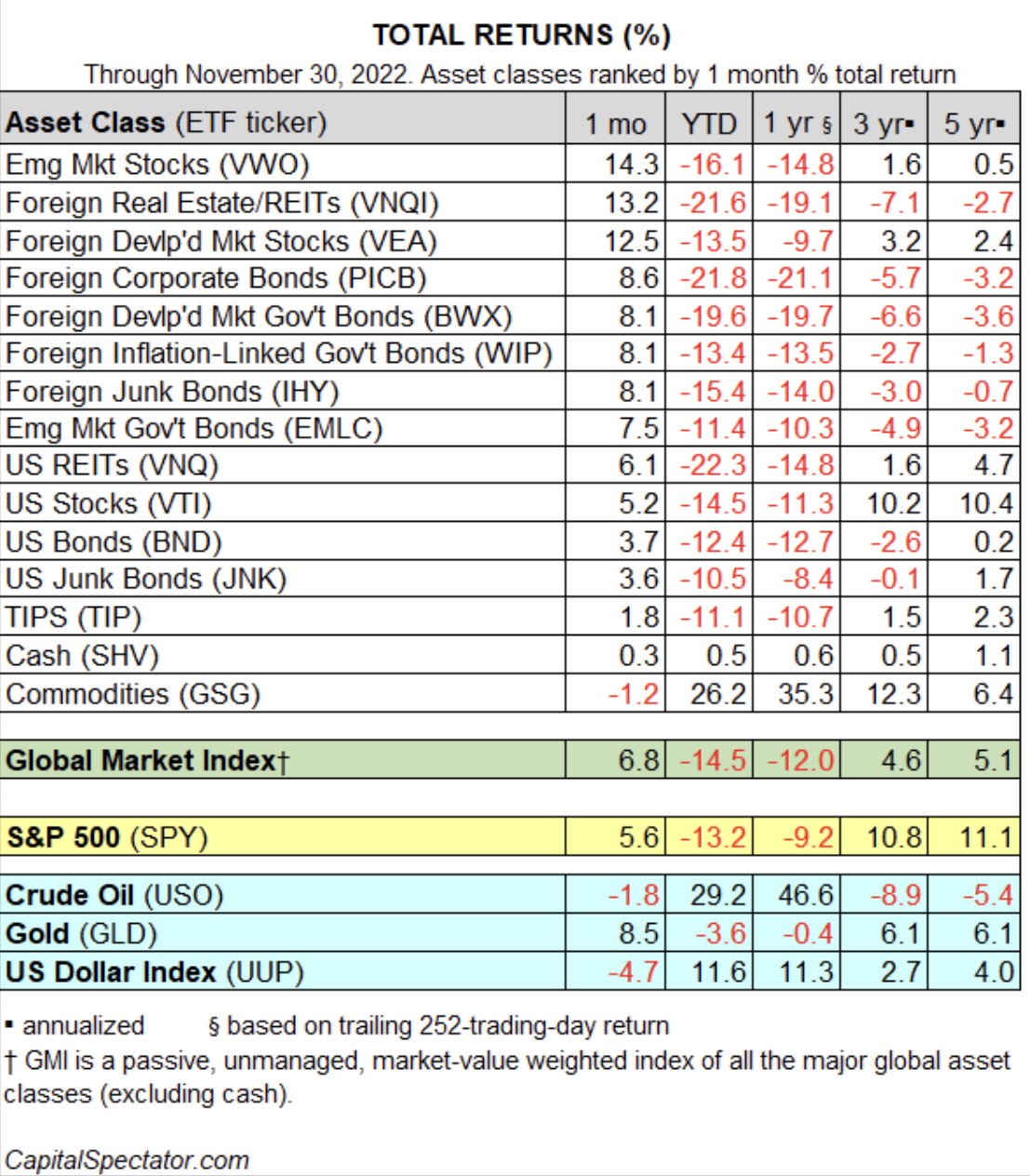

The rebound in global markets strengthened and broadened in November, building on October’s rebound. Only commodities lost ground last month. Otherwise, all the major asset classes posted gains, based on a set of proxy ETFs.

Stocks in emerging markets led November’s winners. Vanguard Emerging Markets Stock Index Fund ({{40696|VWO})) surged 14.3% last month, the ETF’s first monthly gain since May. Despite an unusually strong rally in November, VWO remains deep in the red for the year to date via a loss of 16.1%.

Several other markets also posted strong returns last month, including foreign real estate (VNQI) and developed-markets stocks ex-US (VEA). Both funds enjoyed double-digit gains in November.

US stocks ({{523|VTI})) and bonds (BND) also rose, although the rallies were relatively modest.

The only loser in November: commodities (GSG), which eased 1.2%.

The Global Market Index recovered continued to rebound, posting a second monthly gain. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, increased by a strong 6.8%–the benchmark’s biggest monthly advance in two years. For the year to date, however, GMI is still nursing a steep loss of 14.5%.

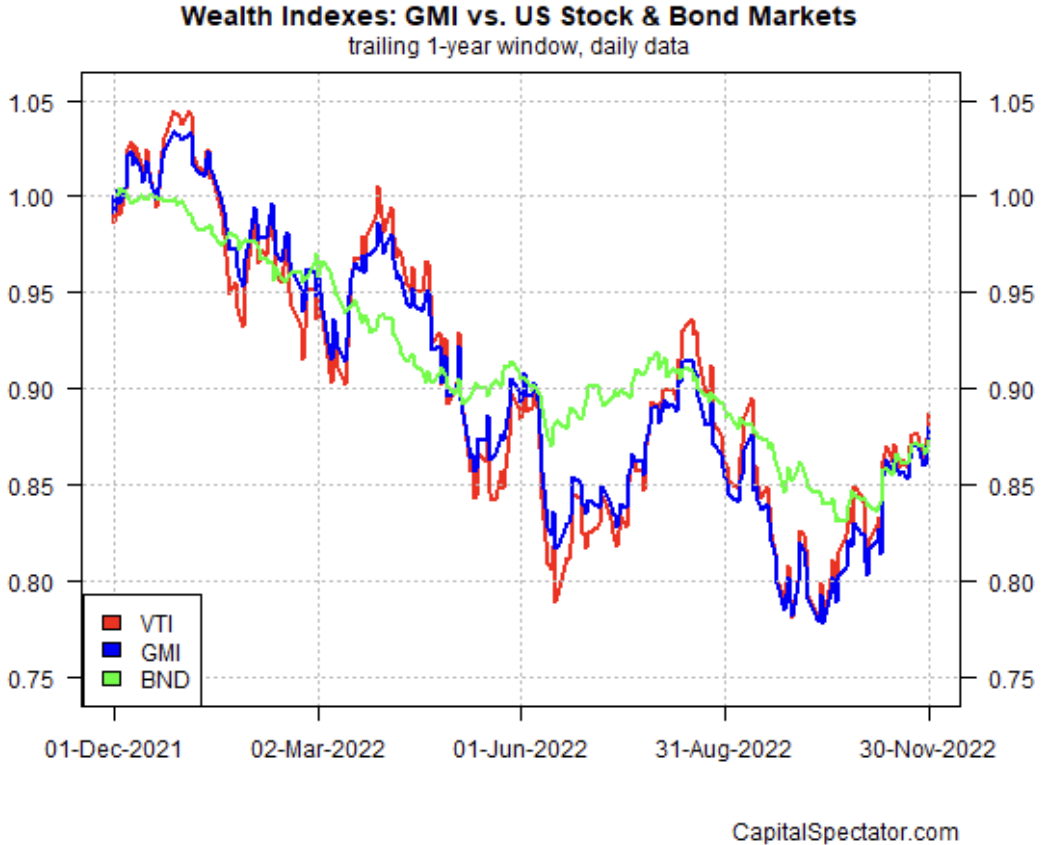

Comparing GMI’s performance to US stocks (VTI) and bonds (BND) over the past year shows that multi-asset-class portfolios continue to rally in line with the recent gains for equities and fixed-income securities.