The U.S. stock market closed on Thursday (June 8) with a 20% gain above its previous low in October, triggering announcements by a number of analysts that a new bull market has started.

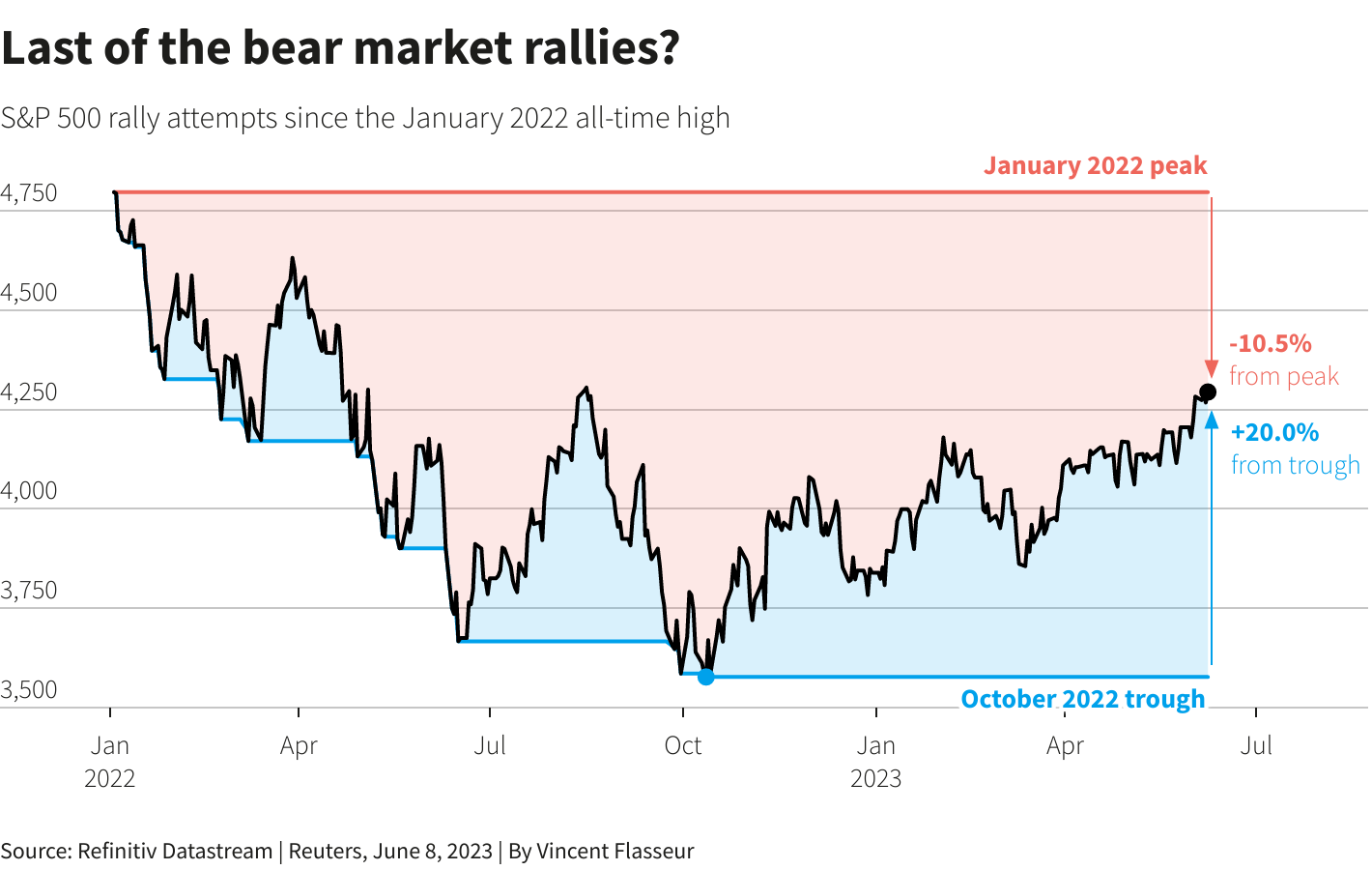

Let’s dig into the details and commentary for some perspective. The smoking gun, we’re told, is the S&P 500’s 20% rise since its October bottom.

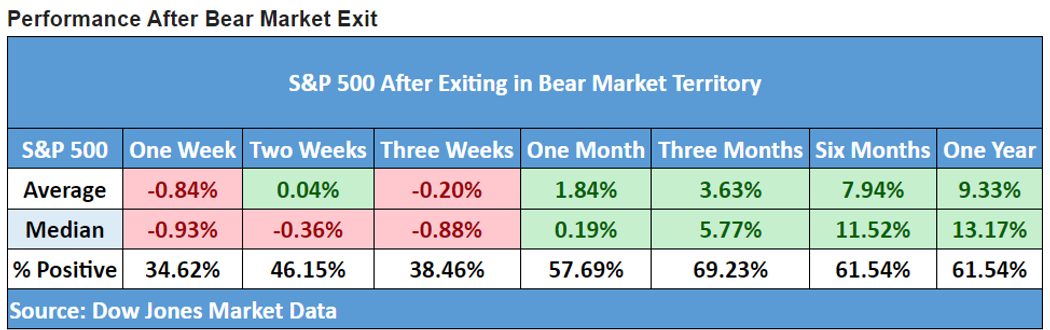

History suggests that there are more gains to come, according to an analysis by MarketWatch.com. Median and average performance for stocks following a bear-market exit skew positive by a solid degree via data since 1929.

Encouraging, but with an obvious caveat: averages and medians hide individual periods that are relatively ugly.

For now, part of the reason for the market’s recent strength is the economy, which so far has defied recession forecasts that have been front and center in some circles this year.

“Bottom line, the economy has been very resilient,” says Anthony Saglimbene, chief markets strategist at Ameriprise Financial. “So much negativity was built into the market,” he advises. “While it’s too early to know this for sure, stocks look like they’re doing what they normally do when all the negativity has been discounted into the stock market: They start moving higher in anticipation of better days ahead.”

Although using a 20% marker off the previous high is widely used, not everyone agrees that this is the final word on a bull market signal.

“The problem is there is no authority of rules or regulations on there, 20% came back from the really olden days, like during the First World War, it was the first time we see it,” says Howard Silverblatt, senior index analyst at S&P Dow Jones Indices in New York.

The fact that the S&P remains well below its previous high – the January 2022 peak, which marked an all-time high, convinces some analysts to reserve judgment on the idea that a new bull market has started.

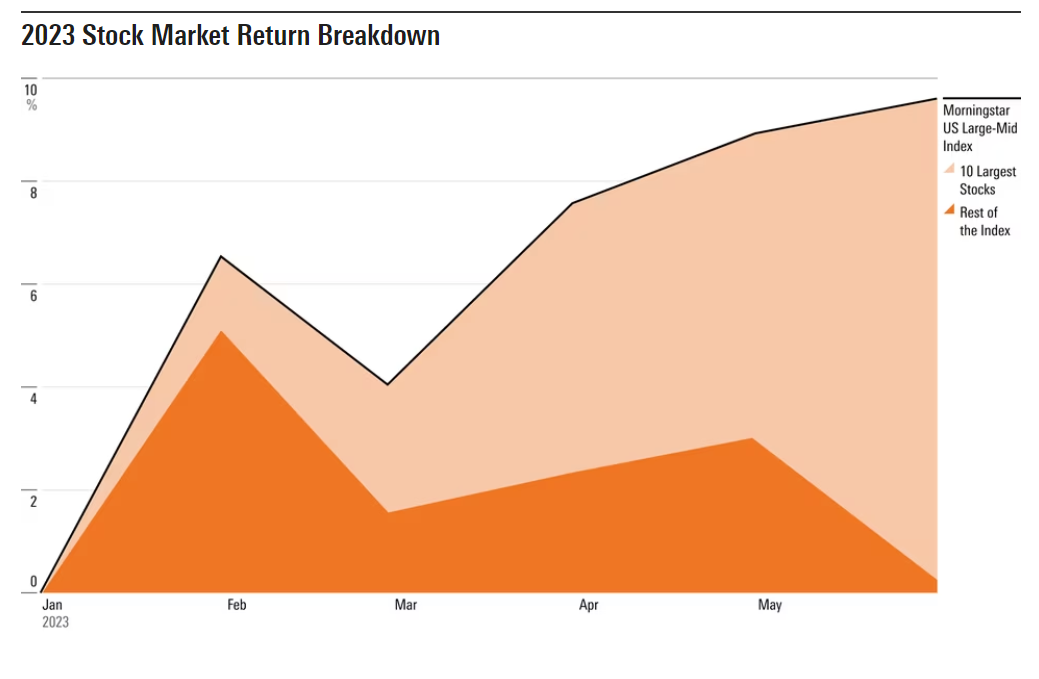

Some observers say that the narrowly-led rally for the S&P is a warning sign.

“It may seem like the stock market is having a good year,” notes Morningstar.com. “But take a closer look, and you see that its gains are more highly concentrated than ever before. Just a handful of stocks are responsible for virtually all the market’s gains so far in 2023.”

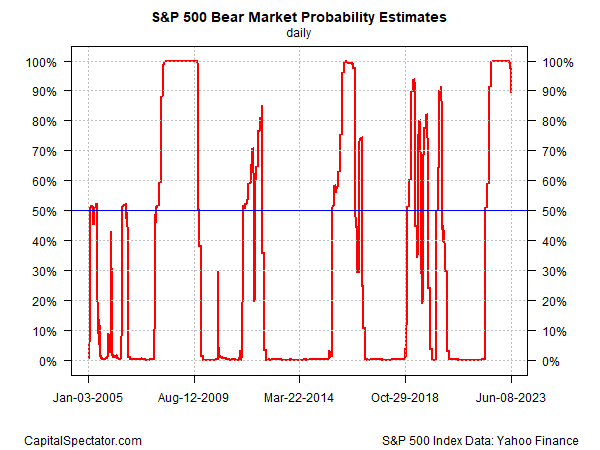

For another perspective, consider CapitalSpectator.com’s quantitative estimate of bear-market risk. After months of sticking to a ~100% probability estimate, this indicator has recently turned lower, which may be a sign that the bear market has ended.

Ultimately, a 20% rally off a previous low is a random yardstick, albeit one that resonates with investors. The danger is assuming that crossing this line unleashes some magical force that guarantees positive returns in the near term. Instead, it’s best to view the 20% rally as one more sign that the market is recovering its upside momentum after more than a year of turbulence.

The key factors that will likely determine if this is really the start of a new bull market or another bear-market rally that ends in more tears include the path ahead for Federal Reserve monetary policy and the staying power of the recent U.S. economy’s resiliency. It’s fair to say that Mr. Market’s increasingly optimistic on these fronts. Alas, Mr. Market’s record for near-term forecasting is well short of perfect.