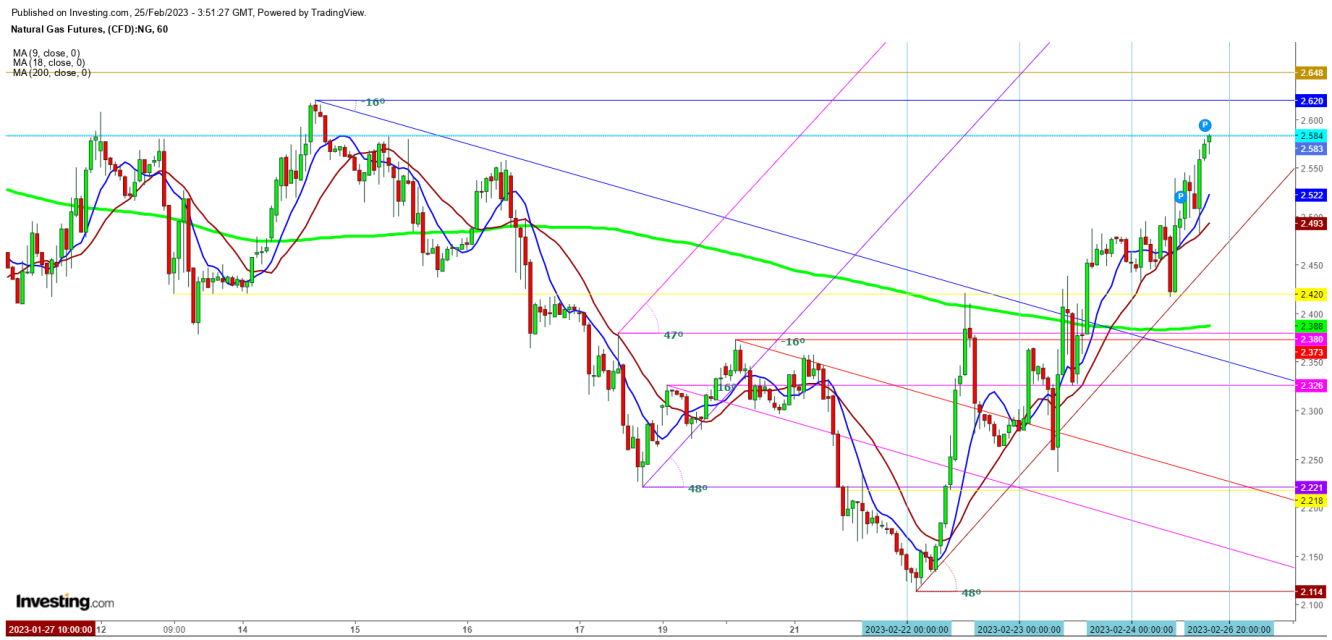

Over the last week, movements in natural gas futures indicate a win-win situation for the bulls. They managed to recapture in three sessions the territory that had been lost between February 15th and 22nd (six trading sessions).

Natural gas futures experienced a sharp reversal after testing a fresh low of $2.114 on Feb. 22nd and continued to move upward till the end of the week, closing at $2.583.

This recovery in prices was due to changing weather conditions. A deadly winter storm had a firm grip on the Northern Plains and Upper Midwest last Thursday, resulting in a bumpy move in natural gas futures of more than 22% in the last week.

At the same time, parts of the Ohio Valley and the South could see near record-breaking high temperatures, starting on Thursday and continuing over the next few days. On Sunday, Jacksonville, Florida is likely to hit 88°F (31°C).

Despite the recovery, the natural gas bulls are still under fear as natural gas futures closed last week at the same level where they had previously felt stiff resistance in the first half of Feb. 2023 before sliding downward.

If natural gas futures begin the upcoming week with a gap-up opening and sustain above the immediate resistance at $2.648, the uptrend is likely to remain intact ahead.

Natural gas futures have maintained an uptrend at a 48-degree angle since last Thursday, despite the bearish inventory announcement. This indicates that the price momentum in natural gas prices is still strong and could find confirmation during the upcoming week if natural gas futures experience a breakout above the second resistance at $2.767.

On the other hand, any changes in the weather outlook over the weekend could lead to a gap-down opening, potentially resulting in a retest of the immediate support level at $2.420.

Technically speaking, in a 1-hour chart, natural gas futures have sustained above the 200-day moving average since a bullish crossover formation on Feb. 23rd. The 9 DMA and 18 DMA have also crossed above the 200 DMA, indicating that the current uptrend is likely to continue during the upcoming week.

Disclaimer: The author of this analysis does not hold any position in natural gas futures. Readers are requested to create a trading position at their own risk, as natural gas is one of the most liquid commodities in the world.