This article was written exclusively for Investing.com

- Oil refining stocks declined for the wrong reason

- Energy and tax policy pressuring on pricing

- VLO shares have dropped

- Seasonality also weighing on the shares

- Buying VLO on a scale-down basis for 2022 - An attractive dividend pays while you wait

In his latest speech, US President Joseph Biden outlined a fifty-million-barrel release of crude oil from the country's Strategic Petroleum Reserve (SPR), in order to temper the rise in gasoline prices. The President pointed his finger at oil companies for price gouging, saying that oil and gasoline prices have moved lower, but they continue to remain very high for consumers at the pumps.

The administration’s attempt to blame the oil industry for high gasoline prices is purely political. After all, administration policies have limited US crude oil, natural gas, and coal production. The US now depends on foreign oil after years of working toward energy independence.

Oil refining companies do not profit from the price of crude oil or oil products. They make significant capital investments in refineries. Their earnings are purely a function of the spread between the price of crude oil and the prices of gasoline and distillate products or crack spreads.

Market forces determine crack spreads levels and are a real-time indicator of the supply and demand for oil products. They are also a barometer for refining companies’ earnings.

Crack spreads remained at elevated levels in November 2021. However, the rhetoric coming from the Biden administration has pushed shares of San Antonio, Texas-based Valero Energy Corporation (NYSE:VLO) lower. The current environment could be an opportunity to pick up some VLO shares, which have declined by nearly 18% since late October.

Oil refining stocks declined for the wrong reason

Fuel prices have been rising worldwide. A combination of falling US production, rising inflationary pressures, supply chain bottlenecks, and increasing demand have created a nearly perfect bullish storm for crude oil and oil products. Rising prices create headaches for political leaders as consumers blame government policies. Meanwhile, the Biden administration has gone on the offense as, the best defense is often an aggressive offense.

The administration recently opened probes into oil company “price gouging,” claiming a deviation between oil and gasoline wholesale prices and those charged to customers at the pump. That's why, last week, President Biden authorized the release from the SPR to temper price appreciation.

Meanwhile, an honest review of the markets may reveal embarrassing results for the politicians in Washington DC.

Energy and tax policy pressuring pricing

Any complete review of oil and oil product price rises would reveal the following facts:

- Addressing climate change has caused US production to drop. The US produced 13.1 million barrels of crude oil each day in March 2020. As of Nov. 19, output was 12.2% lower at 11.5 mbpd.

- US energy policy passed pricing power back to OPEC and Russia. After years of suffering from low prices because of rising US shale production, consumers worldwide are paying the cartel back for the previous years. The Biden administration requested OPEC+ to increase production twice over the past weeks. The cartel refused.

- President Biden went out of his way to explain that higher energy prices are not the result of his administration’s energy policy, deflecting the blame to the oil companies.

- Crack spreads reflect supply and demand fundamentals. The gasoline crack spread peaked at $8.95 per barrel in November 2020. On Nov. 29, it stood at $15.49 per barrel. The heating oil crack spread, a proxy for distillate fuels, reached a high of $12.82 in November 2020 and was at the $20.17 level on Nov. 29. The rise in crack spreads reflects the growing demand for oil products, putting upward pressure on prices.

- States charge taxes on gasoline on a percentage basis. As the price of the fuel rises, the nominal tax revenue rises.

- Inflation at 6.2%, well above the Federal Reserve’s 2% average target rate, is pushing all prices higher.

- The central bank liquidity and government stimulus since early 2020 are the root causes of rising inflationary pressures.

- Crude oil, oil products, and fossil fuels continue to power the world. The Biden administration canceled the Keystone XL pipeline project, banned drilling and fracking for oil and gas on federal lands in Alaska, and canceled other pipelines for environmental reasons.

The bottom line is that oil companies are far less responsible for rising fossil fuel prices than the US government. While addressing climate change is a noble cause, replacing hydrocarbons with alternative and renewable choices is a multi-decade project.

Around one percent of the cars on the road today are EVs. The rest are gasoline-powered vehicles. As gasoline prices rise, state governments hungry for revenue are taking a bigger bite via tax policies.

Moreover, the SPR release is nothing more than a Band-Aid on a gaping wound. Fifty million barrels of crude oil amounts to three days of US consumption. I have been trading crude oil for nearly four decades. Oil prices moved higher after most of the SPR releases over past decades.

The evidence points to the administration’s deceptive efforts to blame rising gasoline prices on oil companies, while the responsibility sits in Washington DC.

Valero shares have dropped

Valero is a leading crude oil refining company worldwide. Shares have been volatile since the March 2020 pandemic-inspired low.

Source: Barchart

The chart shows that after falling to a low of $31 per share in March 2020, VLO shares made higher lows and higher highs, reaching $84.95 on June 3, 2021.

VLO has run into technical resistance between the $80 and $85 level. The shares reached the latest high at $83.15 on Oct. 22.

Source: Barchart

Since then, they fell to a low of $66.26 on Nov. 26 when selling caused crude oil’s price to decline by over 14%. VLO was trading at just over $68 per share on Nov. 29.

Seasonality also weighing on the shares

Gasoline is the most ubiquitous energy product. Peak driving season occurs during the spring and summer, when people tend to put more miles on their cars. The winter months are typically a seasonally weak period for demand and prices.

Source: Barchart

The long-term monthly chart shows that during typical years, VLO shares fell to seasonal lows during the winter months. The chart also shows that the $85 level is a technical gateway to much higher prices.

In 2019, VLO reached $101.99, and in 2018 it traded to an all-time high of $128.96 per share.

Buy VLO on a scale-down basis for 2022; attractive dividend pays while you wait

The attack on oil companies likely weighed on VLO shares, but the recent selling could create a compelling buying opportunity because US and European companies are expanding their production and refining capacity. VLO’s leadership role puts the company in the perfect position to profit from rising crude oil prices as fundamental supply and demand factors continue to favor higher levels.

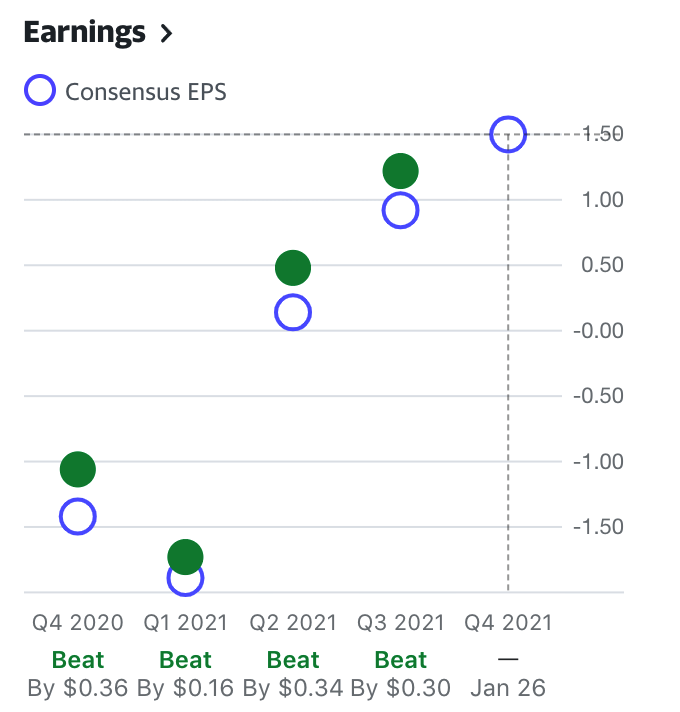

Source: Yahoo Finance

The chart shows that VLO beat analyst earnings forecasts over the past four consecutive quarters.

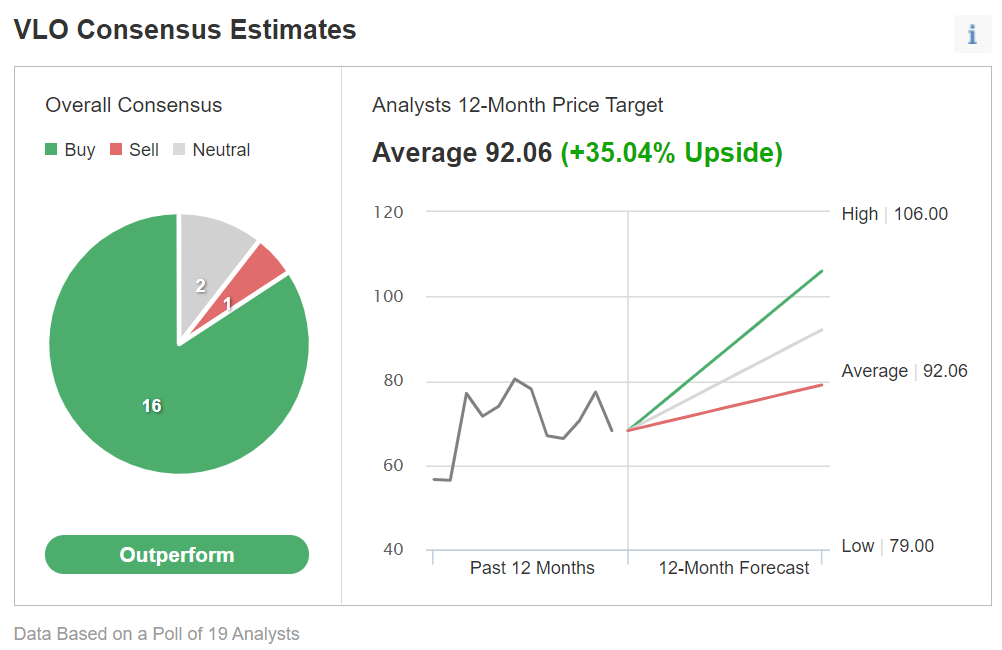

A survey of 19 analysts on Investing.com gives the stock an 'Outperform' rating, with an average price target of $92.06 per share, with estimates ranging from $79 to $106.

Chart: Investing.com

At $68.17 on Nov. 29, the target stands at over 35% above the current price.

Moreover, VLO pays shareholders an annual $3.92 dividend, which translates to an above-market yield of 5.76%. VLO is a compelling buy below the $70 level, and I would add to long positions on any further price weakness.

Crack spreads are a real-time indicator for oil product demand and refining company profits. All signs point higher for the shares that have fallen victim to US government rhetoric that deflects the blame for higher fuel prices from the real cause, the governments’ monetary, fiscal, and energy policies.