- MicroStrategy is one of the best-performing US stocks this year, with a gain of over 375%.

- The stock's fate is more closely linked than ever to that of Bitcoin after another massive purchase.

- But can the company's strategy bear fruit over the long term?

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

MicroStrategy (NASDAQ:MSTR) shares exploded to the upside on Wednesday, closing the regular session up 11.06%, and adding a further 1.40% in after-hours trading, taking its year-to-date gains to just under 375%.

This is one of the best performances of the entire US stock market in 2023.

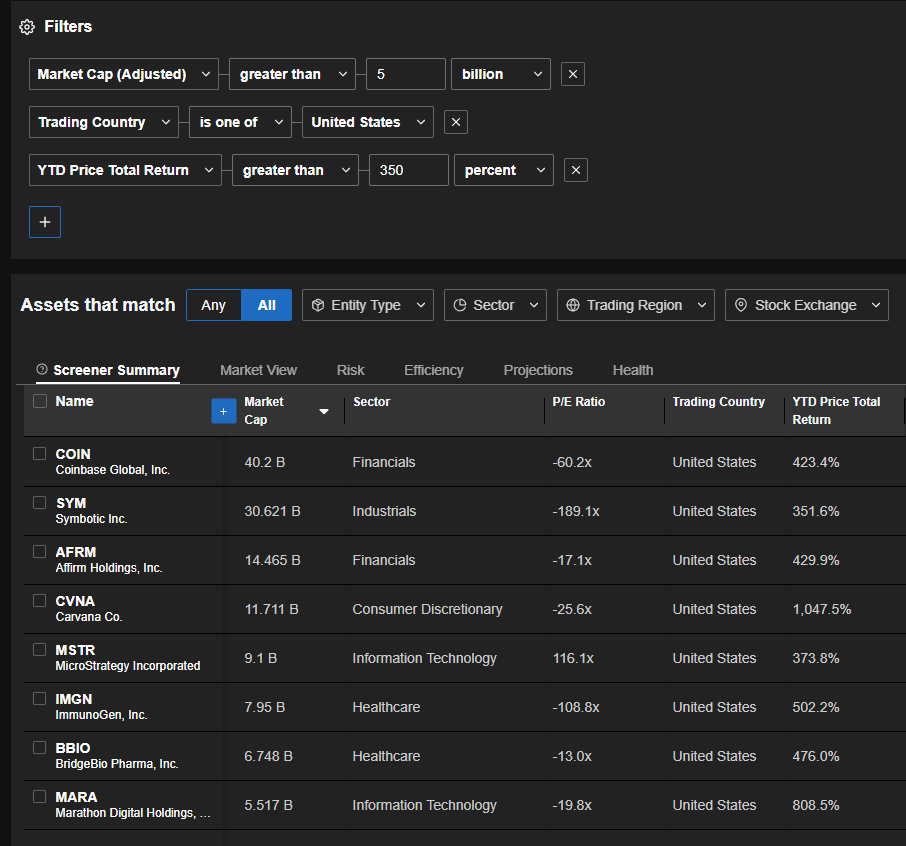

Indeed, a search on the InvestingPro screener showed us that MicroStrategy is the 7th best-performing stock in the US this year if we limit the search to companies with a capitalization of over $5 billion.

Now, this surge in the stock is largely linked to the rise of Bitcoin this year, as the company has been investing heavily in the cryptocurrency for several years.

Source: InvestingPro

What's more, our research on InvestingPro has shown us that other companies whose fortunes are linked to crypto-currencies are also among this year's best-performing US stocks.

This includes exchange platform Coinbase (NASDAQ:COIN), whose stock is up 423% this year, or crypto miner Marathon Digital (NASDAQ:MARA), whose stock is up over 800%.

MicroStrategy's fate more than ever linked to that of Bitcoin following another massive purchase

Remember that MicroStrategy, officially a software company, began accumulating Bitcoins in 2020, gradually accelerating the pace and going so far as to take on debt and issue shares to buy more cryptocurrency.

Indeed, yesterday's rise came in response to the announcement that the company had once again made a massive purchase of Bitcoin, for over $600 million.

Following this latest acquisition, MicroStrategy now owns over 189,000 Bitcoins purchased at an average unit price of $31,168, for a total value of.

Given that BTC is currently trading at around $43,000, the company is currently sitting on a treasure trove of over $8.1 billion worth of BTC, with a latent gain of over $2.2 billion.

The company's long-term plans remain unclear, and the arrival of Bitcoin ETFs poses a threat

It has to be said that, for the time being, MicroStrategy's gamble on Bitcoin, though repeatedly criticized, has paid off. In the longer term, however, the company's outlook could be bleaker.

Indeed, with the company's software business showing little growth and losses, and given its massive accumulation of BTC, its stock is now essentially a bet on Bitcoin.

As such, the stock should continue to rise if Bitcoin also continues to rise, which most analysts believe is likely, mainly thanks to the SEC's approval of Bitcoin spot ETFs, expected in early January.

Indeed, experts believe that Bitcoin ETFs will enable massive inflows of new capital into the crypto market, by offering a regulated means of investing directly in BTC.

However, while the expected bullish impact on the Bitcoin price is a positive factor for MicroStrategy, the launch of these products will raise the question of the stock's relevance in the eyes of investors since it will be in direct competition with Bitcoin ETFs as a vehicle for exposure to the crypto market.

So, while MicroStrategy's fate in 2024 will be closely linked to that of Bitcoin, and a rise seems likely, the company will have to figure out what to do with its Bitcoins to boost its core business or find a new avenue of development.

Analysts and valuation models call for caution on MicroStrategy

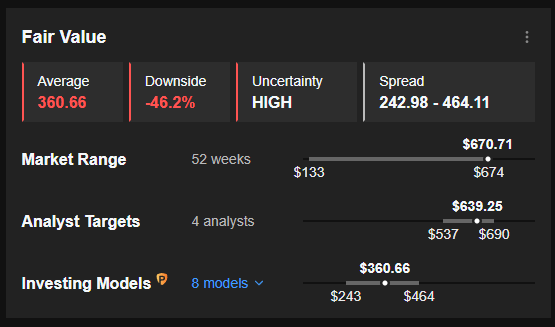

The study of analyst forecasts and valuation models for the stock is yet another reason to be cautious about MicroStrategy.

The data available on InvestingPro shows that the analysts who follow the stock have an average target price of $639.25, or 4.8% below the current share price.

Source: InvestingPro

The InvestingPro Fair Value, which synthesizes 8 recognized financial models, is even more pessimistic, coming in at $360.66, more than 46% below Wednesday's closing price.

Finally, the analysis of MicroStrategy's financial health based on InvestingPro data also warrants caution, with an overall score of 1.95.

Conclusion

Although MicroStrategy's bet on Bitcoin has paid off the stock has a good chance of continuing to rise in 2024, if BTC also rises.

But there is considerable uncertainty surrounding the company's longer-term future, while the arrival of Bitcoin ETFs will make the stock relatively less attractive as a means of gaining cryptocurrency exposure for investors.

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users. Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship "Tech Titans," which outperformed the market by 670% over the last decade.

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice .