Ford (NYSE:F) has had a tumultuous year, with several impressive new vehicles in the line-up, the chip shortage, and the increasing focus on EVs. Shares are up about 87% over the past year but are down 19.4% from the YTD high close of $15.99 on June 3.

Ford shares’ early-2021 surge was largely due to an improving outlook based on the firm’s new models and, particularly, enthusiasm about Ford’s EV offerings. The logic for the rapid increase in share price seems to have been based on the belief that EV firms can support higher valuations than traditional auto manufacturers, with Tesla (NASDAQ:TSLA) being the key example (TSLA has a forward P/E of 99 as compared to F’s 6.5, according to Morningstar). Ford’s EV offerings are impressive, with the Mach-E getting solid reviews and reservations for the F-150 Lightning (the electric version of the F-150) recently reaching 130,000.

Ford recently reported that total sales for August 2021 were 33% below those in August 2021, although EV sales were up by 67%. Ford sold 8,756 EV’s and a total of 124,126 vehicles across all brands and types in August 2021.

These are, obviously, disappointing numbers overall and the sales of EVs can only do so much for the time being. If EV sales continue to increase at anything like the recent pace and the F-150 Lightning does as well as expected, Ford should be in good shape.

General Motors' (NYSE:GM) recent setbacks with EVs give Ford an even greater lead, as well. Ford seems particularly well-positioned to put a broader demographic in EVs. In the near term, however, chip shortages present a major problem.

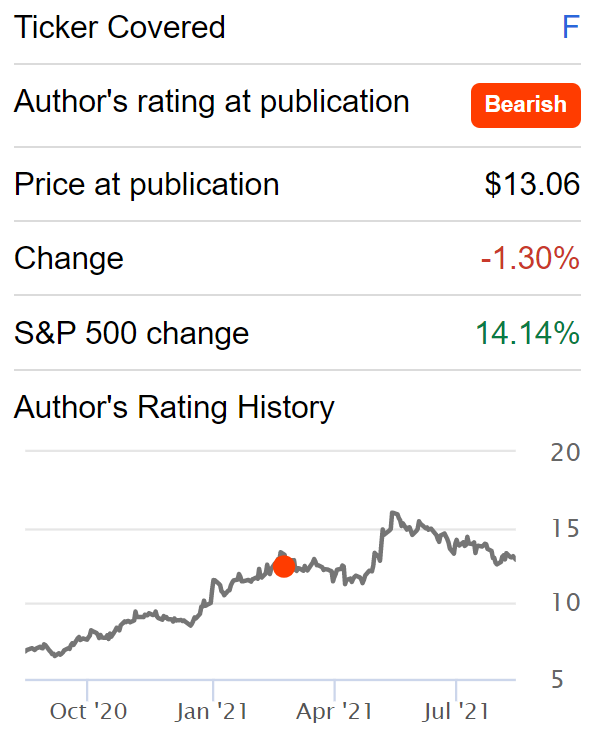

When I last analyzed Ford on Mar. 16, the shares were trading at $13.06, slightly higher than the current price. I gave the shares a bearish rating because they had appreciated much faster than could be justified from the metrics.

As I noted at the time, it was hard to rationalize the shares being more than 40% above their pre-COVID 2020 high. Bolstering that view, the shares were 6%-8% above the Wall Street consensus 12-month price target and the prices of options suggested a bearish view.

Source: Seeking Alpha

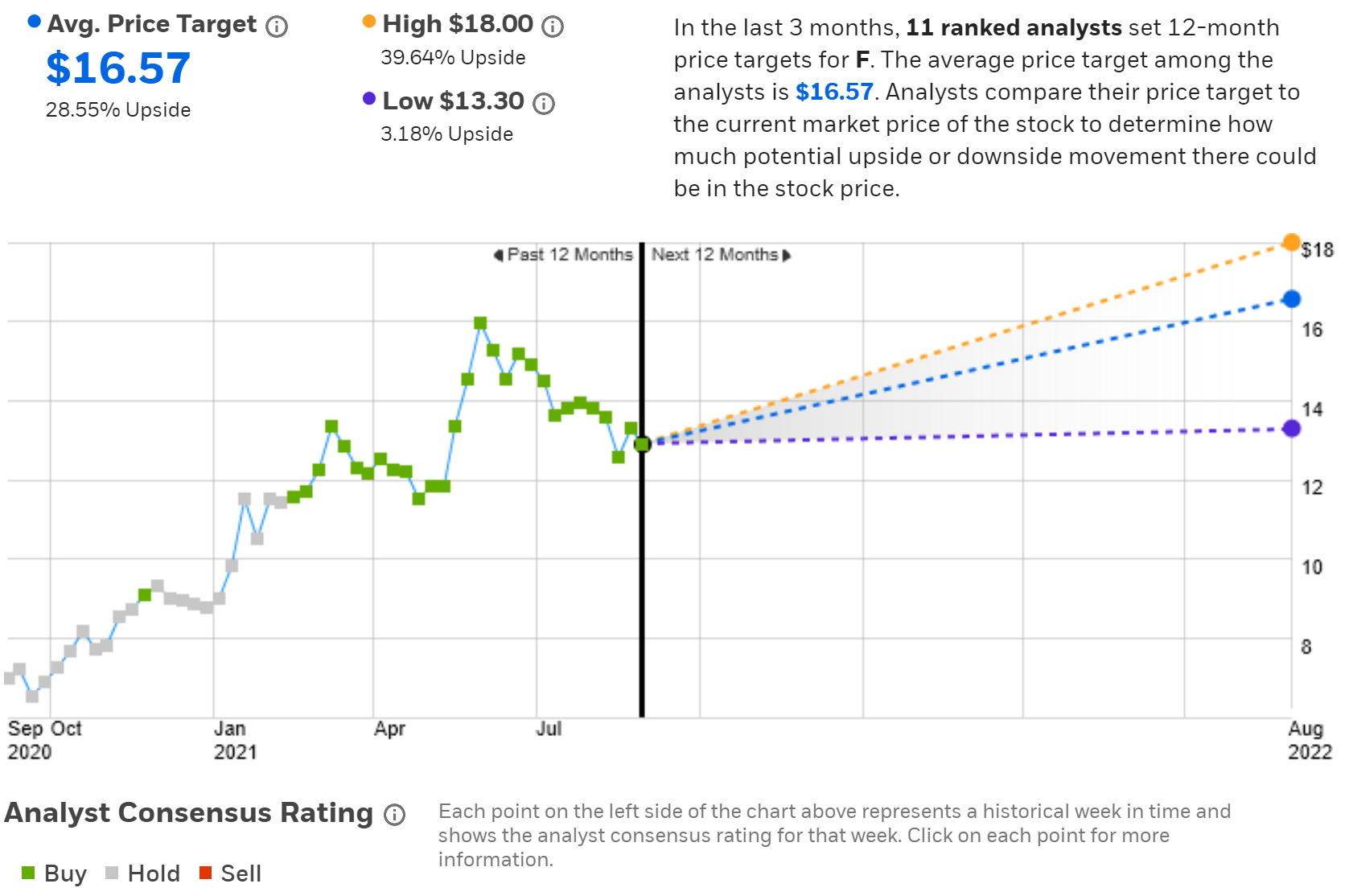

Most readers will be familiar with the Wall Street analyst consensus ratings and price targets. When the analyst price targets are fairly consistent, the consensus has meaningful predictive value.

Along with the analyst consensus, I look at the market-implied outlook, which represents the implicit consensus forecast for price returns reflected in options prices. The price of an option represents the market’s estimate for the probability that the price will rise (call option) or fall (put option) relative to the option strike price.

The prices of options at a range of strikes can be used to calculate a probabilistic price return outlook for the underlying stock that reconciles the options prices. For those who are unfamiliar with this concept, I have written an overview post that includes examples and links to the relevant financial literature. I have also written a substantial number of articles using this approach to analyze individual stocks. Wall Street

Analyst Outlook for Ford

eTrade’s estimate of the Wall Street consensus outlook combines the views of 11 ranked analysts who have issued views within the last 90 days. The consensus rating is bullish and the consensus 12-month price target is $15.57, 28.6% above the current price.

Of the 11 analysts, 7 give Ford a buy rating and 4 give the stock a neutral/hold rating. The lowest of the analysts’ price targets has a 12-month price target that is 3.2% above the current price.

Source: eTrade

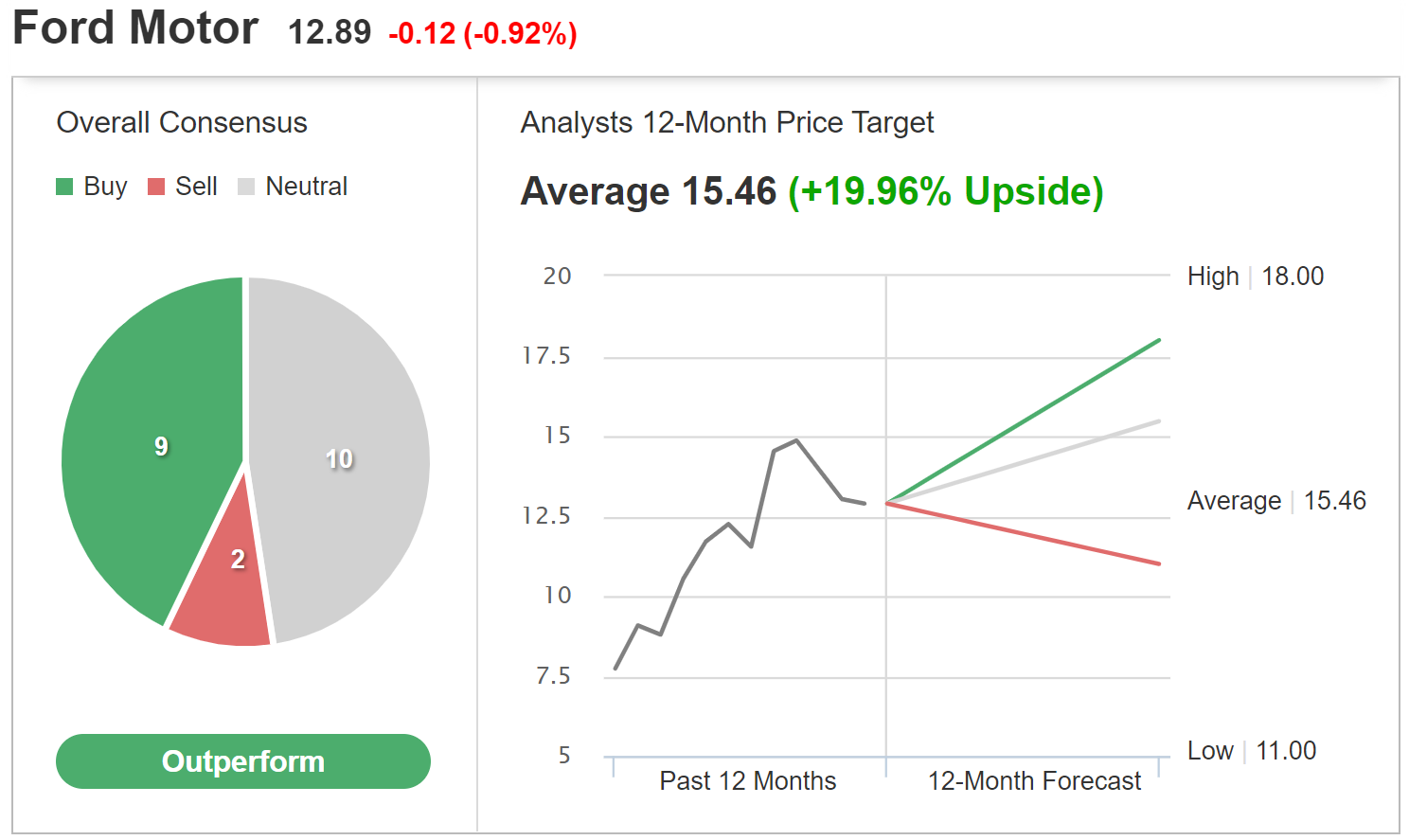

Investing.com’s version of the Wall Street consensus outlook aggregates the ratings and price targets of 21 analysts. The Investing.com consensus rating is bullish and the 12-month price target is 19.96% above the current price. Of the 21 analysts, there are 2 with sell ratings on Ford and the lowest of their 12-month price targets is $11.

Source: Investing.com

It is encouraging that the analyst consensus is for 20%-28.6% price appreciation over the next 12 months and that the prevailing outlook is bullish. The question is whether the expected gains justify the risks, a topic explored further in later sections.

Market-Implied Outlook for Ford

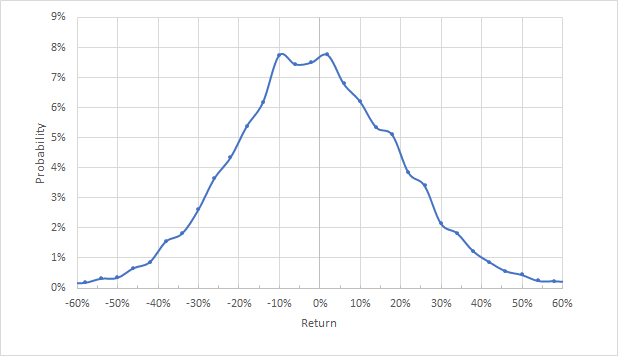

I have analyzed call and put option prices at a range of strikes to generate market-implied outlooks for F. To build a nearer-term outlook (4.5 months into the future), I analyzed options expiring on Jan. 21, 2022. For a slightly longer view (6.3 months out), I analyzed options expiring on Mar. 18, 2021. Options trading on F is very active, which adds confidence in the meaningfulness of the market-implied outlook.

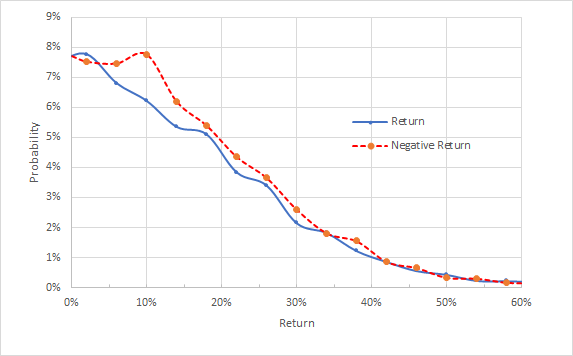

The standard presentation of the market-implied outlook is in the form of a probability distribution of price returns, with probability on the vertical axis and return on the horizontal.

Source: author’s calculations using options quotes from eTrade

The market-implied outlook is quite symmetric, with comparable probabilities for a range of positive and negative returns of the same magnitude. There is not a well-defined peak probability, but there is a modest negative tilt, withe elevated probability of negative returns. The annualized volatility derived from this distribution is 44.2%. This is quite high for an individual stock, as would be expected given the rapid gains and drops in F in 2021.

To make it easier to directly compare the probabilities of positive and negative returns, I look at a version of the market-implied outlook with the negative return side of the distribution rotated about the vertical axis (see chart below).

Source: author’s calculations using options quotes from eTrade. The negative return side of the distribution has been rotated about the vertical axis.

This view shows the elevated probabilities of negative returns for the range of returns from about -20% to + 20% (the red dashed is consistently higher than the blue dashed line on the chart above from 0% to 20% on the horizontal axis. The largest elevated probability for a negative return corresponds to a price return of -9.8%.

In general, we expect that the market-implied outlooks for stocks will be somewhat negatively tilted because risk-averse investors in F may overpay for put options to limit their downside exposure. Compensating for this effect is subjective. I interpret this market-implied outlook as being neutral with a slight bearish tilt.

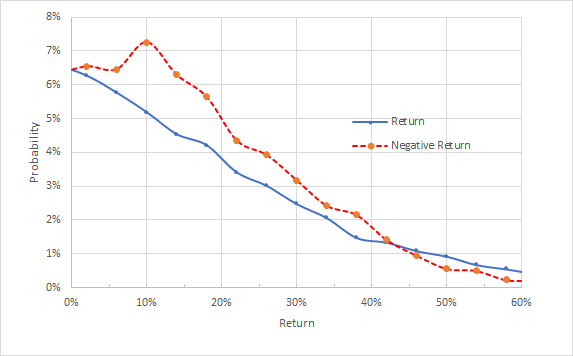

Source: author’s calculations using options quotes from eTrade. The negative return side of the distribution has been rotated about the vertical axis.

When I run the market-implied outlook for the next 6.3 months (using options that expire on Mar. 18, 2022), the view is somewhat more bearish, with a better-defined peak probability at -10% return. The probabilities of negative returns are even more elevated related to positive returns than they were in the shorter-term outlook (there is a bigger distance between the red dashed line and the solid blue line). Even with consideration of the tendency to see a negative tilt, this market-implied outlook is slightly bearish. The annualized volatility derived from this distribution is 44.5%.

The market-implied outlook goes from neutral, with a slightly bearish tilt, over the next 4.5 months to modestly bearish over the next 6.3 months. The two outlook periods match on expected annualized volatility of about 44%. The market-implied outlooks from my last analysis were much more bearish.

Summary

The auto industry is at what appears to be a major transition point, with traditional internal combustion engines being increasingly placed by electric motors. The capital markets are very enthusiastic about the potential for EVs, as reflected in the valuations of companies that manufacture them.

Ford is recovering from the impacts of COVID-19, while faced with a shortage of chips used in manufacturing cars and trucks. At the same time, Ford has made impressive steps in building out EV’s as well as some having a solid pipeline of vehicles coming to market (the Bronco and Maverick, for example).

The market is struggling to value Ford shares, as evidenced by the large swings in the share price. The Wall Street consensus projects the shares will gain 20%-29% over the next 12 months. The market-implied outlook is neutral, with a slight bearish tilt, between now and mid January 2022, but becomes more bearish by mid March.

The contrast between the bullish analyst consensus and the neutral-to-slightly-bearish market-implied outlook brings me to a neutral rating as a compromise.