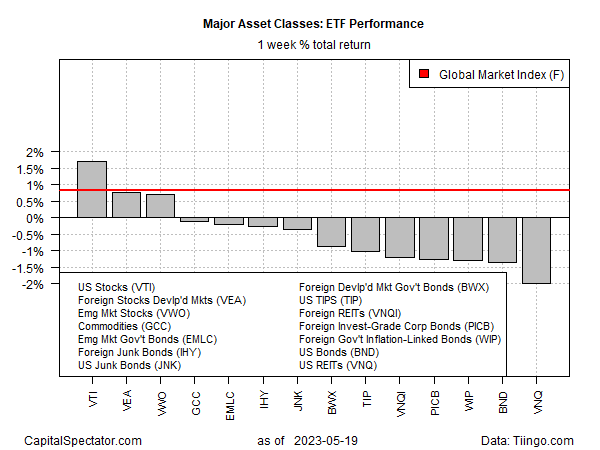

U.S. shares led rallies in equities markets around the world in the trading week through Friday, May 19, based on a set of ETFs. The rest of the major asset classes lost ground.

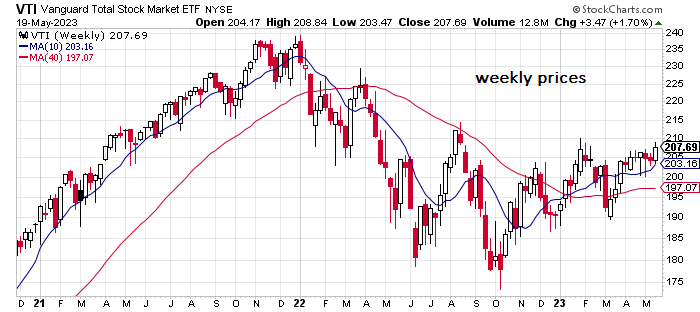

Vanguard Total Stock Market Index Fund (NYSE:VTI) gained 1.7%, rising to the highest level since February. The latest increase sets up the fund for higher odds of a bullish breakout if it can move decisively above the current price.

The immediate headwind for risk assets is the evolving uncertainty surrounding the U.S. debt ceiling and the potential for a default of Treasuries. President Biden and House Speaker McCarty are scheduled to meet again today to discuss possibilities for a political compromise. Markets will be keenly focused on the outcome for assessing the risk of a U.S. default, which could strike as early as next month without a deal, according to some estimates.

Last week’s biggest loss for the major asset classes: U.S. real estate via the Vanguard Real Estate Index Fund (NYSE:VNQ) slumped 2.0%. The decline suggests that the ETF remains caught in a bearish trend that’s persisted for well over a year.

The Global Market Index (GMI.F) rebounded last week, rising 0.8%. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class-portfolio strategies.

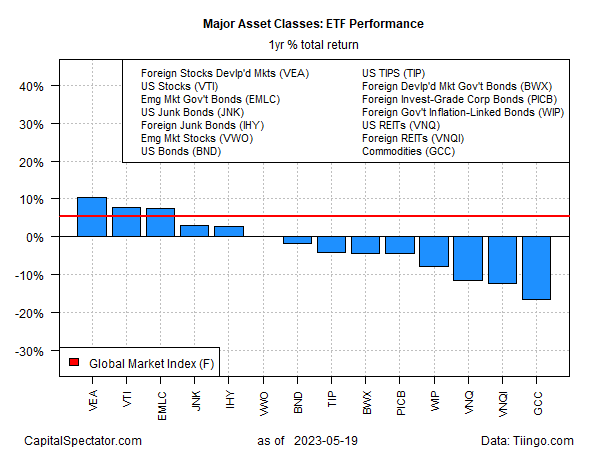

The major asset classes continue to post mixed results for the one-year window, with most ETF proxies reporting a loss. The performance leader over the past year: foreign shares in developed markets ex-U.S. (VEA), which is up more than 10% over the trailing one-year period. Commodities (GCC) are the loss leader with a 16.5% decline.

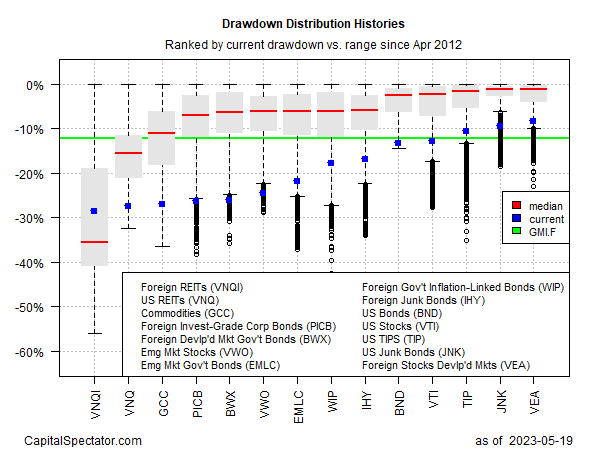

Most of the major asset classes are still posting relatively deep drawdowns. The deepest: foreign real estate shares (VNQI), which ended last week with a near-30% peak-to-trough decline. Stocks in foreign developed markets (VEA) reflect the softest drawdown for the major asset classes: -9.5%.