Just when you thought it was safe to assume that the soft-landing fix was in, the bond market has thrown a wrench into the machine. So it goes with the constantly shape-shifting risk profile for the US business cycle. Most of the time the changes are relatively trivial. Is this time different?

Reading the latest headlines suggests that a recession in the near term is once again a high, or at least higher, risk compared with recent history. Bloomberg, for example, captures the new macro zeitgeist today by reporting: “Fed’s Bid to Avoid Recession Tested by Yields Nearing 20-Year Highs.”

Meanwhile, DoubleLine Capital founder Jeff Gundlach posted on X earlier this week:

“The US Treasury yield curve is de-inverting very rapidly. Was at -108 bp a few months ago. Now at -35 bp. Should put everyone on recession warning, not just recession watch. If the unemployment rate ticks up just a couple of tenths it will be recession alert. Buckle up.”

The latest estimate of US payrolls from ADP for September paints a darker profile too, raising concerns that tomorrow’s payrolls report from the Labor Dept. could trigger a new warning. Meanwhile, ADP advises that hiring at companies last month slowed to the softest pace since January 2021.

If a new recession is brewing, it’s unlikely to start in the third quarter. As reported yesterday by CapitalSpectator.com, the latest median nowcast for the government’s initial Q3 GDP report due on Oct. 26 is a robust 3.1% rise in output – well above Q2’s 2.1% increase.

The outlook for Q4 and early 2024, however, has deteriorated, if only modestly, compared with a month or so earlier, when Treasury yields were lower and relatively stable. As recently as Sep. 15, for instance, Ashok Varadhan, co-head of Global Banking & Markets at Goldman Sachs, advised:

“Unbelievably resilient is the way I would characterize the US economy.”

But that was then, and the latest pop in Treasury yields is a new headwind for the economy. Deciding if this is the catalyst that pushes the economy into an NBER-defined recession is still debatable, but it’s clearly a factor that’s not helping.

Another dynamic to monitor for assessing recession risk is the recent peaking in so-called US economic resilience. On Aug. 30, when the resilience argument was enjoying a near-consensus, CapitalSpectator.com offered a bit of counterprogramming by observing that a recent runup in macro momentum was showing signs of cresting. The observation was based on a broad review of data via a pair of business-cycle indexes published weekly in The US Business Cycle Risk Report.

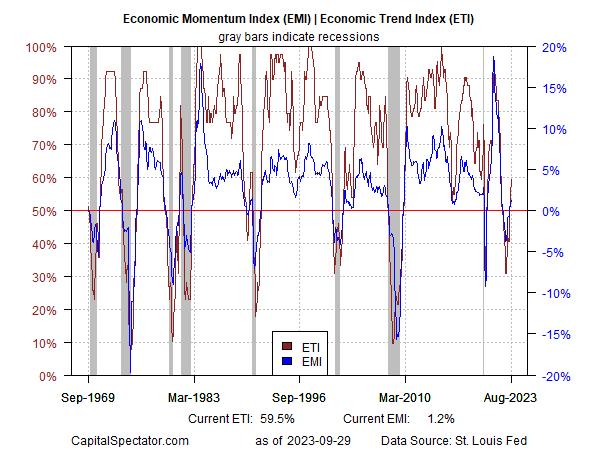

It’s still unclear if the peaking is a prelude to recession or a slower/stable run of economic activity. The peaking claim is based on a near-term estimate of how economic data will print in the next month or so. For perspective, here’s how the Economic Trend Index and Economic Momentum Index stack up based on available data through August:

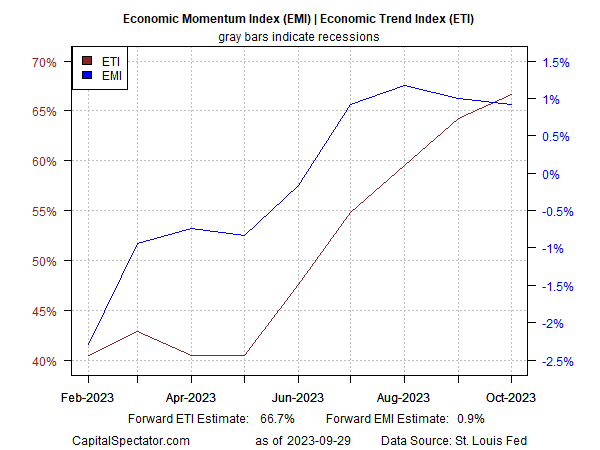

Using econometric forecasting tools to project these indexes through October now shows that EMI is peaking while ETI is still edging higher. Note that both are expected to hold above their respective tipping points that mark the start of recessions: 50% for ETI and 0% for EMI.

Bottom line: recession risk may be rising, again. It could be another head fake, as it was a year ago when macro momentum was deteriorating but then staged a surprising rebound in late-2022/early 2023.

Is it different this time? Nobody knows although the next several weeks of new data points will be crucial for deciding what happens next. Meantime, the future remains uncertain, which leaves only one comparatively reliable macro tool: monitoring recession risk through a broad mix of indicators and nowcasting/forecasting with an outlook of no more than one to two months.

With that in mind, the upcoming November estimates for ETI and EMI will be valuable for reassessing the odds of hard-landing risk.