The euro has posted gains today and briefly punched above the symbolic parity line. In the North American session, EUR/USD is trading at 0.9978, up 0.11%.

German Business Confidence Dips

It seems that whatever angle you examine Germany’s economy, things are not looking good. Services and manufacturing PMIs both remained in contraction territory (below 50.0) for a second straight month. The labour market, which had been a bright spot in the economy, saw the pace of job creation fall to a 1.5-year low. Today’s releases didn’t add any cheer. GDP in Q2 rose a negligible 0.1%, revised from 0.0%. As well, German Ifo Business Climate fell to 88.5, down from 88.7. This wasn’t a sharp drop, but it was significant since it marked the index’s lowest level since mid-2020.

What is no less alarming than the weak numbers is the pessimistic outlook. As the war in Ukraine drags on with no end in sight, the energy crisis could get significantly worse in the winter, as Western Europe is vulnerable to a cutoff of Russian oil and natural gas. Germany appears headed towards a recession later in the year, and the rest of the eurozone will likely fare no better.

The US economy contracted for a second straight quarter in Q2, but second-estimate GDP was revised upwards to -0.6%, up from -0.9% in the initial estimate. This follows a 1.6% decline in the first quarter. The upward revision was good news for the US dollar, as a weak GDP reading could have raised speculation about a Fed U-turn in policy and sent the greenback lower.

The dollar’s next test comes as soon as Friday, with all eyes on Fed Chair Powell’s speech at the Jackson Hole Symposium. If Powell reiterates that the Fed will continue to tighten aggressively until inflation is curbed, the dollar could gain ground. However, if the Fed Chair’s message is less hawkish than expected, we could see sharp gains in the equity markets at the expense of the dollar, as was the case following the surprise drop in US inflation earlier this month.

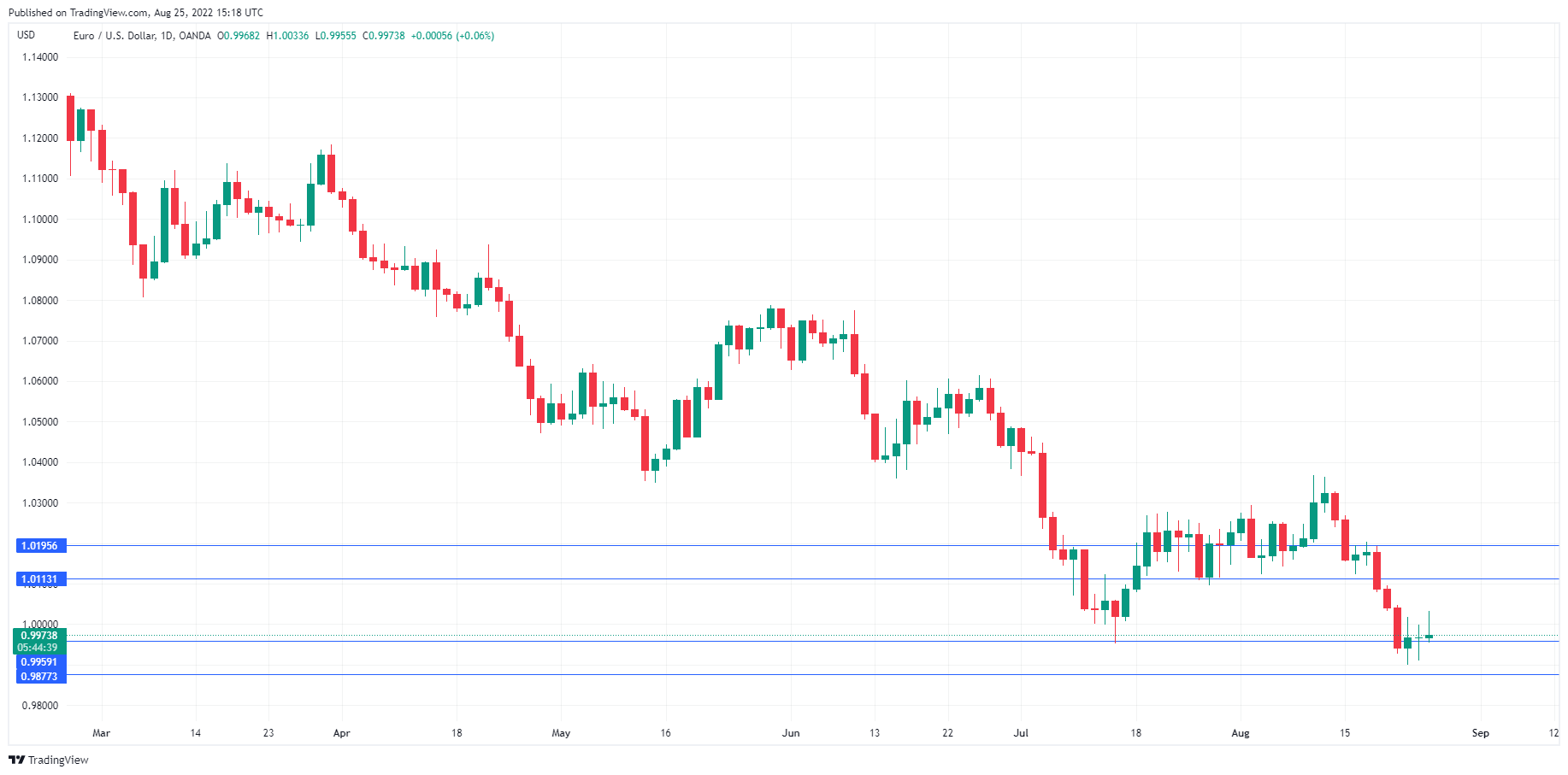

EUR/USD Technical

- EUR/USD is testing support at 0.9959. Below, there is support at 0.9877

- There is resistance at 1.0113 and 1.0195