Oil bears think a barrel of US crude will hit the low $50 levels next, and UK Brent under $60, to extend this week’s selloff.

I think instead that oil’s one-way trade over the past four-and-a-half months is possibly over; that crude prices will no longer go in just one direction—up—but start to gyrate more often.

To me, what was most impressive, as well as ludicrous, about the near 90% rally in oil from the end of October—before its 7% plunge on Thursday—was its virtually correction-less factor.

There are often as many good reasons for a market to rally as for it to fall.

In oil’s case, the 95% efficiency in Pfizer’s COVID-19 vaccine revealed in the first week of November was definitely a game-changer for risk markets wallowing in uncertainty.

New York-traded WTI, which by that time, had slowly risen to $38 per barrel from a historic minus-$40 in April, saw an incredible boost in January from surprise OPEC+ production cuts that took its price to above $50 the first time in nearly a year.

From there, the market digressed almost into a one-trick pony show, led by a Saudi oil minister, who impressed upon the world that production cuts alone were good enough for oil prices to go higher and even higher.

Soon, investment banks showed up on the side, chiming in chorus about London’s Brent possibly hitting in succession $60, $70, $80 and even $100 per barrel (the self-fulfilling prophecy of their widely-reported research notes helped oil hit the first two targets in just two months).

But the difficult question that few were asking enough—and even if they did, wasn’t met with enough answers—was whether there was adequate demand to support a near doubling of oil prices in under five months, with sales of jet and other transportation fuels remaining sluggish as the pandemic continued to hold down global travel.

Queries inconvenient to the bull narrative were hushed up with data showing that oil inventories in the most developed nations were already near five-year seasonal trends and will get better with more production cuts, never mind demand (in fact, the underlying theme was that it was better not to talk about demand at all, given its subjectivity due to the pandemic).

Anyone who remained doubtful was silenced by the promise of economic reopenings and COVID-19 vaccinations. The last two became more suspect by the day as Europe was overwhelmed by new cases of the virus amid an appallingly slow pace of immunization.

As the saying goes, “It doesn’t rain but it pours”. The unanswered queries about demand, trickling in since the start of the year, turned into a perfect storm of negativity on Thursday. Adding to the mix were inflation concerns from 10-year Treasury yields at 13-month highs of 1.7% (an insanity in itself that needs to be told in a different story) and a ramping dollar that made commodities priced in the greenback, including oil, comparatively more expensive.

As WTI and Brent struggled to find a floor on Friday, making measured moves on either side of red and green at the time of writing at 4:00 AM ET, what was evident was there was as much a bull and bear case for both.

To concur, Jeff Halley, who heads the Asia-Pacific research arm of New York broker OANDA, wrote in his note:

“Now that a culling of the herd has happened, oil’s bullish underlying case will reassert itself, and I do not expect prices to remain down here for very long.”

But Halley also made clear that failure to hold key technical support levels “may flush more stop-loss selling out of hiding”.

I have drawn up a list of variables and technicals to help you form your own view on oil's direction.

The Positives

1. Saudi Minister AbS and His OPEC+ Cuts

The 23-nation OPEC+—made up of the 13-member Saudi-led Organization of the Petroleum Exporting Countries and 10 non-OPEC nations steered by Russia—is withholding at least seven million barrels per day of regular supply from the market.

The OPEC+ cuts have been the single largest driver of oil prices from the lows of the pandemic, lifting WTI from a historic negative pricing of minus $40 per barrel in April to highs of nearly $68 last week.

But Saudi Oil Minister Abdulaziz bin Salman is also beginning to err more on the side of caution than necessary, bypassing an opportunity to raise production in April when he kept in place the kingdom’s voluntary cut of 1 million barrels per day, initially agreed for just February and March.

It’s possible that in his crafty mind, AbS, as the minister is known, was planning to do the same for May, until this week’s selloff. There’s a saying that “one can never get too much of a good thing” and that’s what production cuts have become for Abs and OPEC+. His decision to withhold cuts for April has angered India sufficiently (read below under Negatives).

So far, the Saudi minister has been blessed by unanimous support within the enlarged cartel for his calls. But any break in the ranks could be messy for the market. Case in point: the March 2020 Saudi-Russian argument on production levels that sparked an output war that contributed to WTI’s historic pricing and led to a near collapse of OPEC.

2. Vaccinations

The United States will administer its 100 millionth COVID-19 shot on Friday. This comes 58 days into President Joseph Biden’s term, smashing the 100-day target he set at the start of his term.

Leading European Union states are to restart their roll-out of the Oxford-AstraZeneca (NASDAQ:AZN) COVID-19 vaccine after Europe's medicines regulator concluded it was "safe and effective". Germany, France, Italy and Spain said they would resume using the jab.

The resistance of the Big Four was one of the factors that drove down oil on Thursday. It is up to individual EU states, however, to decide whether and when to re-start vaccinations using the AstraZeneca vaccine. Sweden said it needed a "few days" to decide.

3. Crude Buying-On-The-Dips

It’s an inherent nature of bull markets that when prices fall appreciably, buyers will emerge at that lower level to pick up what they can for a bargain. Thursday’s 7% drop in both WTI and Brent, especially if extended, can result in such buying-on-the-dips, at levels of support often determined by technicals.

Negatives

1. India Looking To Displace 25% of Saudi Oil

India, the third biggest oil importer after China and the United States, will cut its purchases from Saudi Arabia by about a quarter from May after Riyadh refused to let OPEC+ to raise output appreciably.

New Delhi needs more oil, and at lower prices too, to bring down Indian pump prices for fuel that have soared from nearly a year of OPEC+ cuts. Iran is already defying US sanctions on oil to export crude to China at deeply-discounted prices, undermining OPEC+ cuts, and the Islamic Republic could strike a deal with India as well.

As I suggested earlier, OPEC+ cuts can sometimes be a bane for oil as much as a boon. In India’s case it seems to suggest the former. The rumor making its rounds is that in rejecting New Delhi’s request for more supply, the Saudis are trying to pressure the Indians to buy even more oil from the United States, which is already the second largest supplier to the subcontinent.

There are two problems for the Saudis with this strategy: One, they risk losing Indian market share to the US which they may not be able to recoup easily; two, the higher Indian demand may prompt the US to produce even more—something OPEC+ might not want to encourage. India can also buy from Iran—a worse prospect for the Saudis and OPEC+.

2. Third Wave Of COVID-19 In Europe

COVID-19 cases in Germany, the European Union’s largest country by population, jumped by over 17,000 on Wednesday, the biggest daily rise since Jan. 22, data from the Robert Koch Institute for infectious diseases showed. Large parts of Italy, meanwhile, were back in lockdown.

The surge in European cases and more pandemic-related restrictions suggested that a third wave of COVID-19 was building on the bloc, on the back of a sluggish immunization program.

3. US Refinery Maintenance Season

Early spring and fall traditionally are busy periods for US refinery maintenance, as operators gear up for summer driving demand and switch to making more heating oil and winter gasoline blends. Regular overhauls also are needed to ensure safety.

“How far the refinery run rate slides is the only question.” Of course, the resulting impact of this was, “How much crude stocks could pile up?”

As of last week, the refinery utilization rate was 76.1% to capacity, picking up from the record low of 56% after the mid-February Texas snowstorm. Crude stocks had built by almost 39 million barrels the past four weeks, distorted again by the Texas storm.

4. Iran & Libya—The Dark Horses

Since the Biden administration came into office, reports have increased of Iran defying Trump-era export sanctions to ship its oil to select buyers, a process that not only helps fill its coffers but also effectively undermines OPEC+ production cuts.

This week, a Bloomberg report said China, the world’s largest crude oil importer, was buying close to 1 million barrels a day of sanctioned crude, condensate and fuel oil from the Persian Gulf nation.

That’s displacing favored grades from countries such as Norway, Angola, and Brazil, traders said, and resulting in an unusually quiet spot market.

The Biden administration says it will do a nuclear deal with Iran that will lift the sanctions, if Tehran dismantles its uranium enrichment first, while the latter demands that the curbs on its exports be lifted for talks to begin, resulting in a cat-and-mouse game between the two. It is logical to assume a deal will be done at some point.

But it also looks like the Biden administration will not aggressively penalize Iran for its oil sales till then, a situation that could make OPEC+’s position perilous, especially if Tehran adds another million barrels to its exports.

In Libya’s case, it has a unified government for the first time in more than a decade of civil war. It is also pumping 1.3 million barrels of oil daily and plans to increase this to 2.1 million bpd within four years. Libya has been the odd man out in OPEC production cut agreements, exempt from any because of its political turmoil. Now, it is in a position to undermine the cartel’s price control efforts.

Technicals

All charts courtesy of SK Dixit Charting

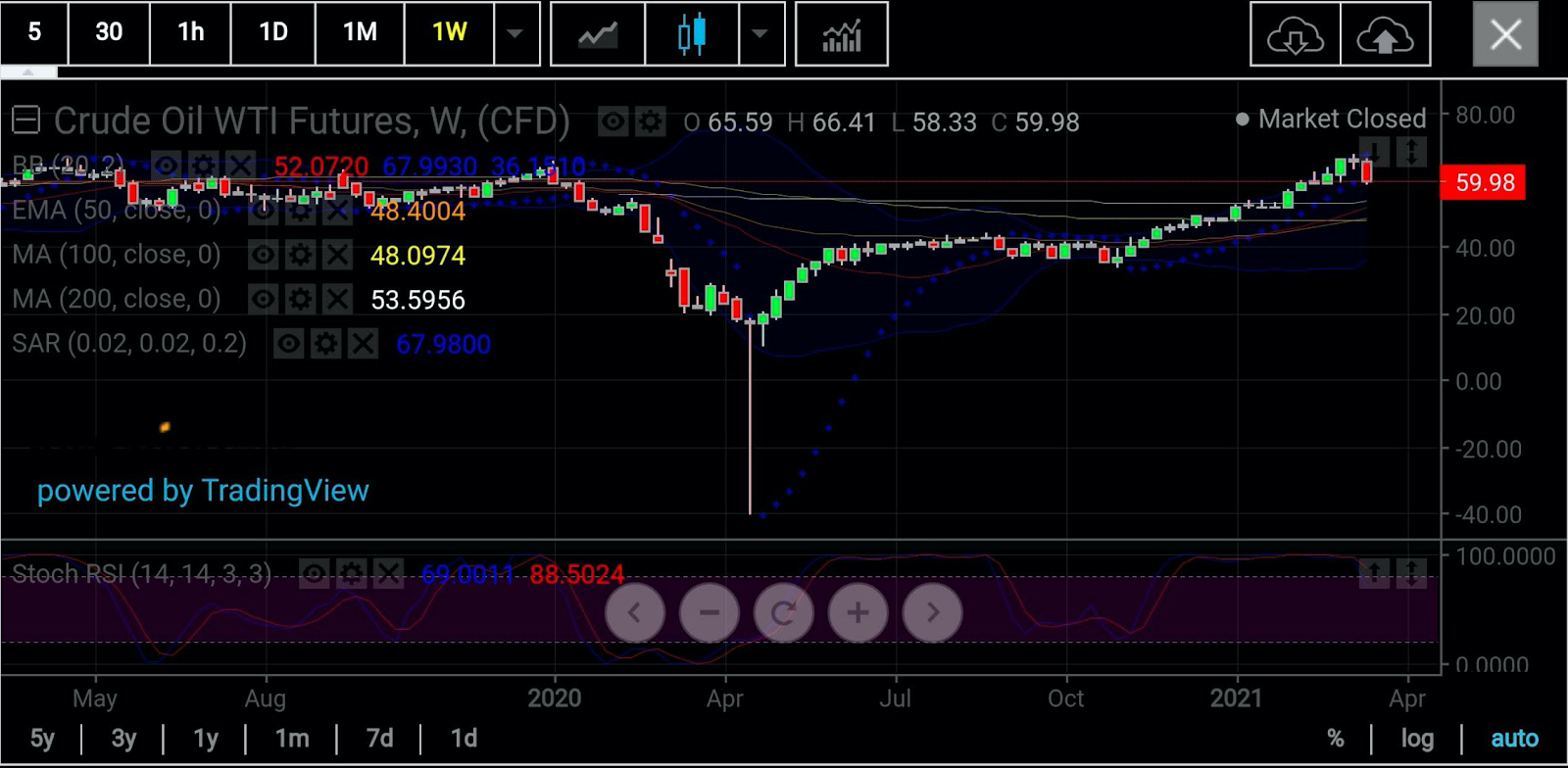

WTI broke below the critical middle Bollinger Band support of $63.15 on Thursday and fell sharply to $58.20 but closed above 50 Day Exponential Moving Average of $58.70. Any counter-trend pullback can result in a short-term spike/retracement to the 20-Day Simple Moving Average of $63.15 and $63.75, the point of breakdown.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.