- The video-streaming giant is forecast to report a 30% drop in its earnings per share when it reports its third-quarter Tuesday.

- Netflix lost about a million subscribers in the first half of 2022.

- A 60% plunge in its stock value has wiped out more than $200 billion from the company’s market capitalization.

During a week packed with some major earnings announcements, investors will particularly focus on Netflix (NASDAQ:NFLX), which is trying to revive growth in subscribers after a massive plunge during the first half of this year.

The video-streaming giant is forecast to report a 30% drop in its earnings per share when it reports its third-quarter numbers on Tuesday, Oct. 18 after the market close, according to analysts’ consensus forecast. Sales are likely to reach $7.85 billion, compared with $7.48 billion during the same period a year ago.

But investors will be particularly zeroing in on the company’s subscriber numbers, which have been showing a declining trend since the pandemic-driven boom ended last year. Netflix lost about a million subscribers in the first half of 2022 as four-decade-high inflation, and people's renewed preference for indulging in outside activities after the pandemic lockdowns, slowed demand for indoor entertainment.

Source: InvestingPro+

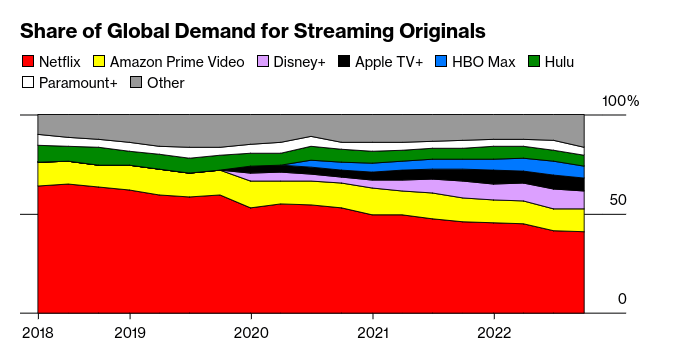

Netflix was also battered by the rising competitiveness in the streaming business: Many deep-pocketed global players, including Walt Disney (NYSE:DIS) and Amazon.com (NASDAQ:AMZN), stepped up their games and have taken significant market share.

These blows hurt Netflix badly this year. Its stock is down 60% this year, making it of the worst performers among the big-cap technology firms. This massive plunge has wiped out more than $200 billion from the company’s market capitalization since its November peak, and has put a big question mark on the company's future growth prospects.

An Ad-Supported Service

In order to deal with these challenges, the Los Gatos, Calif.-based Netflix is introducing an advertising-supported plan on Nov. 3, charging $7 a month for a subscription that the company bets will entice new budget-conscious customers and fuel growth.

The lower-priced streaming package will debut in the U.S. and 11 other countries, including Japan, France, and Brazil. It will include four to five minutes of commercials per hour and offer lower-video quality than that of higher-priced tiers.

CEO Reed Hastings had originally positioned Netflix as an ad-free alternative to cable TV. However, given the current challenges, the CEO has pivoted and now says commercials are necessary to appeal to people who find the service too expensive. Netflix has raised prices several times and is now one of the most expensive streaming services.

The problem is that the ad-free business is also poised to be a competitive space, as Disney plans to launch a similar enterprise on Dec. 8. Netflix also has limited experience in the digital ad market.

Despite these doubts, Netflix is still the world’s most popular streaming service by a wide margin. With 221 million subscribers and a huge lead on the competition in almost every major market, Netflix now accounts for about 8% of all TV viewership in the U.S. - the most of any network - and it has more customers abroad than Disney+, HBO Max, Paramount+, and Peacock combined do.

Source: Parrot Analytics, Bloomberg

Evercore ISI recently upgraded Netflix, saying that Wall Street is underappreciating the growth opportunities from the company’s ad-supported service and its password-sharing initiative.

The research firm also hiked its price target on the company to $300 a share, 27% higher than Friday’s close. The note says, "We believe these opportunities, especially the ad-supported service, constitute Growth Curve Initiatives (GCIs) - catalysts that can drive a material reacceleration in revenue growth.”

“We don’t believe these opportunities are factored into current Street estimates or into NFLX’s current valuation. Hence the upgrade," continues the note.

Bottom Line

Despite that optimism, Netflix has become a “show me” story after maturing from its initial growth phase. In order for its stock to rebound in a major way from here, the company has to prove that its new initiatives are meaningfully contributing to healthy top- and bottom-line growth and that its free cash flows are growing. Until that happens, it will be hard to call a bottom on NFLX stock.

Disclosure: At the time of writing, the author doesn’t own any shares mentioned in this report. The views expressed in this article are solely the author’s opinion and should not be taken as investment advice.