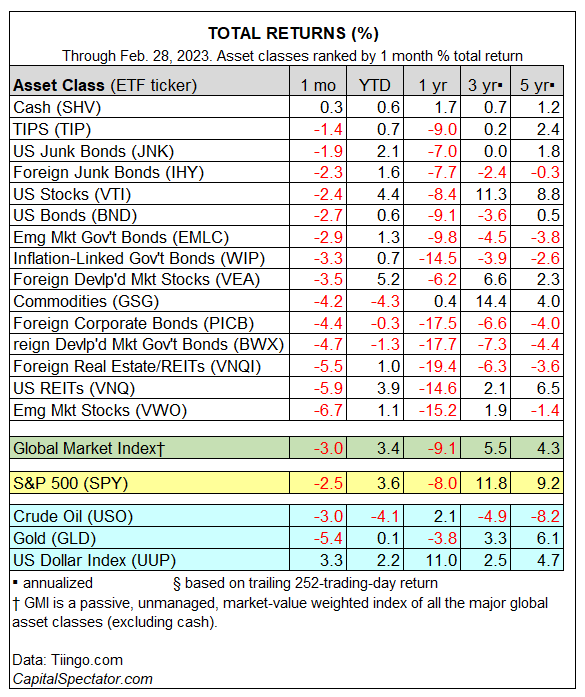

After starting the new year with roaring gains, global markets whimpered in February, posting across-the-board losses, based on a set of proxy ETFs.

Although every corner of risk assets took a hit last month, most asset classes still post gains year to date. But the whipsawing so far in 2023 is extensive, raising questions about what comes next.

The only winner for the major asset classes in February: cash, based on a short-term Treasury fund. The iShares Short Treasury Bond ETF (NASDAQ:SHV) rose 0.3% last month. The fund is also the only winner at the moment across all the time frames shown in the table below. Amid market expectations that the Federal Reserve will continue to lift interest rates, SHV, which benefits from rising yields, looks set for ongoing and incrementally higher gains in the months ahead.

Otherwise, losses in February were posted far and wide, ranging from a moderate 1.4% decline in inflation-indexed Treasuries (TIP) to a sharp selloff in emerging markets stocks (VWO), which tumbled 6.7%.

The Global Market Index (GMI) lost ground in February too. This unmanaged benchmark (maintained by CapitalSpectator.com) holds all the major asset classes (except cash) in market-value weights and represents a competitive benchmark for multi-asset-class portfolios. GMI retreated 3.0% last month, although it’s still up a solid 3.4% year to date.

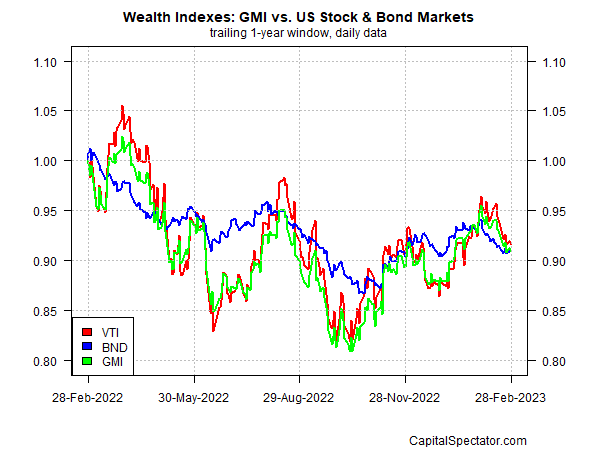

Reviewing GMI’s performance relative to US stocks (VTI) and bonds (BND) over the past year reflects performances in close alignment lately. All three benchmarks are posting unusually similar results at the moment for the trailing one-year window: losses of roughly 8% to 9%.