Markets took another loss on Friday, but there was no change in the larger picture. The key breakouts remain intact, and we are still waiting for the Dow Jones Industrial Average to make its move, but it remains close.

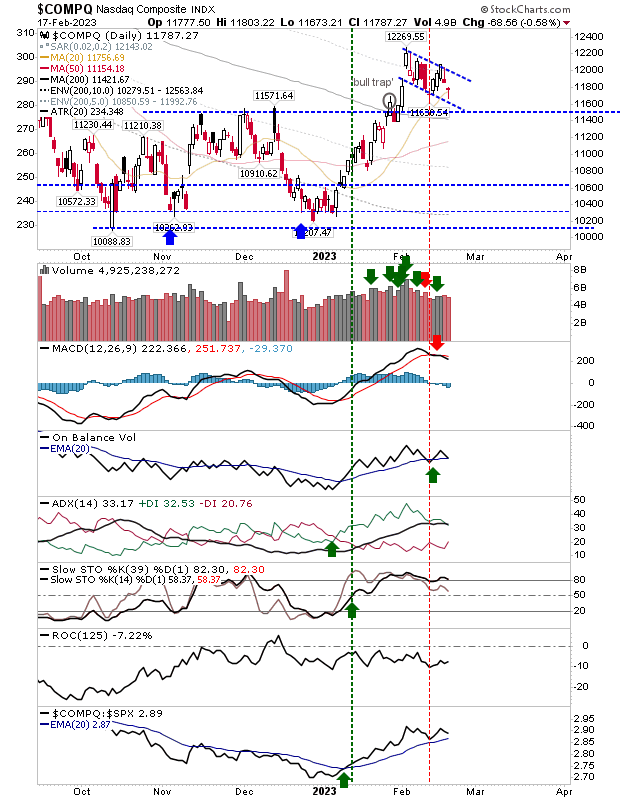

Nasdaq

In the case of the Nasdaq, I have redrawn the boundaries of the 'bull flag' to consume the early - now failed - move from the consolidation. Friday's finish didn't break support of its 20-day MA and, from a volume standpoint, didn't rank as distribution.

Technicals have a 'sell' in the MACD, but it's the relative performance advantage that likely holds the key as to which direction we can expect the 'bull flag' to break. Optimistic.

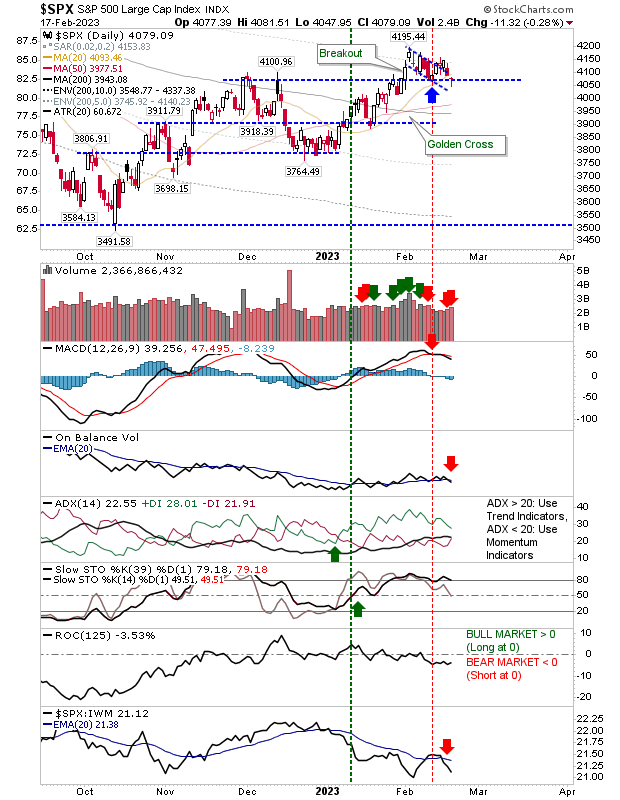

S&P 500

The S&P 500 is also at 20-day MA support like the Nasdaq but is also at the support of the December swing high. The selling did rank as distribution, which may not be as bad as it sounds, as heavier trading at support - even if it's selling - still points to strong demand.

However, the return to relative underperformance against the Russell 2000 is a concern, and if we see further losses from here, then things could get ugly.

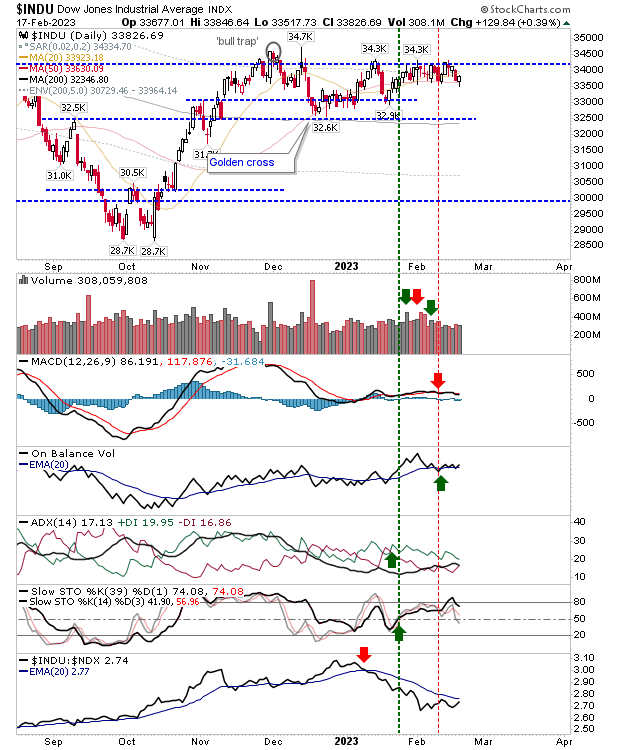

Dow Jones

Should sellers drive further losses in the S&P 500, then the long-awaited breakout in the Dow Jones Index will remain long-awaited. If the Dow Jones Index could lead out with a breakout, it could help spark a move higher in the S&P 500 - an index that could benefit from a fresh stimulus.

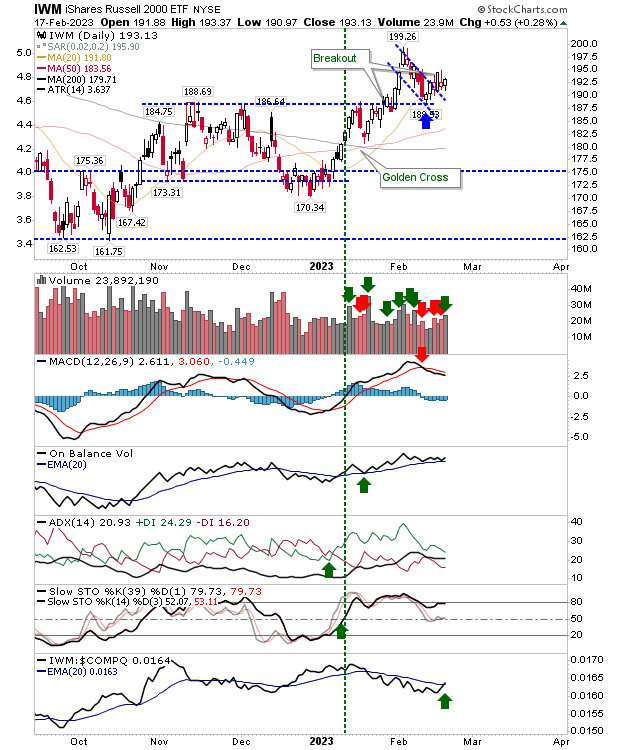

Russell 2000

The Russell 2000 is the only index left with a 'bull flag' breakout that helped it with a new 'buy' signal in relative performance to the Nasdaq. There is still the MACD trigger 'sell' to work off, and it's going a little slow, but this is the index with the most bullish momentum.

For the coming week, we have indices at workable support, but the work has to start soon - preferably Monday. Momentum traders have the Russell 2000 to trade, but those who have missed the major breakouts from the other indices have the Dow Jones Industrial Average to track.