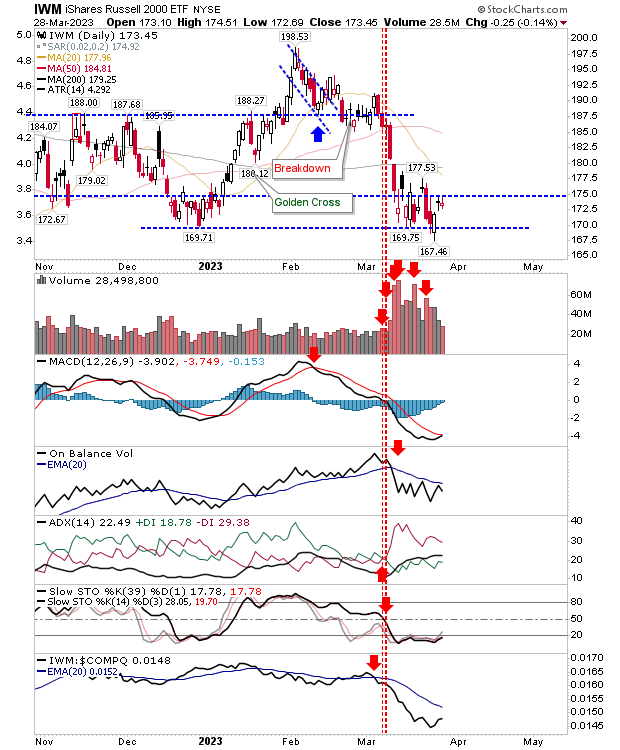

It's getting a little dangerous for the growth stock index. The Russell 2000 (IWM) is experiencing an ever-decreasing series of individual highs as it looks to defend December lows. Technicals are net bearish, but there is a chance for a 'weak' buy below the bullish zero line.

Trading volume is a little light, but I want to see a solid white candlestick rather than the two indecisive candlesticks over the last couple of days, particularly as Friday's 'bullish' piercing pattern had promised more. The March consolidation is not the best if you are of bullish persuasion.

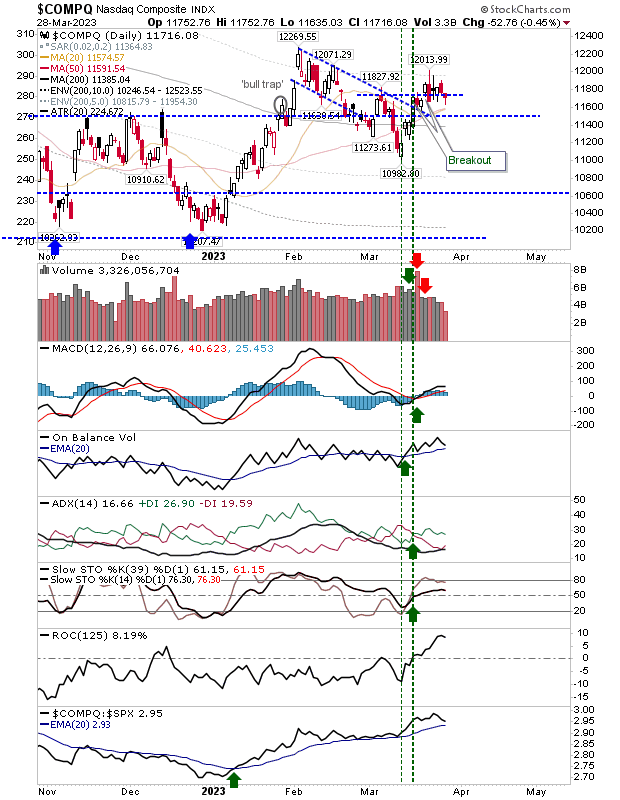

The Nasdaq is trading at a minor support level, but one delivered off the back of a breakout. Today's candlestick ranked as a small 'bullish' hammer, helped by bullish technicals. I would be looking for higher prices tomorrow for the simple reason a loss would rank as a breakdown. The 50-day MA is there to lend support should this happen.

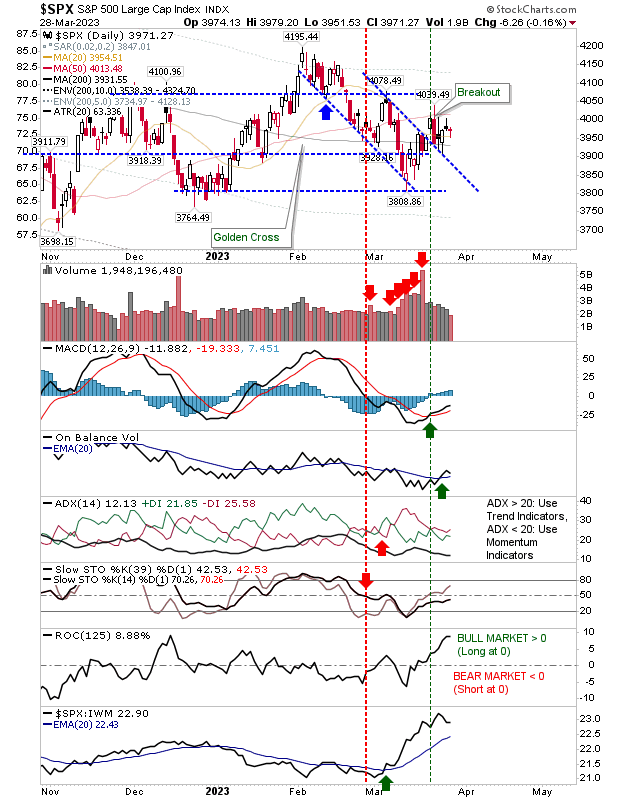

The S&P 500 has at least managed to clear its consolidation and trades above its 200-day MA, but I would like to see a more concerted move above 4,075. Technicals are a bit of a mixed bag, but with the 'buy' signal in On-Balance-Volume and MACD, there is a reason for optimism.

We need to see markets emerge from March Madness with a bit of bullish momentum on their sides. The Nasdaq and S&P 500 look to be doing their bit, but it's the Russell 2000 I want to see perform.