Repair and recovery were on display last week as the major asset classes clawed back some of the across-the-board losses in February.

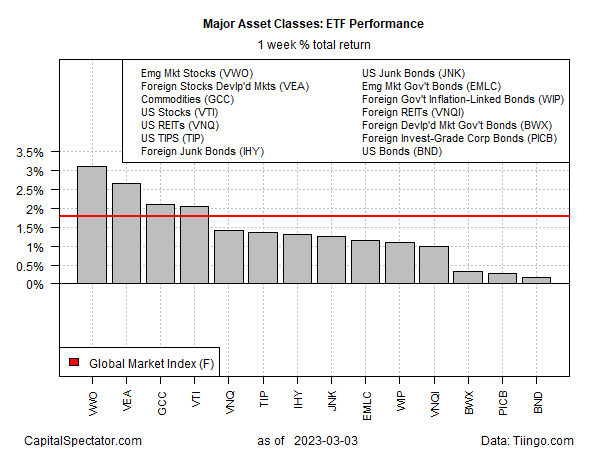

All the primary categories of global risk assets pushed higher in the first week of trading for March, based on a set of ETFs. Stocks in emerging markets led the rally through Friday’s close (Mar. 3).

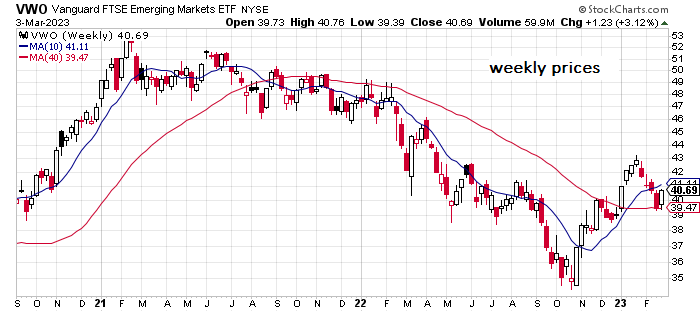

Vanguard Emerging Markets Stock Index Fund (NYSE:VWO) surged 3.1%, marking the ETF’s first weekly gain since January. Despite the rally, it’s unclear if VWO’s long-running slide has finally bottomed.

The next several weeks could be decisive for deciding if the fund is in a trading range or laying the foundation for a new bull run.

Gains prevailed across all the major asset classes. Even the embattled US bond market managed to eke out a win. But with Federal Reserve officials continuing to talk up the odds for more rate hikes, the fractional gain in Vanguard Total Bond Market Index Fund (NASDAQ:BND) looks like noise.

On Friday, the Federal Reserve submitted its semi-annual Monetary Policy Report to Congress and advised that more interest rate increases are required to achieve price stability. The central bank “anticipates that ongoing increases in the target range will be appropriate.”

The tailwind for markets last week lifted the Global Market Index (GMI.F), which rose 1.8%. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class portfolio strategies.

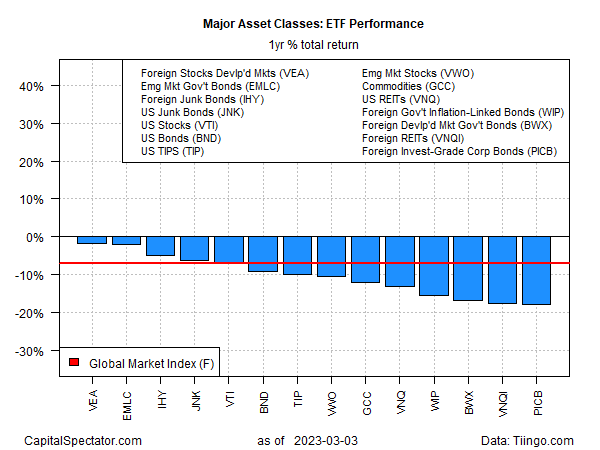

Despite the latest rally in markets, all the major asset classes continue to post losses for the trailing one-year trend. Shares in developed markets ex-US (NYSE:VEA) are suffering the least, with a modest 1.9% decline at Friday’s close vs. the year-ago price after factoring in distributions.

The biggest one-year loser: corporate bonds ex-US (NYSE:PICB) with an 18.0% one-year decline.

GMI.F is also in the red via a 7.2% loss over the past 12 months.

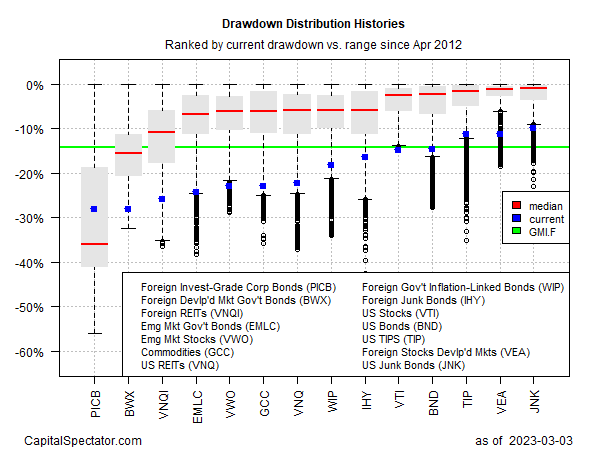

Comparing the major asset classes through a drawdown lens continues to show relatively steep declines from previous peaks for markets around the world. The softest drawdown at the end of last week: US junk bonds (NYSE:JNK), which ended the week with a 9.9% peak-to-trough loss.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI