me that the yield curve needs to steepen, and needs to happen in the form of the 2-year falling to the 10-year because it appears to me that much of the data is pointing to softening of the economy, and that will make retail sales today a critical metric. Once the yield curve starts moving, I think the move higher may happen fast.

I have been using the 10-year futures to trace equity prices over the last few months, but I think that changed yesterday, and I need to start focusing on the curve.

The reason is that the 2-year rate has been pegged, and it has been the 10-year moving. But now both have been released, which means the curve matters more and has become more dynamic.

The dollar has also significantly contributed to movements yesterday.

Despite the drop in yields and the dollar, oil fell yesterday, too, and that is odd, not what one would expected to see.