This post was written exclusively for Investing.com

Gold miners' stocks may be poised to rally sharply by the middle of March. The VanEck Gold Miners ETF (NYSE:GDX) has witnessed significant bullish option betting in recent weeks. It could result in the ETF rising by as much as 19.3% from its price of approximately $28 on Jan. 9.

The bullish options bets coincide with a sharp rise in the price of gold. The precious metal has seen its price rise by around 5% since Dec. 24, and based on the technical charts it could be heading even higher in the weeks and months ahead. The bullish set up in gold could be one reason why traders are making big bets on the gold miner sector rising.

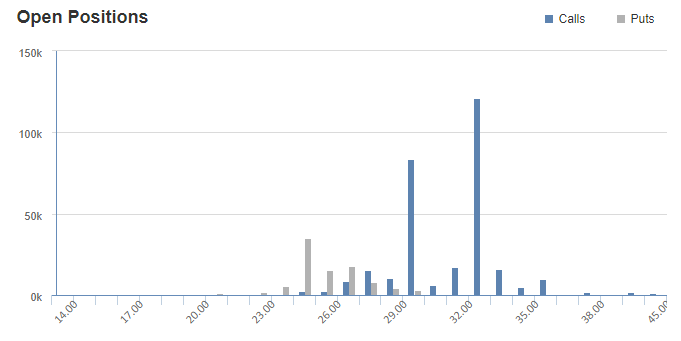

Betting That The Gold Mining Stocks Surge

The open interest for the GDX March 20 $33 calls saw the number of open contracts rise sharply on Jan. 6 by around 48,000 contracts. Data provided by Trade Alert shows that the calls traded on the ASK, an indication the options were bought, and a bet that the underlying ETF would rise. At that time, the options were purchased for around $0.55 per contract. It means that for a buyer of these calls to earn a profit, the ETF would need to rise above the breakeven price of $33.55, which is determined by adding the strike price plus the premium paid for the calls.

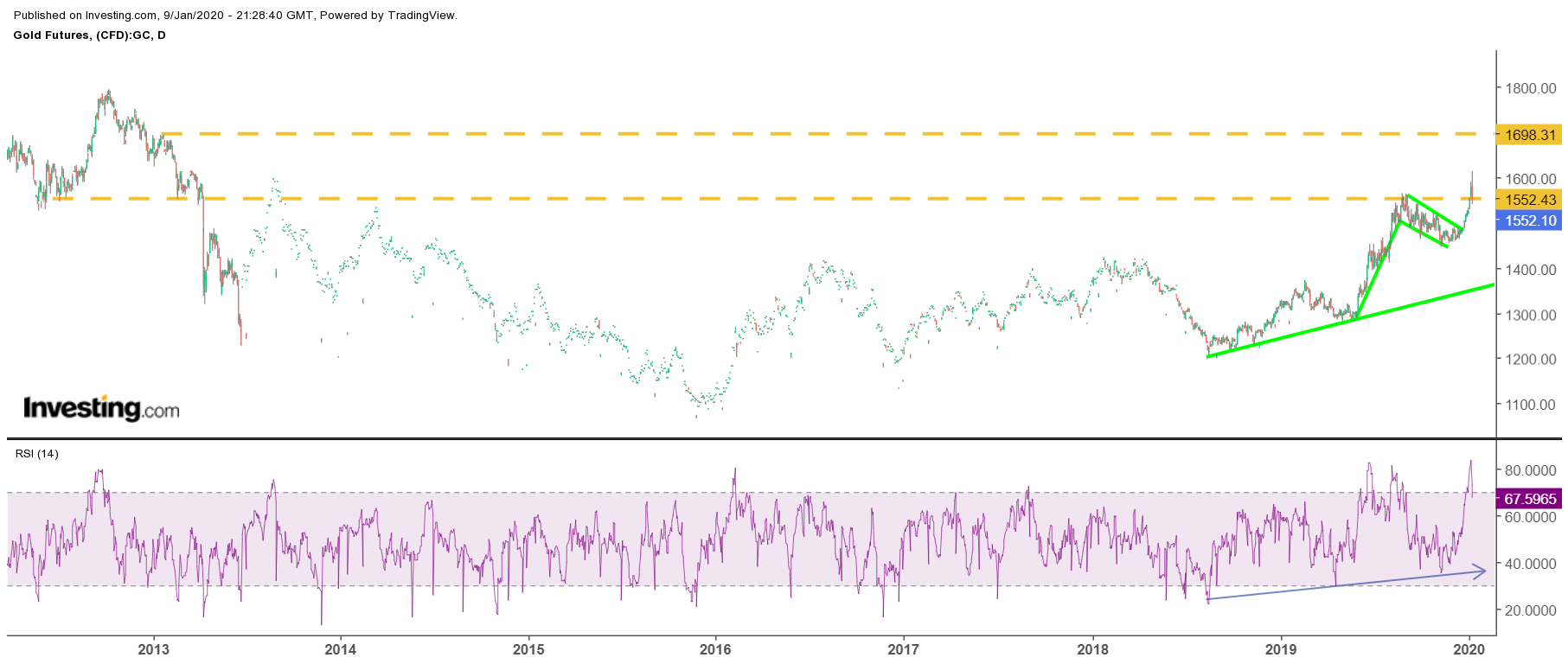

Technical Patterns Have Turned Bullish

The technical pattern for gold has turned positive and indicates that the precious metal could be poised to increase to higher prices in the weeks ahead. Gold has been trending higher since August 2018. But more recently, the chart shows that gold has created a bullish continuation pattern known as a pennant. Additionally, the price has recently risen above a level of technical resistance at around $1,555. Based on a projection of the pennant pattern and the next significant levels of resistance on the chart, gold could see its price rise to around $1,700.

However, any move higher may take some time, because the price of gold has seen its relative strength index reach overbought levels, which is currently near 70. The longer-term trend in the RSI suggests that the price continues to rise, suggesting bullish momentum is entering the metal.

A Weaker Dollar May Help

One reason why gold may continue to rise, and sending the mining stocks higher in the process, is that the U.S. dollar has been dropping in recent weeks. The U.S. Dollar Index, which measures a basket of currencies against the dollar, has fallen in value by approximately 2% since peaking at roughly 100 on Oct. 1. The dollar index is very close to falling below a level of support which could send the currency even lower. If that happens, it would be bullish for the price of gold.

Higher gold prices would help to lift the stocks of the gold miners by boosting those companies' revenues. Additionally, the higher prices and improving revenue should help to raise margins for the mining companies, and thus increase their profits and earnings.

Should the dollar continue to weaken, and gold prices rise, it seems only natural for gold miners to gain. It is likely the big reason why some traders are making bullish bets on the gold mining group.