U.S. stocks fall as Oracle’s datacenter woes puts AI trade in jeopardy

The list of things that could derail risk-on sentiment is long and varied, but at the moment the crowd has shown little enthusiasm for abandoning winning trades.

That’s the message via several pairs of ETF proxies for profiling the risk appetite — a review that reaffirms that bullish enthusiasm remains strong, based on prices through Apr. 8, 2024.

This positive profile carries over from our previous update in late February. In today’s update, several key trends remain firmly skewed on the side of the bulls.

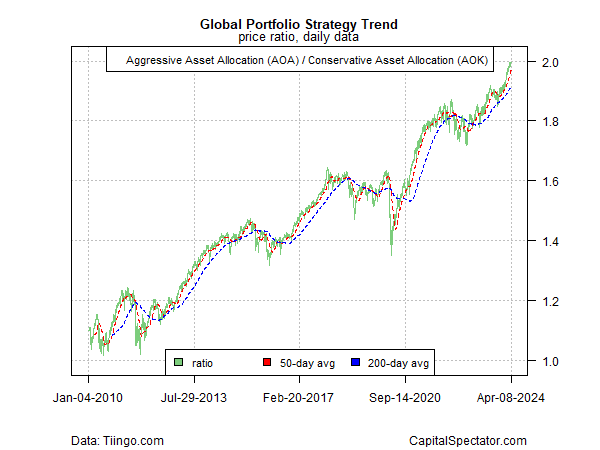

Consider a big-picture profile based on an aggressive global asset allocation portfolio (AOA) vs. its conservative counterpart (AOK). This ratio continues to go from strength to strength.

There’s a growing debate about the staying power of the trend in the months ahead, but for the moment this broad measure of the global risk appetite serves as an unsubtle reminder that the crowd has yet to throw in the towel on the rally.

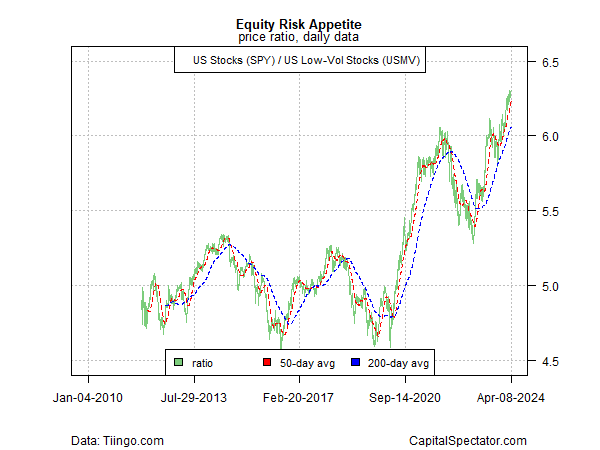

A similar profile favoring risk-on applies to a comparison of US equities (SPY) vs. a low-volatility subset of stocks (USMV).

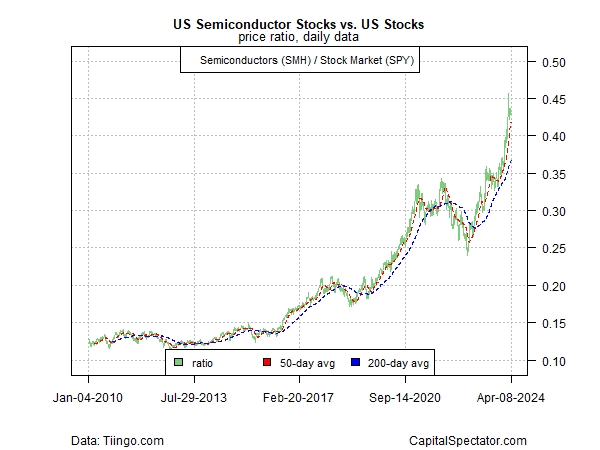

Similarly, the view that markets are poised to roll over finds little support in the ongoing surge in semiconductor shares (SMH) — considered a business-cycle proxy — vs. a broad measure of US equities (SPY).

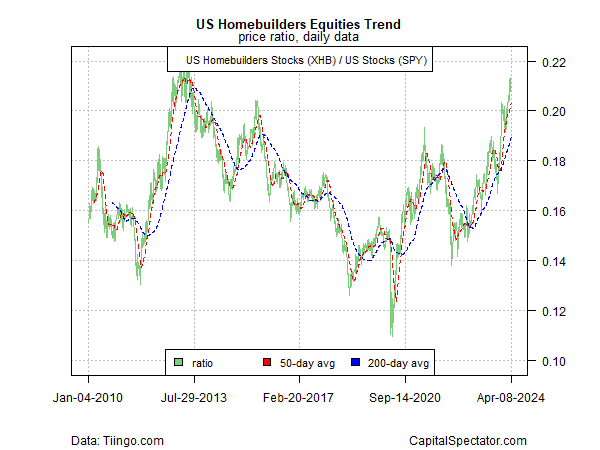

Even homebuilders (XHB) are rallying sharply relative to US equities (SPY), a trend that surprises some analysts given the fallout in real estate following the recent rise in borrowing costs, which has weighed on demand for property purchases.

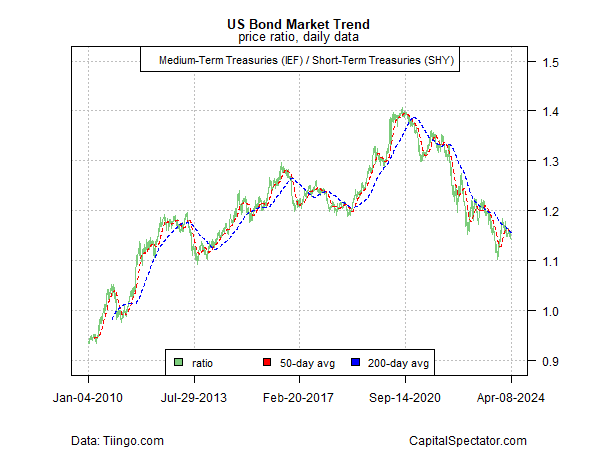

One area that’s still conspicuously bearish, is the US Treasury market. Comparing medium-term government bonds (IEF) with their shorter-term counterparts (SHY) continues to reflect a negative trend.

The latest round of diminished expectations for rate cuts is fueling a new selloff in bonds. Using the IEF/SHY pair as a guide, however, suggests that the bear market in fixed income has been ongoing for several years and shows no sign that a bottom has arrived.

The persistent weakness in bonds raises the question of whether this negative trend will eventually take a toll on the bull market in stocks?

For the moment, there are few, if any signs, of spillover risk. That may be surprising, perhaps even irrational. But as the saying goes, markets can stay irrational for longer than you stay liquid and so ignoring the trend can easily turn into an unforced error.