- Since losing $3 perch, the mid-$2 support for natural gas has been fleeting

- Bulls aimed for small advances while trying to prevent a return below $2.40.

- Bears are trying to get the market to $2 without mass position-taking, like in Jan.

- Cold weather is expected again end-Feb but it might be too little, too late

‘Now you see it; now you don’t’ — the mid-$2 support for natural gas, that is.

Since the heating fuel’s front-month contract on the New York Mercantile Exchange’s Henry Hub lost its $3 perch on Jan. 30 — hitting a 20-month low of $2.341 four sessions later — the mid-$2 support has been hit-and-miss for longs in the game.

Of the 14 trading days in the $2 range, wins and losses have been symmetrical, with both bulls and bears claiming seven days each. What’s different is the size of the moves. For shorts, the biggest win was a 14% plunge on Jan. 30, while for longs, the largest gain was 6.7% on Feb. 14.

Long story short, neither side has been able to create a parabolic spike or cataclysmic implosion that natural gas and its volatility are notorious for. Instead, the action of the past three weeks can best be described with a phrase quite uncharacteristic for gas: Flat.

That’s exactly what it was, as both sides deployed caution. The bulls aimed for small advances while trying to prevent a return below $2.40. The bears tried to steer the market toward the next critical support of $2 without the kind of massive position-taking seen a month back.

Sunil Kumar Dixit, Chief Technical Strategist at SKCharting.com, said Henry Hub’s front-month contract was at such an inflection point that it could violently move up as much as $1+ if storage drawdowns of gas surprise over the next three weeks. Alternately, chart signals were indicating a test of the $2 support if the lift through in demand doesn’t come, Dixit said, adding:

“As futures have been rising calmly within an ascending channel with support at $2.45 and $2.35, the upward move would aim to clear $2.68 to reach the $2.78 and $2.88 critical barriers, which would serve as an acceleration point for a further upside towards $3.1, $3.3 and $3.5.”

At Wednesday’s settlement, the benchmark March gas contract on the hub settled at $2.471 per million metric British thermal units, or mmBtu. At the time of writing, it hovered at just above $2.50.

On the flip side, Dixit believes “a sustained break below $2.35 support will push prices down towards $2.15 and eventually $2.”

Part of this week’s upside for gas came from the larger feed volumes noticed at Freeport LNG, the Texas-based liquefied natural gas export terminal, which was slowly clambering back to life after being shut following a June fire at the plant. Freeport, which once handled 2 billion cubic feet, or bcf, per day of gas, this week received up to 0.7 bcf daily — or 30% of its capacity.

While the plant remains in the early stages of a restart mode, the incrementally higher volumes of gas it is handling each day are a sign that it is moving in the right direction.

That aside, there was a sentiment boost from the U.S.-based GFS and the European ECMWF weather forecast models, suggesting colder trends toward the end of this month.

Of the two, the ECMWF model was the more bullish, forecasting a late February and/or early March cold outbreak.

Those forecasts bumped up expectations for Gas-Weighted Degree Days, or GWDDs, staying at or above long-term averages.

Combined, the Freeport factor and weather forecasts helped the market from ceding the last vestiges of $2 support.

Yet, as the saying goes, all these might be too little too late in a winter that incredibly hasn’t delivered a single major snowstorm to the U.S. North Eastern region, which forms the country’s largest gas-driven heating market.

Trade journal naturalgasintel.com said in a post:

“The ongoing warmth that has pressured futures and cash prices alike in recent weeks is showing few signs of a lasting turnaround based on the latest weather data.

Models continue to show only a brief period from Feb. 22-26 as having any meaningful cold weather to boost demand. The rest of February should see moderate temperatures and, thus, light demand at the national level.”

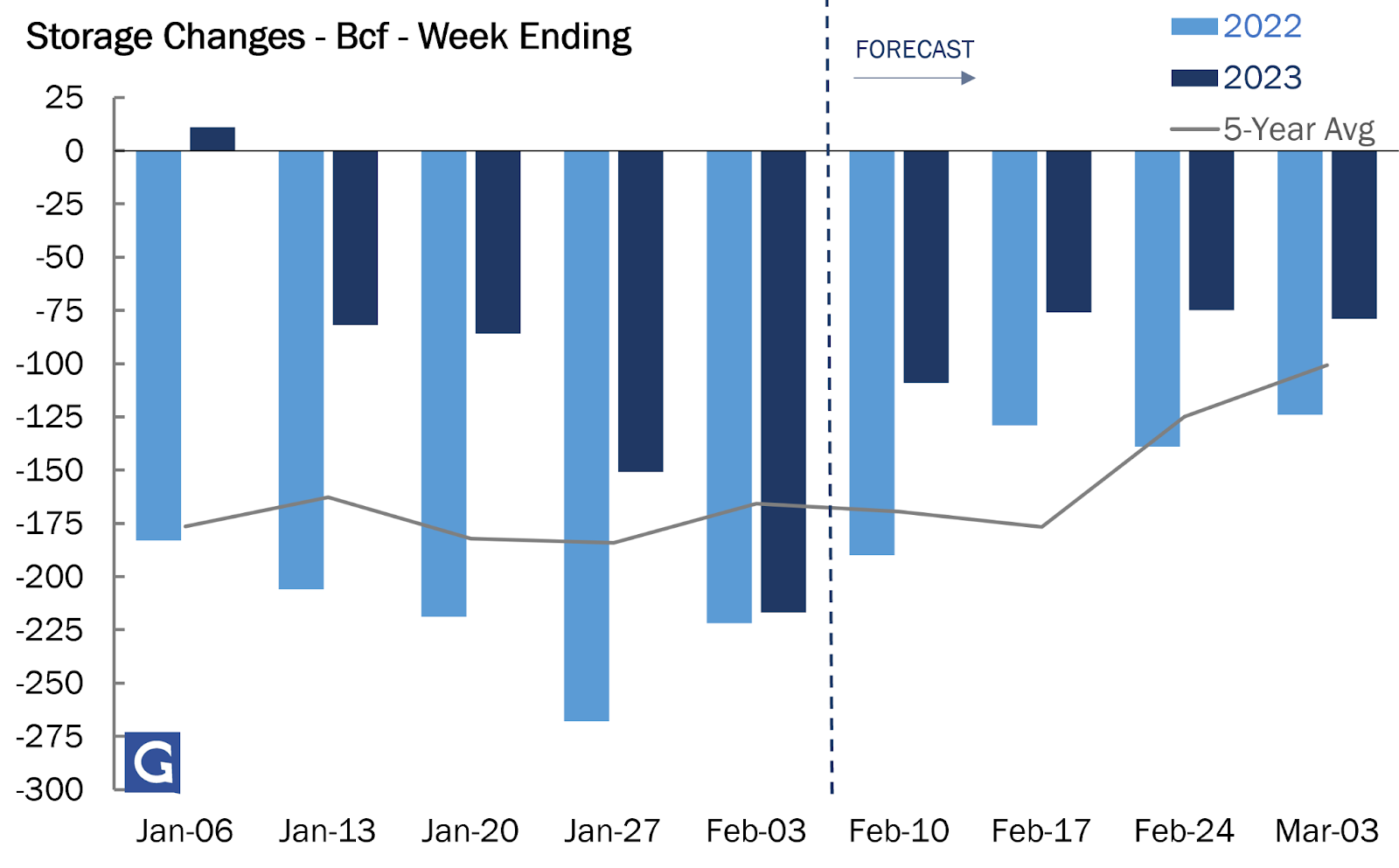

Source: Gelber & Associates

There will be further clarity on gas supply-demand today when the Energy Information Administration, or EIA, provides its update on natural gas storage levels for the week ended Feb. 10.

On average, industry analysts tracked by Investing.com are anticipating the EIA to report that U.S. utilities pulled a smaller-than-normal 109 bcf from storage last week. This is due to less-than-usual cold weather at this time of the year that has hit heating demand.

EIA data shows a 195-bcf withdrawal during the same week a year ago and a five-year (2018-2022) average decline of 166 bcf.

In the prior week to Feb. 3, utilities pulled 217 bcf of gas from storage.

If correct, the forecast for the week ended Feb. 10 would cut stockpiles to 2.257 trillion cubic feet — or tcf. That would make inventories about 16.5% higher than the same week a year ago and 8.4% above the five-year average.

Said analysts at Gelber & Associates, a Houston-based research and trading consultancy for energy markets:

“The US gas market remains unquestionably bearish from the underlying supply/demand perspective. The current supply glut on hand will only become more pronounced as the late winter winds down, and the lower demand springtime enters the picture.”

Naturalgasintel said that after the next two government inventory reports are accounted for, surpluses are expected to increase to more than 260 bcf ahead of the brief cold snap that could arrive in the Lower 48 U.S. states by around Feb. 22.

Lending some color to the situation, The Schork Group said in comments carried by the trade journal that Boston residents “could count on two hands” the number of significant, or 5% above the seasonal trend, heating degree days, or HDDs, the city has experienced this winter.

“The situation is just as bad in the Midwest,” analysts at Schork added. They noted this is particularly bad for bulls, given the region is the largest gas furnace market in the Lower 48.

While the late-February cold snap may slow the surplus from expanding further, real cold temperatures will be needed from Feb. 27-March 3, said those in the know. Adds NatGasWeather:

“That’s where the weather data isn’t as convincing as needed if it’s to be expected.”

***

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.