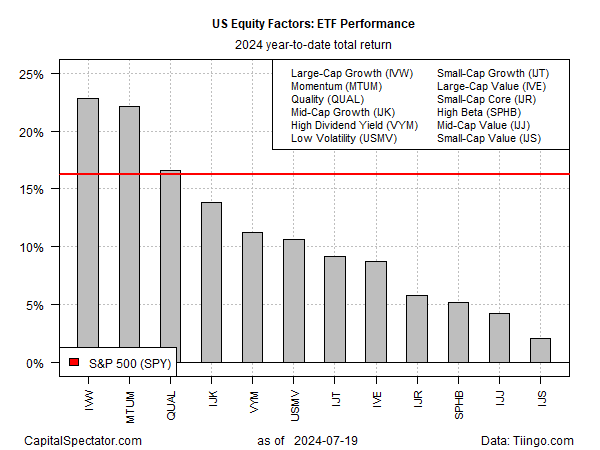

Reviewing the major US equity factors on a year-to-date basis continues to show large-cap growth leading the horse race, based on a set of ETF prices through Friday, July 19.

But last week may have been a turning point for the factor laggards, say analysts.

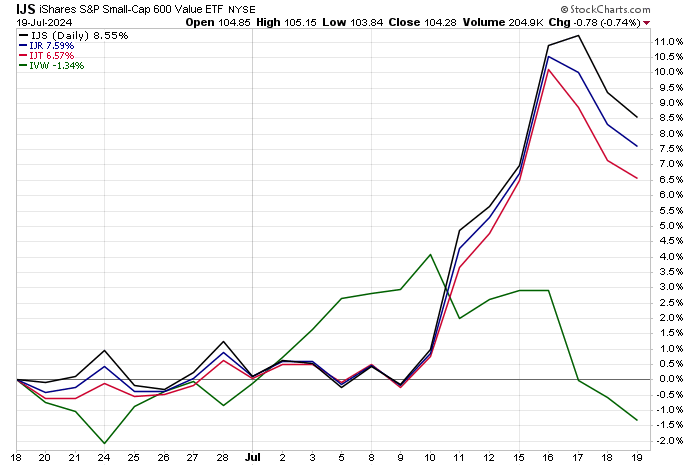

The short-term shift in leadership is certainly striking. Consider the worst-performing risk factor this year: small-cap value (IJS).

So far in 2024, this slice of the factor universe is up a measly 2.0%. By comparison, the broad equity market (SPY) has rallied more than 16% and the factor leader, large-cap growth (IVW) has surged nearly 23%.

But last week’s trading has analysts talking up the possibility that a shift in market leadership may be brewing. The key catalyst: the sharp upside turnaround for small-caps.

The sudden change has catapulted small caps generally ahead of large-cap growth by a wide margin for the trailing one-month period.

It’s too soon to say with any confidence if small-caps and other lagging sectors and factors are poised to lead for an extended period, but analysts are considering the possibility.

“I think the narrative has changed,” says Eric Kuby, chief investment officer at North Star Investment Management Corp, a small-cap manager. “I’m hoping this jump over the last week is really just the beginning of what could be a very long, multi-year period of time where small caps could make up a lot of ground.”

Analysts at Marks Group Wealth Management remind: “Small-cap stocks have been out of favor for years thanks to their relative underperformance and interest rates that have remained ‘higher for longer.’

But small-caps have bounced big time in July with a growing consensus that rate cuts from the Federal Reserve are coming in September.

As a quick refresher, smaller companies are generally more reliant on borrowing money to finance their growth (unlike corporate behemoths with billions in cash).” They speculate: “Less restrictive monetary policy from the Federal Reserve could be the spark this asset class so desperately needs.

But longer term, it still looks like an uphill battle for small-cap benchmarks.”

Fed funds futures are currently pricing high odds that the central bank will start cutting interest rates at the Sep. 18 FOMC meeting.

But strategists at Yardeni Research warn that it’s premature to read too much into the latest burst of energy in small caps.

“Interest-rate cuts should help boost forward profit margins, but we doubt a few 25bps cuts to the federal funds rate will improve [small-caps] bottom lines significantly,” the firm told clients last week.

“The problem might be that the most successful [small-cap] companies get acquired quickly these days before they can significantly boost the earnings/revenues/margins of [small-cap] stock price indexes.”

Meanwhile, ETF analyst Dave Nadig is preaching patience with what might be called a trust-but-verify approach.

“If we have a sustained rally in small caps, and by sustained, I mean, like we have two or three months where small caps of all varieties are clearly beating the pants off large caps, then I think you’ll see a ton of money chase that performance that always happens,” he tells CNBC.