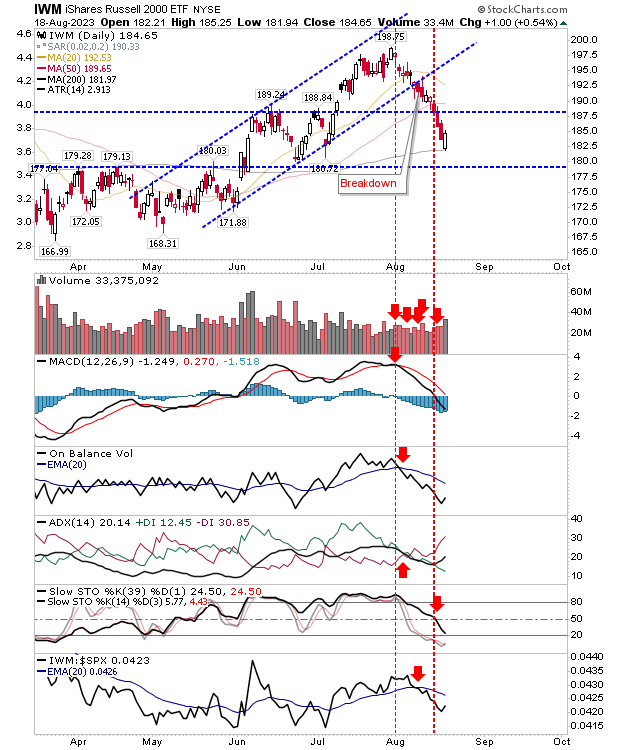

The latter part of last week saw sellers pick up the pace, but buyers were not going to give up without a fight. In the case of the Russell 2000 (IWM), the 200-day MA has acted as a point of action for buyers. Volume rose in confirmed accumulation, although technicals remain net bearish.

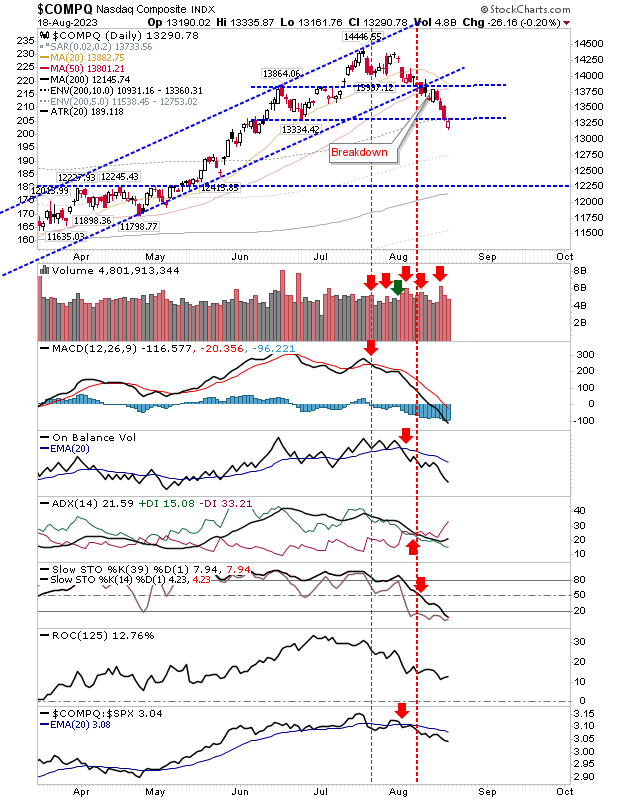

The Nasdaq did manage a higher close compared to the open price, but there isn't a huge amount of support on offer. The swing low from June offers an opportunity for bulls to step in, but even then, there is a potential reversal off 13,865 that would mark a possible head-and-shoulder reversal pattern. Shorts could aggressively go short at this point, but short-term traders could look to buy Friday's finish for a move to 13,865.

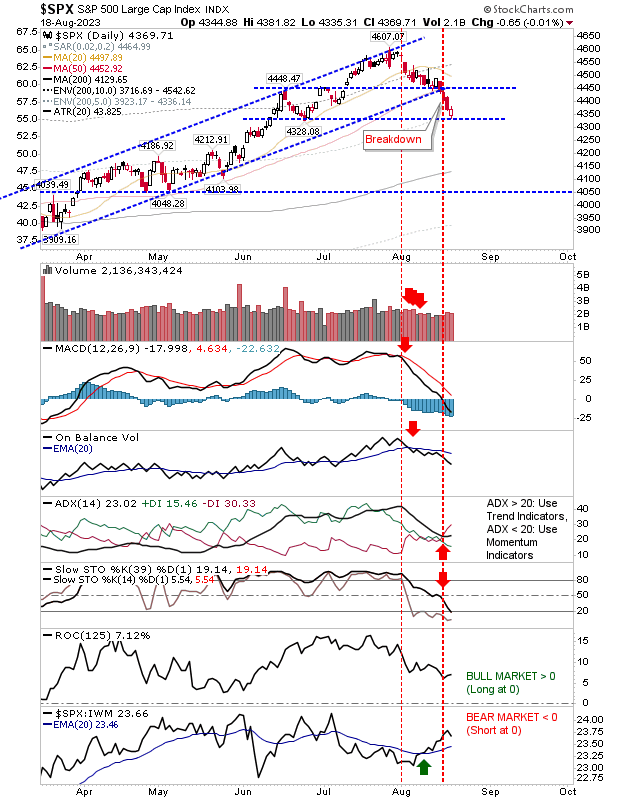

The S&P 500 is also testing June lows in what, like the Nasdaq, could turn into a head-and-shoulder reversal. Technicals are net negative, although stochastics are oversold. The index is outperforming the Russell 2000, which in itself, offers itself as a buying opportunity. Longs could take a punt here, but look for a reversal at 4,450 *if* a head-and-shoulder pattern were to emerge here.

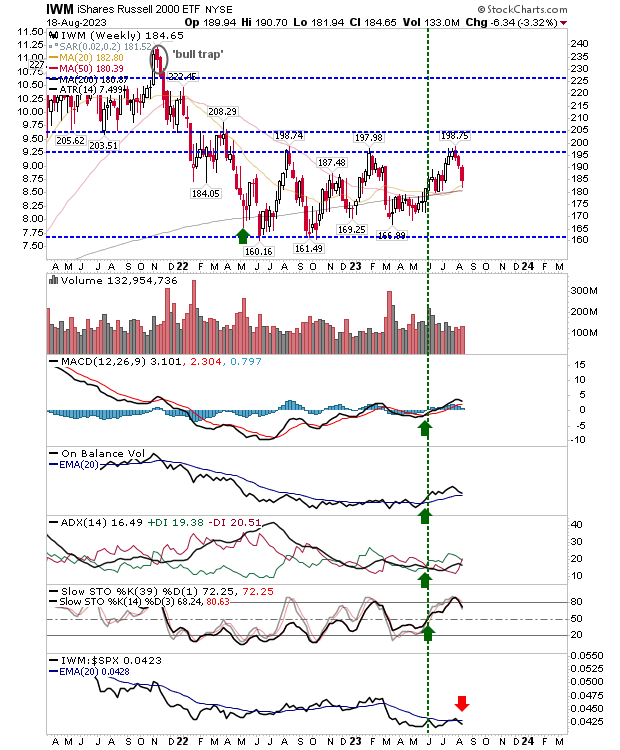

If there is a chart to watch, it's the weekly chart for the Russell 2000 ($IWM). Friday's close has brought the index to converged support of 20-week, 50-week, and 200-week MAs; so by the close of business on Friday, we want to see continued support of these moving averages.

This would offer itself as a buying opportunity, but note how earlier tests of the 200-day MA have seen confirmed bearish crosses, all of which had managed to be rebuffed, but it does mean buying support here is the correct thing to do unless you are prepared to offer a wide buffer as a stop/risk.

For the week ahead, look for an early rally for the S&P 500 and Nasdaq, then later, look for a close above key weekly MAs for the Russell 2000.